Post-mergers, big banks aren't gobbling up smaller ones. Not yet

Some bankers, analysts and housing finance experts foresee a consolidation in financial services, but it will be need-driven and neither widespread nor constant

Now large banks, strengthened with improved balance sheets and P&L, have the confidence to go out and scout for acquisitions

Illustration: Chaitanya Dinesh Surpur

Now large banks, strengthened with improved balance sheets and P&L, have the confidence to go out and scout for acquisitions

Illustration: Chaitanya Dinesh Surpur

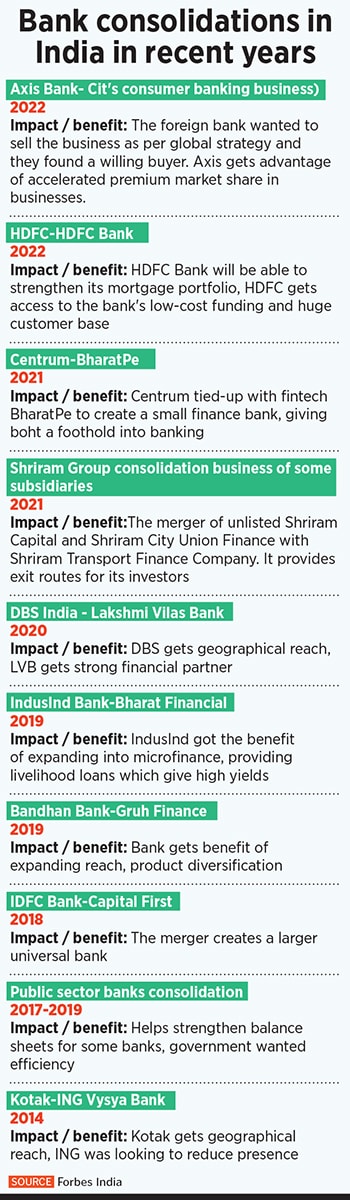

Two banking developments that took place in April—one, the proposed merger of Housing Development Finance Corporation (HDFC) with private sector lender HDFC Bank, being touted as a ‘one-in-a-lifetime’ deal; and second, Axis Bank buying out Citi India’s consumer banking business—leads one to think more such are on the way. Combine this with the fact that India has just 12 state-owned banks, down from 27 earlier, through a forced consolidation by the government in 2019, and one might think it is a secular trend emerging. But a closer look at recent mergers suggests that other factors are playing out.

In September last year, Finance Minister Nirmala Sitharaman spoke about the need for 4-5 banks the size of State Bank of India (SBI), to meet the needs of a growing economy. The driving force for amalgamation (of banks) was that India needs not just a lot more banks, but a lot more big banks, she had said at that time.

Confidence to scout again

In recent years, banks were not actively scouting for mergers and acquisitions because the larger players were going through their own challenges to improve asset quality and capitalisation levels after the non-banking financial companies (NBFC) crisis and the pandemic. With provision levels (excluding write-offs) improving to an average 71 percent for all commercial banks, the stress level which banks are likely to face can be better assessed.“Now large banks, strengthened with improved balance sheets and P&L, have the confidence to go out and scout for acquisitions. Consolidation in the BFSI space is going to happen,” says Anil Gupta, vice president of credit ratings agency ICRA.

A similar sentiment is echoed by Fitch India senior director Saswata Guha, colleague Siddharth Goel and Singapore-based senior director Elaine Koh. They believe the two recent deals “could encourage banks to turn to M&A. Large NBFIs could be acquisition targets, given their higher-margin products, large pools of priority-sector customers and loans, and potential cross-selling opportunities. However, the regulatory attitude towards such acquisitions will be an important factor in their success,” they said in a non-rating commentary.

Gupta points out that barring the big four private banks (

Gupta points out that barring the big four private banks ( In 2021, Shriram Group consolidated its financial services businesses with a merger of unlisted Shriram Capital and Shriram City Union Finance with Shriram Transport Finance Company (STFC). It streamlined the way for exits for its investors Ajay Piramal and TPG Capital. In 2019, micro-finance lender Bharat Financial was getting a good valuation and IndusInd wanted to expand into this space; Kotak Mahindra Bank had also acquired a micro-finance company BSS Microfinance in 2016.

In 2021, Shriram Group consolidated its financial services businesses with a merger of unlisted Shriram Capital and Shriram City Union Finance with Shriram Transport Finance Company (STFC). It streamlined the way for exits for its investors Ajay Piramal and TPG Capital. In 2019, micro-finance lender Bharat Financial was getting a good valuation and IndusInd wanted to expand into this space; Kotak Mahindra Bank had also acquired a micro-finance company BSS Microfinance in 2016.