Prashant Kumar: Rewriting the Yes Bank story

An unassuming leader, Prashant Kumar has led an ailing Yes Bank out of the woods on a steep trek to the top. He is exploring acquisitions to grow the bank and stay profitable, while building the deposit franchise

Prashant Kumar, MD and CEO, Yes Bank

Image: Neha Mithbawkar for Forbes India

Prashant Kumar, MD and CEO, Yes Bank

Image: Neha Mithbawkar for Forbes India

The demeanour of Prashant Kumar, the managing director and CEO of Yes Bank, contradicts what the financial institution has gone through in recent years–from a near run on deposits in early 2020 which led the Reserve Bank of India to announce a reconstruction scheme to avert any collapse, to infusion of fresh capital from leading banks, and a plan for the complete clean-up of its stubbornly high bad loans.

Kumar is noticeably calm; he shifts to a sofa away from his massive desk at the side of a vast chamber at the Yes Bank corporate office in Santacruz, the backdrop view being regular hustle of flights from the Mumbai airport. His comfort might be coming from the fact that the bank—saddled with weak asset quality for years now—has planned a resolution for these bad loans through a transaction with private equity investment firm JC Flowers, announced on September 20.

Poor Optics

Rising bad loans on a company’s balance sheet is always poor optics. They not only become non-earning assets and reduce the interest income for the bank, thus impacting return on assets and profitability, but they also reduce the confidence which stakeholders and potential investors visualise of the bank.In the case of Yes Bank, between 2008 and 2015, it had expanded rapidly nationwide and lent indiscriminately and aggressively to all, including shadow-lenders and real estate developers. Corporate banking in Q4FY19 formed 65.6 percent of the loan book size. This type of lending had led to a weakening in asset quality, which became a solvency issue because its capital buffers were diminished due to the push for persistent high growth. It was akin speeding without seat belts.

By March 2020, when Kumar took charge of the bank as its CEO, the gross non-performing assets (GNPAs) for Yes Bank had surged to 16.8 percent as a portion of its total advances; double that of the level for all banks in India. “A bank is never seen in the right manner by investors, when its GNPAs are much higher than those in the industry,” Kumar, the former deputy managing director at State Bank of India, tells Forbes India.

As loans and credit flow worsened in the banking system since 2019, Yes Bank had seen a sharp 39 percent erosion in deposits in nearly 12 months: From Rs227,601 crore in March 2019 to Rs137,506 crore as of March 5, 2020. The loss of confidence called for quick action in the form of a cap on deposits, the RBI scheme for a reconstruction of the board and the infusion of capital from some of India’s strongest banks.

As loans and credit flow worsened in the banking system since 2019, Yes Bank had seen a sharp 39 percent erosion in deposits in nearly 12 months: From Rs227,601 crore in March 2019 to Rs137,506 crore as of March 5, 2020. The loss of confidence called for quick action in the form of a cap on deposits, the RBI scheme for a reconstruction of the board and the infusion of capital from some of India’s strongest banks.  Yes Bank will pick up 19.9 percent stake in the Asset Reconstruction Company (ARC), and JC Flowers, the balance. Yes Bank’s net carrying weight—the cost of an asset less depreciated—is Rs8,300 crore. JC Flowers will give 15 percent of the bidding amount (approximately Rs1,670 crore) to Yes Bank. Since the net carrying value is lower than the assignment value, this cash would further bring down the value of the security receipts, which Yes Bank is going to carry in its books. “Whenever there is recovery in the bad loans, the SR value will keep reducing,” Kumar says. The ARC transaction is likely to be completed in Q3FY23.

Yes Bank will pick up 19.9 percent stake in the Asset Reconstruction Company (ARC), and JC Flowers, the balance. Yes Bank’s net carrying weight—the cost of an asset less depreciated—is Rs8,300 crore. JC Flowers will give 15 percent of the bidding amount (approximately Rs1,670 crore) to Yes Bank. Since the net carrying value is lower than the assignment value, this cash would further bring down the value of the security receipts, which Yes Bank is going to carry in its books. “Whenever there is recovery in the bad loans, the SR value will keep reducing,” Kumar says. The ARC transaction is likely to be completed in Q3FY23. In coming quarters, two nominees—from the Carlyle Group and Advent International each—are expected to join the Yes Bank board, once their deals to invest into the bank are cleared by the RBI. Carlyle and Advent will get a 10 percent stake in the bank, with Yes Bank raising Rs8,898 crore through a combination of equity and warrants to funds affiliated with the two private equity investors. The move is seen to further improve the bank’s capital position and bring in strong strategic investors who would assist the growth strategy for the bank.

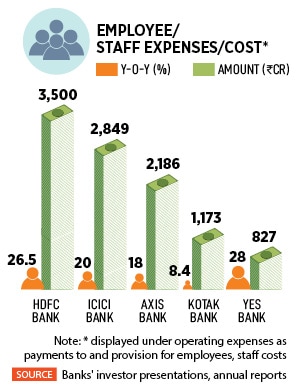

In coming quarters, two nominees—from the Carlyle Group and Advent International each—are expected to join the Yes Bank board, once their deals to invest into the bank are cleared by the RBI. Carlyle and Advent will get a 10 percent stake in the bank, with Yes Bank raising Rs8,898 crore through a combination of equity and warrants to funds affiliated with the two private equity investors. The move is seen to further improve the bank’s capital position and bring in strong strategic investors who would assist the growth strategy for the bank. “Attrition is a concern [for the bank],” Kumar admits. But he points out that Indian corporates, including banks, are facing the same pressure. “People are trying to explore new ideas, and wanting to take more risks,” he says. Not limited to banking, India’s IT industry is plagues with an attrition rate close to 25 percent and it also continues to struggle with moonlighting (secondary jobs).

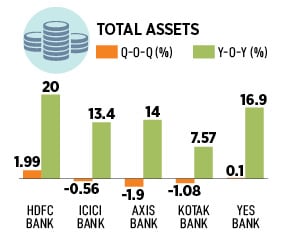

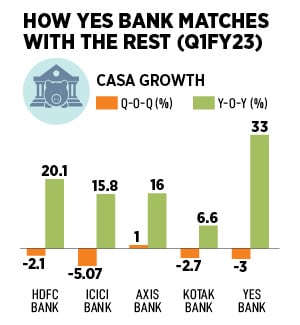

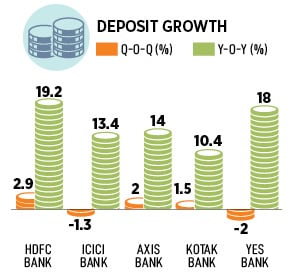

“Attrition is a concern [for the bank],” Kumar admits. But he points out that Indian corporates, including banks, are facing the same pressure. “People are trying to explore new ideas, and wanting to take more risks,” he says. Not limited to banking, India’s IT industry is plagues with an attrition rate close to 25 percent and it also continues to struggle with moonlighting (secondary jobs).  Yes Bank faced one test post-moratorium, in 2020-21, and came out unhurt. “It is one of the few brands where the trust was intact during the tough phase,” says independent market analyst Ambareesh Baliga. The bank saw deposits growing by 55 percent in FY21 and 83 percent from FY20 levels. “We are growing our deposit franchise at double that of the industry,” Kumar says, referring to the Q1FY23 data, with industry deposit growth at 9.5 percent.

Yes Bank faced one test post-moratorium, in 2020-21, and came out unhurt. “It is one of the few brands where the trust was intact during the tough phase,” says independent market analyst Ambareesh Baliga. The bank saw deposits growing by 55 percent in FY21 and 83 percent from FY20 levels. “We are growing our deposit franchise at double that of the industry,” Kumar says, referring to the Q1FY23 data, with industry deposit growth at 9.5 percent.