Lack of capital to limit public sector banks' growth till FY19

Credit costs for PSU banks to remain high

The bad news for public sector banks is not over. A latest study from India Ratings and Research, a Fitch group company, shows that scarcity of capital could pull down the loan growth trajectory for public sector banks to nine percent CAGR over FY16 to FY19. For the previous four years of FY12 to FY15, growth for these state-run banks was around 12.2 percent CAGR, India Ratings analysts said.This (nine percent) growth is the bare minimum they will need to generate sufficient spreads to absorb expected operating and credit costs for these banks over this period, the study shows. Most of India’s state-run banks are struggling with rising bad loans, weak fund raising capacity and poor valuations. This is why we see a scenario where -- barring a few strong public sector banks -- most state-owned banks are looking towards consolidation of balance sheets and preserving capital.

“Unless their market valuations improve, they will need to hugely depend on the government and quasi-government institutions for their capital requirements over the transition period,” India Ratings analysts Abhishek Bhattacharya, Udit Kariwala and Prakash Agarwal said in the report.“The reduced credit availability from banks could further tighten the funding needed for an economic pick-up,” the report says. The analysts also estimate credit costs for these banks to remain ‘fairly high’ in the coming quarters and this would impact their profitability.

PSU Banks account for about 70 percent of the country’s banking sector assets.

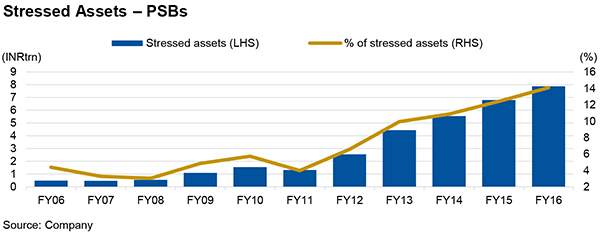

The Reserve Bank of India (RBI) is in the midst of an asset quality review (AQR) for all banks in India and wants banks to clean up their balance sheets by March 2017. The quantum of fresh slippages from large corporate exposure is likely to come down once the RBI exercise is complete. “But many of these large borrower accounts have been recognised as non-performing loans (NPLs) from the date of restructuring,” the analysts said.India Ratings expects a sizeable proportion of NPLs (including large slippage from FY15) to shift to the next classification bucket over the next 12-18 months and attract higher provisioning. This, in turn, would impact profitability.

A financial stability report from the RBI in June showed that the gross non-performing advances (GNPAs) ratio increased sharply to 7.6 percent from 5.1 percent between September 2015 and March 2016, largely reflecting reclassification of restructured standard advances as non-performing, due to the AQR.