RateGain: India's first listed Saas company may be down from stock market highs but not out

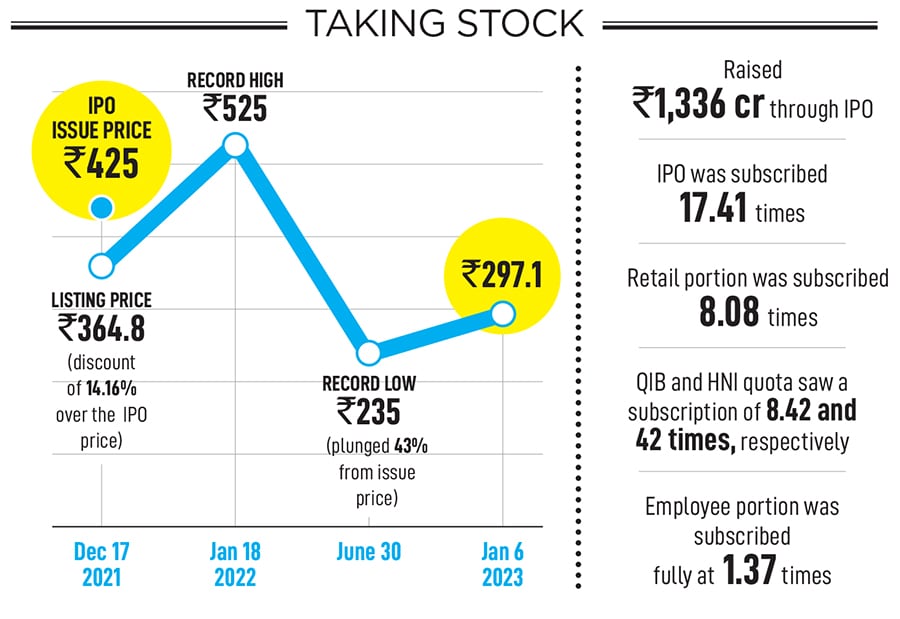

After a blockbuster IPO in December 2021, RateGain's stock fell 43 percent from its listing price before recouping gains as of Jan 18. Here, Bhanu Chopra reflects on the company's performance which remained bootstrapped for a decade, turned profits for 14 years before two years of losses during the pandemic and was back in the black after listing on the bourses

Bhanu Chopra, Chairman and MD, RateGain

Image: Madhu Kapparath

Bhanu Chopra, Chairman and MD, RateGain

Image: Madhu Kapparath

A farmhouse near Delhi airport, May 2021. Tanmaya, we have to do an IPO,” uttered an elated voice from the other side of the phone. “And we have to do it before the year ends,” underlined Bhanu Chopra, exhibiting a sense of abnormal urgency.

The poor CFO, to whom Chopra was speaking, was hospitalised and battling the deadly Delta variant of Covid. He expected a normal check-in call from his boss. The chairman and managing director did call, but he was talking business. “Don’t worry. We will do it. Let me come back, and discuss,” the CFO mumbled, trying his best to calm down Chopra, who too had tested positive with the virus.

“Das,” the founder of RateGain continued with his passionate and obsessive tone, “we need to start working on it as soon as possible.” The CFO ignored, but he knew his boss was up to something.

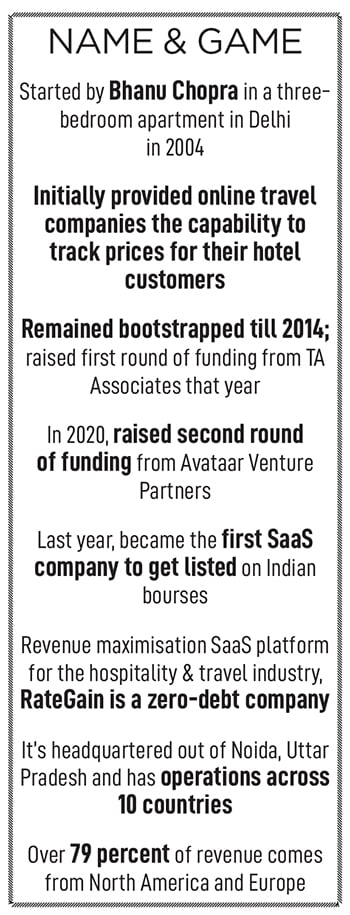

A month later, Chopra set the ball in motion. He summoned the bankers and started preparing for the listing. “I would be lying if I say that I always wanted to take the company to IPO,” says Chopra, who started RateGain as a price comparison website for consumers from his three-bedroom apartment in Delhi in 2004, kept it bootstrapped over the next decade and scaled it profitably from ₹1 crore in revenue in the first year to ₹64 crore in 2014.

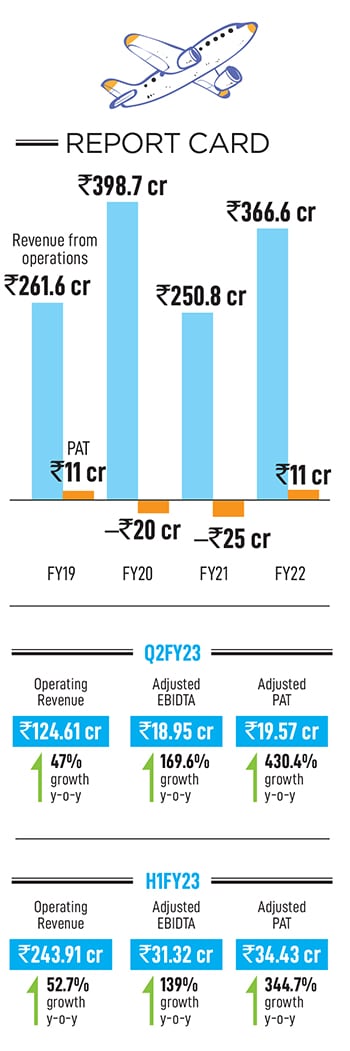

Six fiscals later, RateGain scaled at a furious pace. The company, which had by now morphed into a revenue maximisation SaaS platform for the hospitality and travel industry, closed FY20 with an operating revenue of ₹398.7 crore, and for the first time since inception, it posted a loss. In March 2020, India went under its first national lockdown, and travel and hospitality as a sector got ravaged the most by the pandemic. RateGain, too, felt the pain and posted its second consecutive loss. Revenues too tumbled to ₹250.8 crore in FY21.

Six fiscals later, RateGain scaled at a furious pace. The company, which had by now morphed into a revenue maximisation SaaS platform for the hospitality and travel industry, closed FY20 with an operating revenue of ₹398.7 crore, and for the first time since inception, it posted a loss. In March 2020, India went under its first national lockdown, and travel and hospitality as a sector got ravaged the most by the pandemic. RateGain, too, felt the pain and posted its second consecutive loss. Revenues too tumbled to ₹250.8 crore in FY21.

Chopra was happy with the timing. There was a bit of momentum for tech companies, and valuations too seemed right. A clutch of merchant bankers Chopra spoke with presented a rosy picture as well. “Everybody said you would be a billion-dollar company,” he recalls. There were loads of optimism floating in 2021.

Chopra was happy with the timing. There was a bit of momentum for tech companies, and valuations too seemed right. A clutch of merchant bankers Chopra spoke with presented a rosy picture as well. “Everybody said you would be a billion-dollar company,” he recalls. There were loads of optimism floating in 2021.