Can V Vaidyanathan's Midas touch turn IDFC into a banking behemoth?

The optics look good for IDFC, which announced a merger with IDFC First Bank, but Vaidyanathan will have to handhold the entity through what could be a tricky road ahead

V Vaidyanathan, MD & CEO, IDFC First Bank

V Vaidyanathan, MD & CEO, IDFC First Bank

V Vaidyanathan had always dreamt of being a fighter pilot in the Indian Air Force (IAF).

In fact, if not for a medical condition that he developed as a child, Vaidya would have probably spent much of his life inside cockpits or on tarmacs, mending the country’s fighter aircraft fleet. It was sometime during his growing-up years in Odisha that he fell from the terrace of his one-storied house damaging his prospects for a military career.

“It was not a life-threatening injury, but his left eye was damaged,” Tamal Bandyopadhyay, the noted journalist, writes in his book Roller Coaster: An Affair with Banking. The family was given a two-month grace period by the IAF to surgically fix the eye before Vaidya could reapply. Vaidya’s father, who worked with Hindustan Aeronautics Limited, sold the family refrigerator for the surgery. “It went off well, but he still flunked the IAF medicals,” Bandyopadhyay writes.

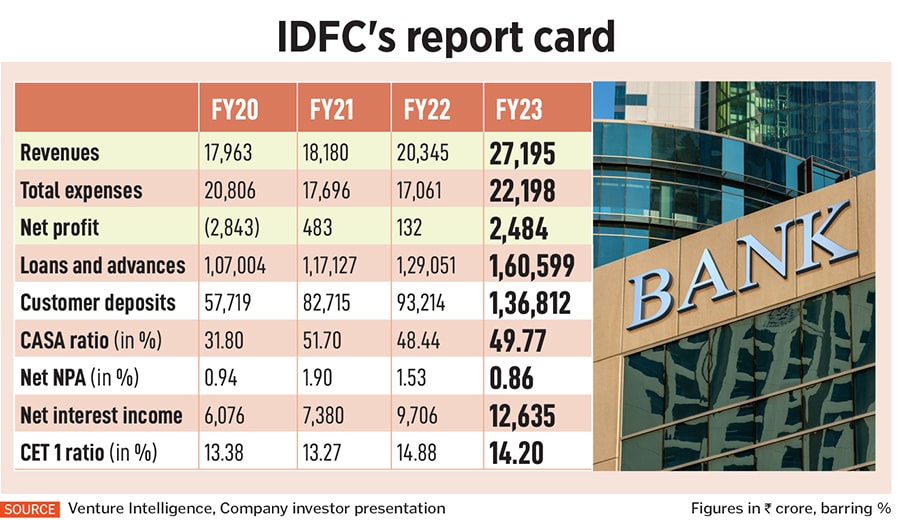

But Vaidya remained unfazed. In fact, if anything, his vision, and perhaps his clarity, was only going to get better from there. A career in banking followed, leading him to rewrite the rules of the game. A lean and balding straight shooter, who had a love for guitar and singing, Vaidya was readying for the big kill in India’s banking sector. As the CEO of IDFC First Bank, a five-year-old bank formed after the merger of IDFC Bank and Capital First, an NBFC, Vaidya has been instrumental in doubling the bank’s revenues, while taking the company out of the red, with deposits of nearly Rs 1.4 lakh crore.

And if the latest manoeuvre by the company is anything to go by, Vaidya is now preparing IDFC First Bank to take it into the big boys’ club. On July 3, a few days after infrastructure giant HDFC and banking behemoth HDFC Bank closed its merger to create an entity worth $157 billion, infrastructure financing company IDFC and IDFC First Bank announced a merger under which shareholders of IDFC Ltd will get 155 shares of IDFC First Bank for every 100 shares held in the former.