A year after ban, many Chinese apps make a comeback with a new interface

Experts say letting them function and allowing Chinese investments to fuel the Indian startup scene have allowed local apps to take over large chunks of the social media space

Image: Hemanshi Kamani / Reuters

Image: Hemanshi Kamani / Reuters

In one comic clip, Akshat Jain, popularly @crazy_akki, gets into a petty argument with his wife. She threatens to leave him and go back to her parents. Jain secretly rejoices until she calls her mother who says that to teach her rogue son-in-law a lesson, she was going to come over and stay with the couple. “Don’t make such a mistake…,” writes Jain in his post on Tiki, a short video sharing app. “Else it will cost you heavy…”

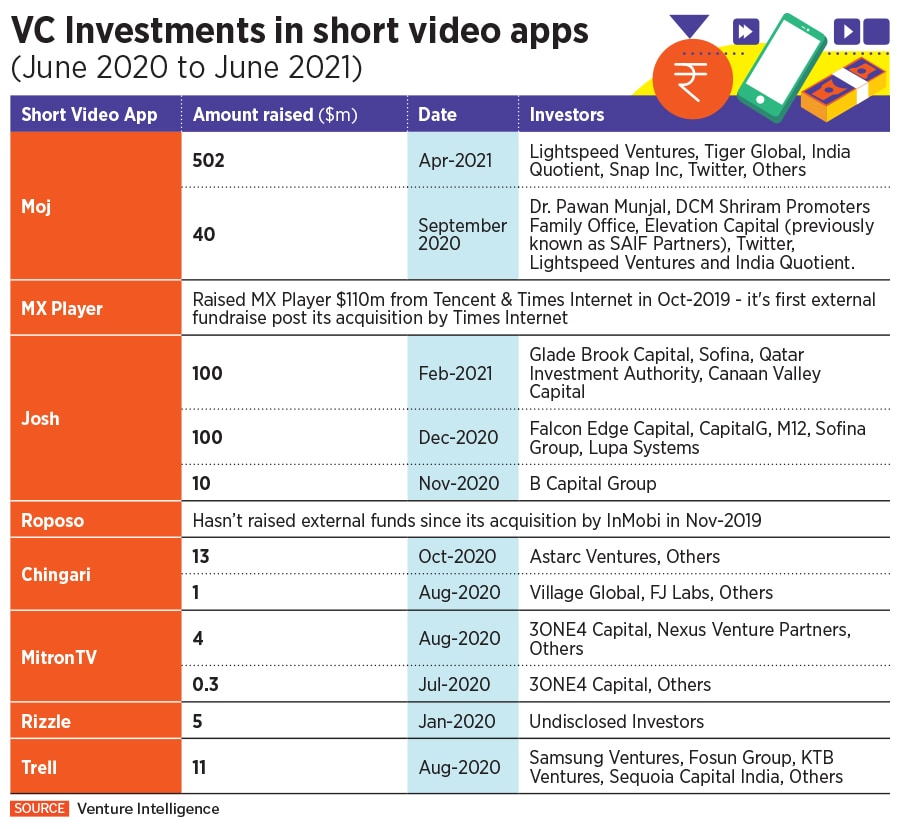

Jain and his reel life wife Anjali Jain (unrelated) were diehard TikTokers where they had gathered 3.2 million followers when the government announced a sweeping ban on the ByteDance-owned short video service in June 2020. Fifty-eight other Chinese-owned apps, including WeChat and Baidu, deemed harmful to the “sovereignty and integrity of India” were also banned. The move stemmed from tensions with China over a Himalayan border dispute that led to an armed clash in which 20 Indian troops were killed.

At the time, the Ministry of Electronics and Information Technology (MeitY) said it had received “many complaints from various sources” that the apps were “stealing and surreptitiously transmitting users’ data in an unauthorised manner” to servers located outside India. In September and November 2020, the government added more Chinese-owned apps to its blacklist, including clones of those already banned, bringing the total to 267.

Even so, many banned Chinese apps are making a comeback, albeit with a different interface. Tiki, for example, made a quiet entry into the Indian market three months ago and is slowly notching up users. It is owned by Singapore-based Bigo Technologies, which, in turn, is owned by Joyy, a Chinese company listed on the Nasdaq. Bigo is also behind the banned apps Bigo Live, a live streaming platform, and short video app Likee. “We reverse engineered Tiki’s app and saw that the code is the same as Likee. They haven’t changed the library inside the code. They just put a new skin and launched it,” says Sumit Ghosh, co-founder and CEO of Chingari, a short video service that saw a huge uptick post the ban.

Jain, who has signed a contract with Tiki to exclusively post his content on the platform, is unaware of the Chinese connection. “Tiki is a Singapore-based company,” he says when prodded. “I used to use Likee earlier. The interface is very different from Tiki… it’s possible that the team members might be the same because they get poached,” he reasons.