Smartphone wars: Is Realme the real thing?

Chinese smartphone brand Realme, launched to take on leader Xiaomi, is off to a blistering start—but its real challenge starts now

Madhav Sheth, CEO, Realme

Madhav Sheth, CEO, Realme Image: Amit Verma

In 2001, Van Diesel-starrer The Fast and The Furious broke all box-office records, both in the US and overseas markets. Made at an estimated cost of $38 million, the movie went on to gross over $207.3 million worldwide. Its success spawned a series of record smashing sequels.

Madhav Sheth doesn’t remember any of these numbers; what the CEO of Realme does like to do is recall the film in the context of the records his fledgling smartphone brand has broken since last May. Realme 1, the first model rolled out by the China-headquartered BBK Electronics, sold out 1.2 lakh units in just 10 minutes in its first ever sale. By September, Realme 2 had clocked 3.7 lakh units in another 10 minutes. Within a span of few months, the sub-brand of Oppo became the fastest to achieve 1 million sales in the country—all through online sales.

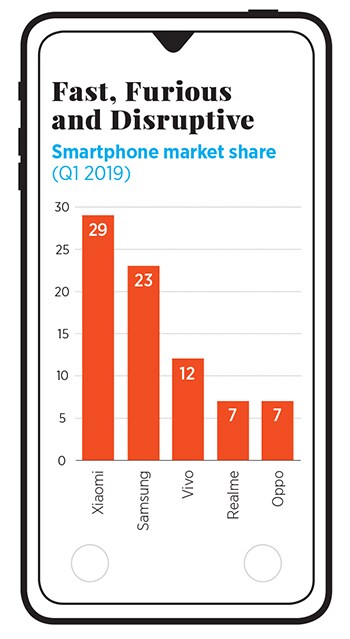

More records were set to tumble. In one year, Realme become the fastest brand to achieve 8 million users, according to Counterpoint Research. In the first quarter of this year, it grabbed third slot in the online smartphone pecking order with 11 percent market share. During the same quarter, it became the fourth biggest overall smartphone brand. “We are fast. We are furious. We are disruptive,” says Sheth, 37, who worked as sales director at Oppo for a year before picking up the reins at Realme India.

At DLF Cyber City—Realme’s office in Gurugram—there is no trace of the umbilical cord between the parent brand and Realme. Except a small board at the entrance that mentions the registered and corporate office: Oppo Mobile India Private Limited. “We are separate brands, with just one thing in common: A manufacturing unit,” says Sheth.

Realme, which now works on an online-offline hybrid model, is present across 50 cities and 5,000 outlets. The target for this year is to reach out to 20,000 outlets in 150 cities. “We will become the biggest smartphone brand in two years,” he claims. Every employee of the company, he adds, swears by the philosophy of the brand: Dare to leap.