Why SaaS in India is more than a moonshot: Zinnov's Praveen Bhadada

Multiple factors are coming together to accelerate the growth of India's SaaS sector, and $100 billion in annual revenues isn't a pipe dream, the managing partner at Zinnov, who heads its emerging technologies practice, writes

SaaS has transformed into a game changer for the India narrative on the global stage—with the ability to touch the mega milestone of $100 billion in revenue by 2026—quite effortlessly. Illustration: Sameer Pawar

SaaS has transformed into a game changer for the India narrative on the global stage—with the ability to touch the mega milestone of $100 billion in revenue by 2026—quite effortlessly. Illustration: Sameer Pawar

Indian SaaS is having its moment in the sun. Never before have all factors converged in a manner that puts Indian SaaS firmly on the global stage, and well on its way to clocking in $100 billion in revenue by 2026. The last two decades have been phenomenal for the SaaS space, having transitioned from SaaS 1.0 in the mid-2000s, to surpassing SaaS 2.0 in the early 2010s, to experiencing its coming-of-age moment in 2021. With unicorns galore and successful public market debuts under its belt, Indian SaaS is set to transition from a pupa into a full-fledged butterfly. Interestingly, it stopped being an ‘India vs the globe’ debate a long time ago, with Indian firms becoming as global as any other SaaS firm, hiring talent where necessary, exploring newer business models to cater to global customers, and creating customer stickiness above it all.

Unlike most consumer tech businesses, SaaS, in general, is more capital-efficient in nature, and the entire business model revolves around predictable recurring revenue from customers. In that sense, higher growth with lower cash burn is fast becoming a realistic milestone for many Indian SaaS firms, which in turn has resulted in higher valuation multiples for these businesses.

Why $100 bln revenue isn’t a pipe dream

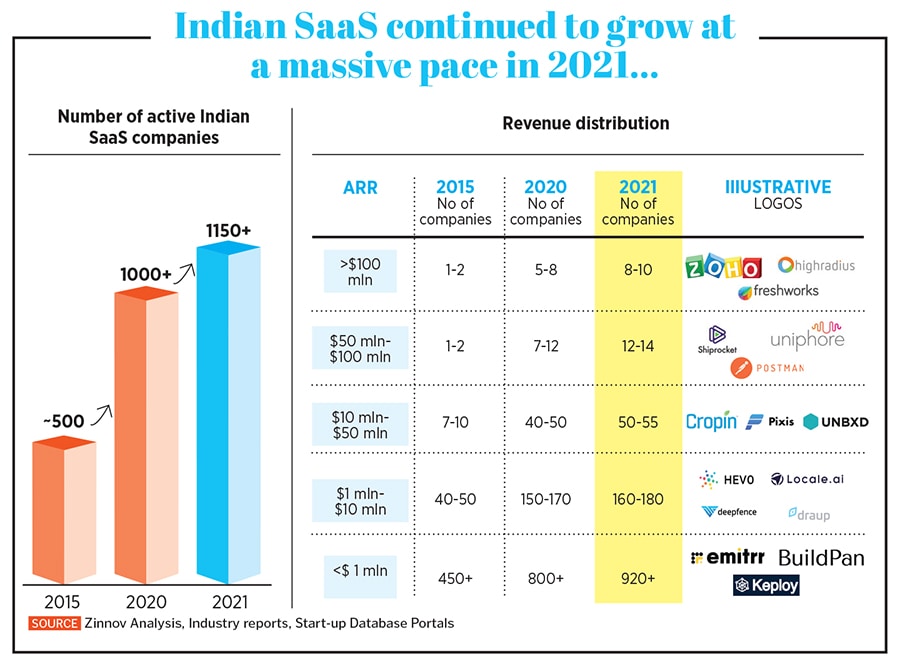

The last few years have been incredible for Indian SaaS—witnessing a 2X growth in the number of SaaS companies to reach 1,150+ active firms in 2021, leading to the creation of about 90 percent of all SaaS unicorns in the last four years alone. In fact, SaaS has experienced exponential growth, on the back of its robust foundational base, aided and propelled by changing enterprise behaviour, accelerated digital technology adoption, and Covid-induced disruptions and uncertainties, whose convergence is creating a tipping point that has exponential returns.

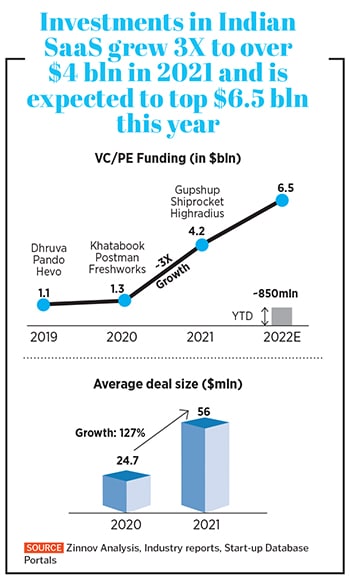

Add to this the vibrant venture capital (VC) ecosystem’s contribution to turbocharge the SaaS space, with investments growing at a 3X pace in the last year, to top $6.5 billion this year. Indian SaaS firms are attracting huge investments, and nearly 40 percent of deals at late-growth stage too, highlighting the maturity of the Indian SaaS space. Also, with the average deal sizes across stages witnessing a substantial rise, SaaS will emerge as the go-to investment opportunity for VCs in the coming years. Additionally, with the time taken for a SaaS firm to become a unicorn reduced to a mere seven years, there is immense potential for Indian SaaS firms to create exponential value to not just shareholders, but stakeholders too.

Add to this the vibrant venture capital (VC) ecosystem’s contribution to turbocharge the SaaS space, with investments growing at a 3X pace in the last year, to top $6.5 billion this year. Indian SaaS firms are attracting huge investments, and nearly 40 percent of deals at late-growth stage too, highlighting the maturity of the Indian SaaS space. Also, with the average deal sizes across stages witnessing a substantial rise, SaaS will emerge as the go-to investment opportunity for VCs in the coming years. Additionally, with the time taken for a SaaS firm to become a unicorn reduced to a mere seven years, there is immense potential for Indian SaaS firms to create exponential value to not just shareholders, but stakeholders too.

These are the why we believe that the stage is set for Indian SaaS to move into the global spotlight: