Bank attrition: Concerning but not a pain point

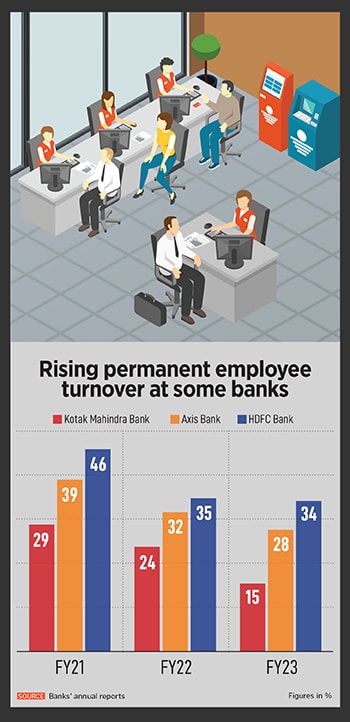

Though attrition at some of India's biggest banks is high and rising, it is the junior management that makes the most exits due to opportunities in fintech and flexible working conditions. Banks are more concerned about retaining senior management talent, which is involved with strategic decision making

Controlling the attrition rate and retaining the skilled workforce often counts as one of the biggest challenges bankers face in India, particularly post the pandemic, where young employees—millennials and applicable Gen Z—believe that professions and jobs need to be flexible.

Image: Shutterstock

Controlling the attrition rate and retaining the skilled workforce often counts as one of the biggest challenges bankers face in India, particularly post the pandemic, where young employees—millennials and applicable Gen Z—believe that professions and jobs need to be flexible.

Image: Shutterstock

Four years ago, Anil Pushkar, at 35, did what most relationship managers (RM) in banking would do. The attractiveness of a slightly elevated job profile and a 30 percent hike in salary led him to quit his four-year-old employment as an RM at Kotak Mahindra Bank to join the larger HDFC Bank in 2019, where he currently works.

His decision to quit might seem odd to some; it was almost decoupled from the bank he was leaving. Kotak Mahindra Bank—like most other lending institutions in India—has been seeing steadily improving profit ratios, a stronger balance sheet and years of a focussed leadership and processes. Pushkar (name changed) is clear that HDFC Bank offers “access to data and products” like no other, but also says if he had stayed on at KMB he would have acquired a similar salary package once he hit a particular grade and slab level.

With no regrets about quitting, he’s followed the adage of ‘People don’t quit bad companies, they leave bad bosses’. After all, the pressures of managing key clients and teams, scaling retail banking, cross-selling and acquiring customers is almost similar across the BFSI (banking, financial services and insurance) sector.

Controlling the attrition rate and retaining the skilled workforce often counts as one of the biggest challenges bankers face in India, particularly post the pandemic, where young employees—millennials and applicable Gen Z—believe that professions and jobs need to be flexible. Most of these would also give priority to maintaining a better work-life balance over career success.

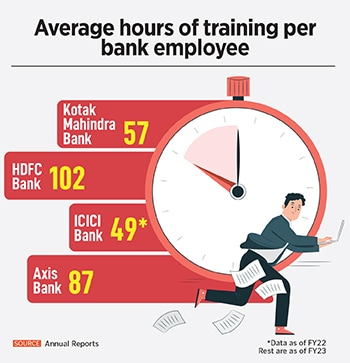

The increased global economic uncertainty has also meant that a majority of the workforce in India remains active job-seekers. And this is despite every bank having organised training and skilling programmes (see details), employee engagement and feedback programmes and incentives for junior level employees to work from the company headquarters.

Add to this the fact that several private and public sector banks and small finance banks are in different stages of expansion, which would mean that they will face a tricky issue of continuing to hire human capital while trying to retain existing skilled staff.

Add to this the fact that several private and public sector banks and small finance banks are in different stages of expansion, which would mean that they will face a tricky issue of continuing to hire human capital while trying to retain existing skilled staff.  HDFC Bank’s CEO Sashidhar Jagdishan in the FY23 annual report says, “The [HDFC] Bank has experienced an increase in attrition over the last financial year, a significant part of which was in the ‘non-supervisory staff’ levels (which includes Sales Officers). One reason that can be attributed towards this increase is a post-Covid phenomenon that may have prompted the younger workforce to recalibrate what they ‘want from their lives’. This has led to increased attrition across all sectors. It is a reality that all major employers are grappling with, especially in the BFSI sector.”

HDFC Bank’s CEO Sashidhar Jagdishan in the FY23 annual report says, “The [HDFC] Bank has experienced an increase in attrition over the last financial year, a significant part of which was in the ‘non-supervisory staff’ levels (which includes Sales Officers). One reason that can be attributed towards this increase is a post-Covid phenomenon that may have prompted the younger workforce to recalibrate what they ‘want from their lives’. This has led to increased attrition across all sectors. It is a reality that all major employers are grappling with, especially in the BFSI sector.”