The science behind HDFC-HDFC Bank's mega merger

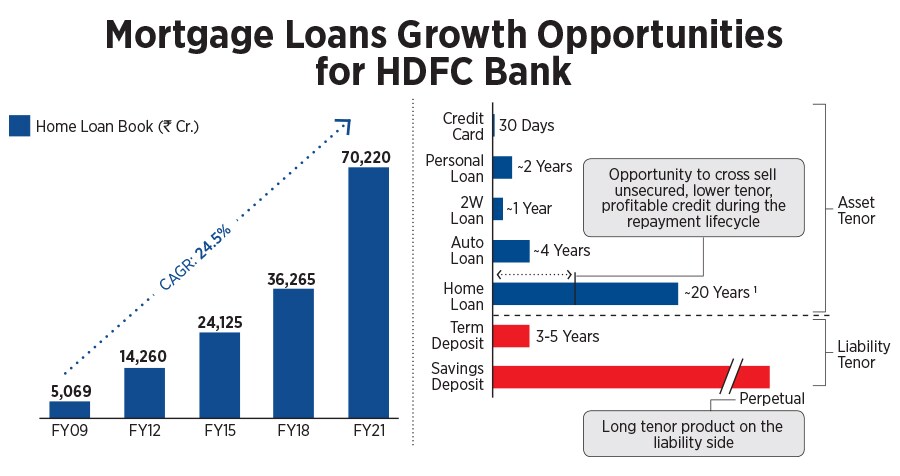

The bank will now get a stickier loan book and can become an aggressive lender in the mortgage loans space. The deal will ring alarm bells for other banks, who need to build scale and strength in the form of data, distribution muscle and cost of capital

Housing Development Finance Corporation (HDFC) chairman Deepak Parekh speaks during a media briefing in Mumbai on April 4, 2022. - India's largest private bank will merge with its largest mortgage lender to become a $237 billion financial giant, both companies said, as low interest rates send demand for home loans soaring.

Image: Indranil Mukherjee / AFP

Housing Development Finance Corporation (HDFC) chairman Deepak Parekh speaks during a media briefing in Mumbai on April 4, 2022. - India's largest private bank will merge with its largest mortgage lender to become a $237 billion financial giant, both companies said, as low interest rates send demand for home loans soaring.

Image: Indranil Mukherjee / AFP

Over seven years since first considering the merger of mortgage lender Housing Development Finance Corporation (HDFC) with the largest private lender HDFC Bank, the inevitable was announced on Monday, April 4.

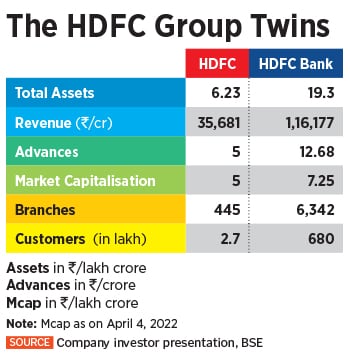

The HDFC board has approved the merger with HDFC Bank, which would include its wholly-owned subsidiaries HDFC Investments Limited and HDFC Holdings Limited with HDFC Bank. HDFC will own 41 percent in HDFC Bank. HDFC’s shareholders will get 42 shares of HDFC Bank for every 25 shares of the non-banking financial company (NBFC) held by them.

The deal, which regulatory approvals pending, is likely to be completed over the next 12 to 18 months, officials of both institutions say. Till then, both institutions will continue to function are independent entities, as they are today.

HDFC Chairman Deepak Parekh in his opening remarks to announce this mega-deal said: “No member of the press could decipher this. Tomorrow's news you are supposed to give today. I was disappointed. You failed this time,” he said jokingly. The boards and legal teams of both organisations had been actively working towards the deal for the past three weeks. “This is a merger of equals,” he said.

Investors cheered the move in early Monday trade, with both HDFC and HDFC Bank stocks gaining handsomely. HDFC Bank rose as much as 14.3 percent to a day’s high of Rs1,721.8 before retracing marginally to Rs1,656 in afternoon trade. HDFC stock froze in early trade Monday at Rs621.5, up ten percent over its previous close. This merger will likely create India’s third largest company by market capitalisation, behind Reliance Industries and TCS.

Independent banking expert Hemindra Hazari says, “For some reason, they probably felt that HDFC on its own would find it difficult to continue to operate…the merger will assist HDFC now. One of the major challenges of such a merger is, of course, the culture. HDBC Bank is a dominant player, in terms of balance sheet size and employees strength.”

Independent banking expert Hemindra Hazari says, “For some reason, they probably felt that HDFC on its own would find it difficult to continue to operate…the merger will assist HDFC now. One of the major challenges of such a merger is, of course, the culture. HDBC Bank is a dominant player, in terms of balance sheet size and employees strength.”