Apple, Micron Technology, First Solar: India is bagging mega tech projects that a few years ago would have been China-bound. But can this sustain?

Things have started on a good note, but experts say roadblocks like infrastructure, red tape, a complex tax system and skilled labour remain

India now ranks 63rd in the world for manufacturing, up 23 places from a few years ago. Image: Shutterstock

India now ranks 63rd in the world for manufacturing, up 23 places from a few years ago. Image: Shutterstock

Global manufacturers are betting big on India. The current global supply chain is heavily dependent on China’s manufacturing capacity. But things are changing now, and many manufacturers around the world are looking for ‘China Plus One’. This term, which came into being back in 2013, is a business plan to avoid investing only in China and expand the business into other countries, and India seems to be the current favourable market for many. Over the past decade, countries like Vietnam, Thailand, Malaysia had emerged as the hot alternatives to China for the United States. Recent announcements, starting with Apple and more recently First Solar, suggest that India is the current favourite. Is it?

Before the Covid-19 pandemic, China remained an important supplier to most countries. However, with the onset of the pandemic, the US-China trade war, and rising labour costs, manufacturers are looking for substitutes to avoid experiencing shortages due to supply chain disruptions in China.

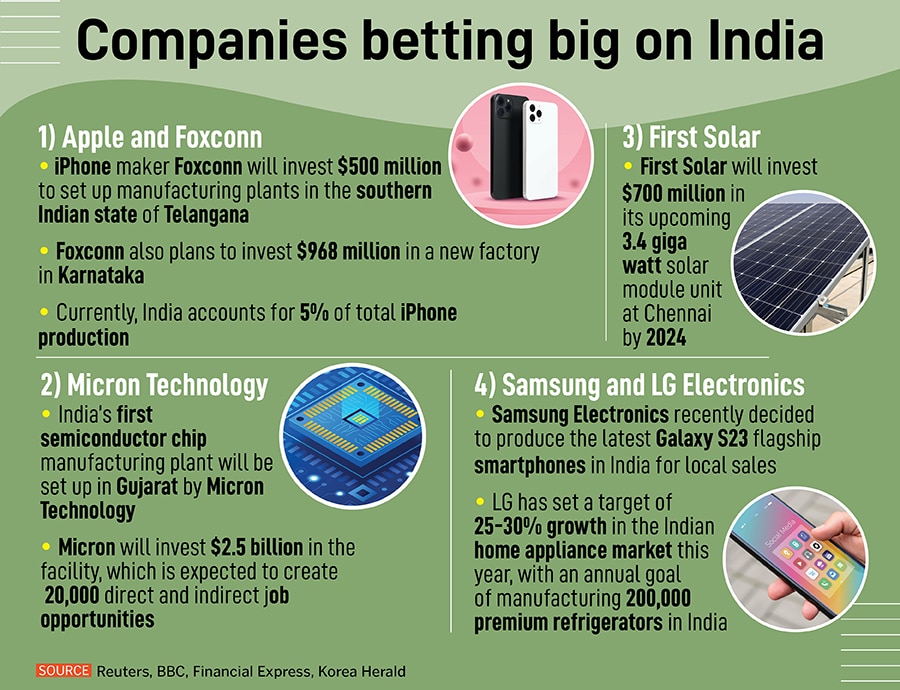

To be sure, a flurry of companies has shifted their focus and increased investments to set up manufacturing plants in India. First, Apple decided to reduce its dependence on producing iPhones in China and chose to make some of them in India. Taiwanese company Hon Hai Technology Group (Foxconn) is expanding its production facilities in India to make the iPhone 12, 13, 14 and 14+ models. It is also evaluating a semiconductor manufacturing project. Foxconn, which is a major Apple supplier and the world’s largest contract electronics maker, has been also attempting to break into making chips as it seeks to branch out and expand into the electric vehicle market. The company recently said in a statement that it is committed to India and sees the country successfully establishing a robust semiconductor manufacturing ecosystem.

Another Taiwanese company Wistron recently sold its iPhone assembly facility in Kolar to the Tata Group, according to news reports. Tata Group is on the verge of finalising the deal to acquire their factory. A report by Bloomberg said that the agreement could be sealed by August 2023. If this deal works out, it will be an important milestone as for the first time a local Indian company will enter into iPhone assembly.

And last fortnight, coinciding with Prime Minister Narendra Modi’s US visit, chip-maker Micron Technology sealed a deal to set up a semiconductor facility in Gujarat. Reports also suggest that South Korean tech giants Samsung and LG Electronics have moved their production operations away from China due to growing uncertainties and are looking very closely at the world's fifth-largest economy.

Also Read: How China's growing supply chain constraints are giving Apple's India play a big boost

India is not the only beneficiary of this China plus one strategy. Countries like Vietnam and Malaysia have also hugely benefited from the re-shift of the supply chain network. Investments in China are now being directed to MITI-V countries. Malaysia, India, Thailand, Indonesia, and Vietnam—termed ‘MITI-V’ or ‘Mighty Five’. India is the biggest beneficiary out of the lot, says Chandranath Dey, India head, operations and business development, logistics, and industrial at JLL, a global real estate services firm.