50 years on, how Medimix is keeping itself relevant

Legacy soap brand Medimix is adding swag to ayurveda, reimagining itself, and making a transition to become a personal care brand. Will it work?

“There are no failures. There are only challenges, and I’m always looking forward to innovate.” - Pradeep Cholayil, chairman and managing director, Cholayil

“There are no failures. There are only challenges, and I’m always looking forward to innovate.” - Pradeep Cholayil, chairman and managing director, Cholayil

It was there in black and white for Pradeep Cholayil to see. The second-generation entrepreneur, who joined the family business of soap making in 1983, knew he was on slippery ground. The rules wouldn’t change. Well, they didn’t till 2005. Young Cholayil had almost exhausted all attempts to persuade his father VP Sidhan to change the iconic ‘red and black’ packaging of the ayurvedic soap brand which the allopathic doctor founded in 1969. The packaging, Cholayil urged, had outlived its utility. The brand now needed to connect with the youth. It needed a makeover.

It was there in black and white for Pradeep Cholayil to see. The second-generation entrepreneur, who joined the family business of soap making in 1983, knew he was on slippery ground. The rules wouldn’t change. Well, they didn’t till 2005. Young Cholayil had almost exhausted all attempts to persuade his father VP Sidhan to change the iconic ‘red and black’ packaging of the ayurvedic soap brand which the allopathic doctor founded in 1969. The packaging, Cholayil urged, had outlived its utility. The brand now needed to connect with the youth. It needed a makeover.

Dr Sidhan, though, wouldn’t budge. He had his reasons. There were brands which got lured, changed packaging, and subsequently lost consumers, and business. The huge downside played heavily on the mind of the founder who had toiled hard to make the medicated brand a household name in South India.

Cholayil, however, didn’t give up. He tried to reason for one last time. The timing was apt. “So you moved from an Ambassador to a Benz,” he started a conversation with his father. The old car had four wheels. The new one too has four. “So what made you move to a Mercedes-Benz?” he posed. The message hit home. The soap brand got its first major makeover; red and black made way for lots of green, and the positioning of medicated bar changed to a ‘beauty soap’.

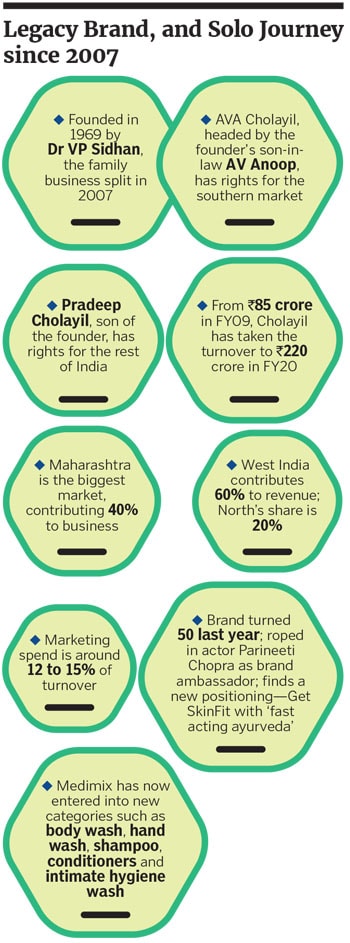

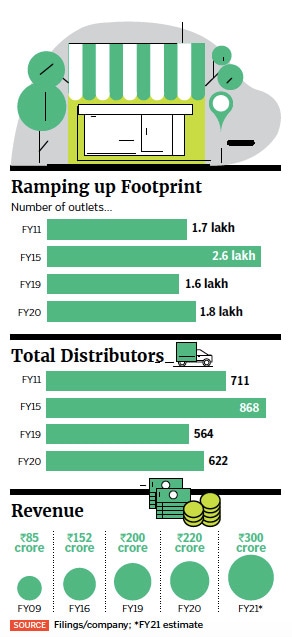

Cut to 2019, the golden jubilee year of Medimix. A sense of déjà vu gripped the chairman and managing director of Cholayil, the company owned by Pradeep Cholayil, who got the rights for Medimix in North, East and West India after a split in the family business in 2007. Volumes of the legacy brand were slipping, and value growth had dropped to single digits. Though the brand posted revenue of Rs 200 crore for FY19 and had its share of loyalists intact, it was not able to lure the younger generation.

The challenge was two-fold. First, the youth perceived ayurveda to be ‘slow’. The instant noodle generation wanted a quick fix. Ayurveda, despite scoring quite high on efficacy and credibility, was losing out to cosmetic products which offered speed of use. The second problem was blurring of the line between natural and herbal. This was confusing the consumer.

Cholayil’s hunger for growth, reckon branding experts, has been the driving force behind the growth of Medimix. “It takes a bold and confident marketer to build a brand and grow in areas other than its home market,” says Jagdeep Kapoor, chairman and managing director at Samsika Marketing Consultants. Medimix, by venturing out of the comfort zone of South India to the West, North and East has shown courage and a ‘conquering thinking’ and grown in a robust manner. “Cholayil’s agility and adaptability have helped a lot,” he adds.

Cholayil’s hunger for growth, reckon branding experts, has been the driving force behind the growth of Medimix. “It takes a bold and confident marketer to build a brand and grow in areas other than its home market,” says Jagdeep Kapoor, chairman and managing director at Samsika Marketing Consultants. Medimix, by venturing out of the comfort zone of South India to the West, North and East has shown courage and a ‘conquering thinking’ and grown in a robust manner. “Cholayil’s agility and adaptability have helped a lot,” he adds.

There was no looking back for Medimix, which in the ’70s was sold as a ‘soap recommended by doctors’. Maharashtra is now the biggest market, contributing 40 percent to the business. West India, overall, contributes 60 percent to the revenue. North comes next with 20 percent. The brand now gets exported to 31 countries, including the US and Gulf nations. Cholayil has ramped up marketing spend from low single digits to 12 to 15 percent of the turnover.

There was no looking back for Medimix, which in the ’70s was sold as a ‘soap recommended by doctors’. Maharashtra is now the biggest market, contributing 40 percent to the business. West India, overall, contributes 60 percent to the revenue. North comes next with 20 percent. The brand now gets exported to 31 countries, including the US and Gulf nations. Cholayil has ramped up marketing spend from low single digits to 12 to 15 percent of the turnover.