How HDFC Bank's litany of crises has spelt opportunity for ICICI Bank

As HDFC Bank awaits the lifting of its credit card ban, it is strengthening its technology architecture. But will it be able to recover lost ground?

When Sashidhar Jagdishan, the managing director and CEO of HDFC Bank, publicly and upfront apologised to shareholders in their integrated annual FY21 report released in June—about issues relating to technology outages the bank had been facing and a ban imposed on it to issue new credit cards—the move was rare and commendable.

It is extremely unusual for a corporate leader, more so of a mega bank, to use the words ‘sorry’, ‘justifiably’ and ‘fix the problem’ in a message to investors. Consider the fact that in the past several years, public sector banks (PSBs) have, in the case of glaring divergences in reporting non-performing assets (NPAs), mentioned these only in the notes to accounts to the financial statements, as mandated. There were no regrets, explanations or concerns.

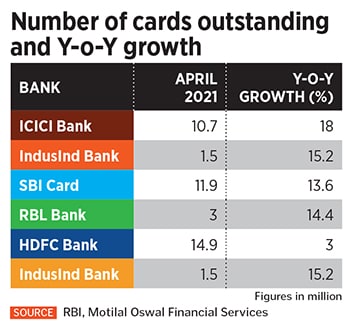

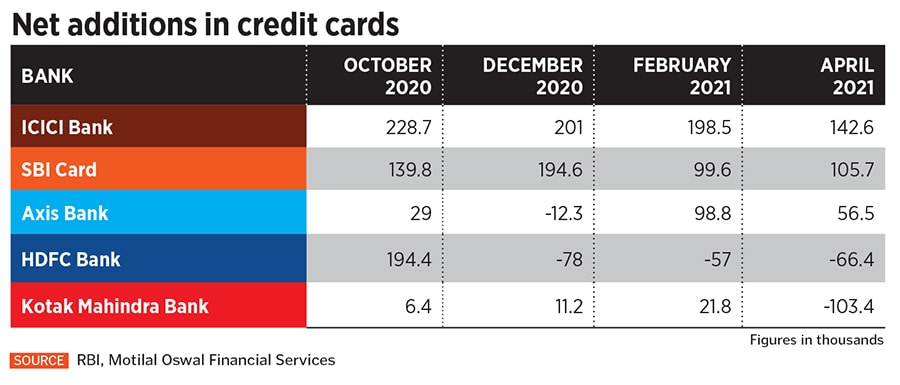

For HDFC Bank, India’s largest private lender by assets, internal crisis—in the form of inquiries, penalties and bans imposed by the regulator Reserve Bank of India—is unfamiliar territory. It has not only caused embarrassment for the bank but has also enabled ICICI Bank—one of its rivals in retail banking—to gain market share in the credit card market alongside SBI Card since December 2020, at the expense of HDFC Bank (see table).

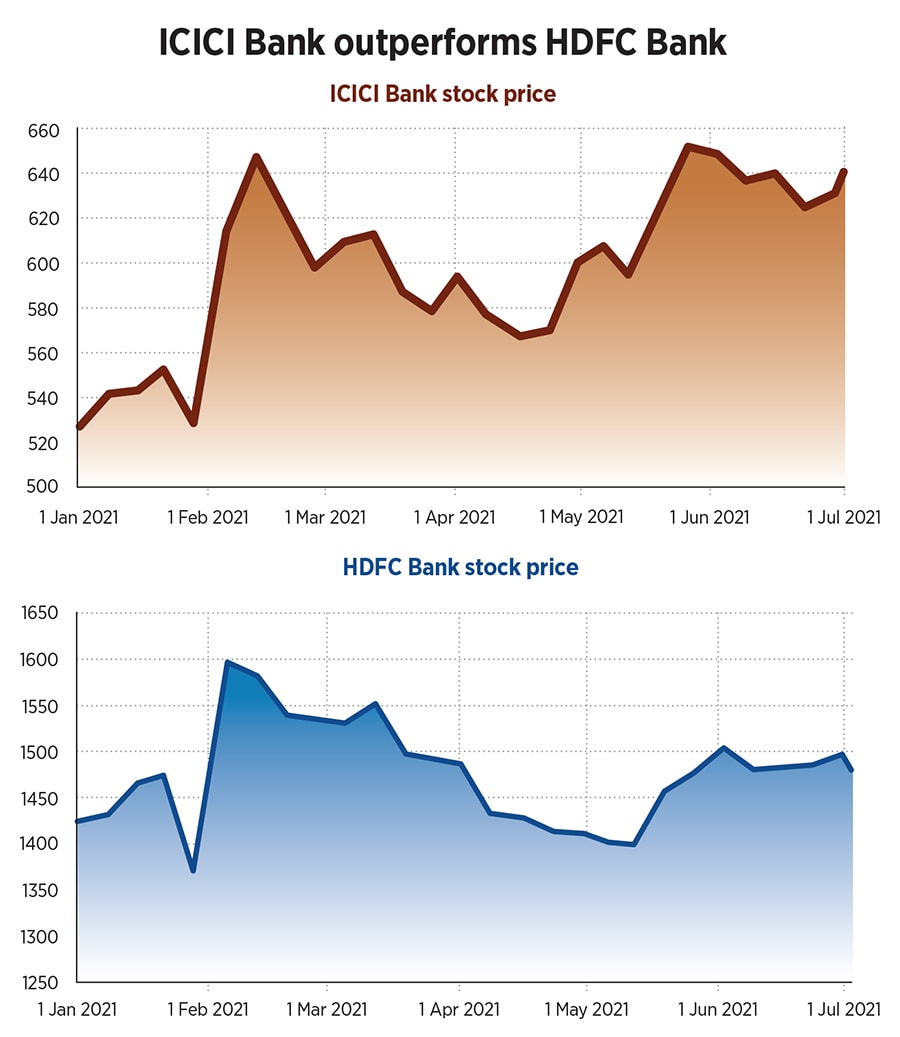

Despite a strong set of earnings through healthy revenue growth and steady asset quality, valuations for HDFC Bank have dipped over the past year while those for ICICI Bank have risen in the same period. Improved quarterly earnings have boosted investor sentiment for ICICI Bank; the stock has outperformed the Nifty Bank index, gaining 21.4 percent in 2021 against just 10.9 percent for the index and only 3.8 percent for the HDFC Bank stock in 2021.

While it is quite likely that HDFC Bank will climb back to normalcy in the credit card business when the ban is lifted, the longer it is out of the market the more it will hurt the bank. As of now, the ban is yet to be lifted, with HDFC Bank awaiting communication from the RBI. HDFC Bank, with a 24 percent market share, was the market leader in issuances of new cards, which ranged between 1.5 to 2 lakh cards every month, prior to the ban.

In the space of eight months Jagdishan has already put some things in order through the Project Future-Ready programme. In this way he has also started to create a new profile for himself which has already moved out of Aditya Puri’s long shadow. “This is probably his way of saying that I am my own person,” says business journalist Tamal Bandhopadhyay, who chronicled HDFC Bank’s digital journey in his book HDFC Bank 2.0: From Dawn to Digital. Bandhopadhyay also says that while several banks today are “extremely savvy” in their digital banking journey, Aditya Puri was well ahead of his time in terms of getting the bank onto the digital journey.

In the space of eight months Jagdishan has already put some things in order through the Project Future-Ready programme. In this way he has also started to create a new profile for himself which has already moved out of Aditya Puri’s long shadow. “This is probably his way of saying that I am my own person,” says business journalist Tamal Bandhopadhyay, who chronicled HDFC Bank’s digital journey in his book HDFC Bank 2.0: From Dawn to Digital. Bandhopadhyay also says that while several banks today are “extremely savvy” in their digital banking journey, Aditya Puri was well ahead of his time in terms of getting the bank onto the digital journey.