As Paris Air Show returns, sustainability is aviation's biggest challenge

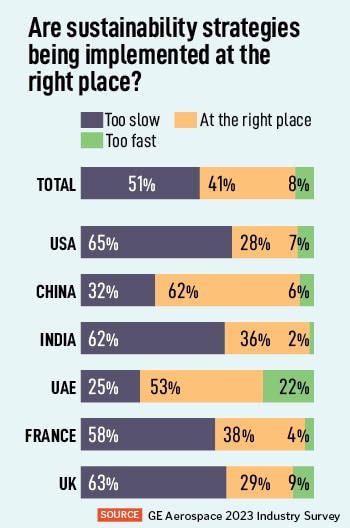

Nearly two-thirds of respondents in the US, UK and India, in a GE Aerospace survey, say the pace of implementation of decarbonisation strategies is "too slow"

A model of the Rafale C fighter jet, manufactured by Dassault Aviation, is displayed during the 54th International Paris Airshow at Le Bourget Airport near Paris, France, June 18, 2023

Image: Benoit Tessier / Reuters

A model of the Rafale C fighter jet, manufactured by Dassault Aviation, is displayed during the 54th International Paris Airshow at Le Bourget Airport near Paris, France, June 18, 2023

Image: Benoit Tessier / Reuters

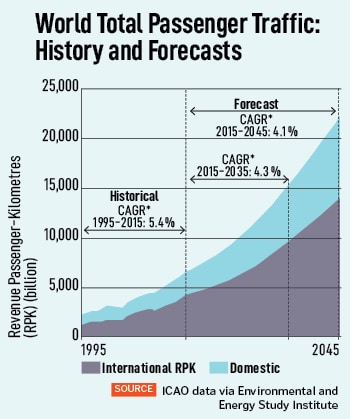

The Paris Air Show returns today after a four-year hiatus, marking the aviation industry’s return to growth since the Covid pandemic. And a recent survey from one of the industry’s biggest players, GE Aerospace—the aviation arm of General Electric—shows that many people, including in India, expect the industry to miss its target to go net-zero by 2050.

Only 30 percent of respondents in the survey believe that meeting sustainability goals outweighs concerns about supply chain and labour issues. However, 51 percent of those surveyed are unhappy with the pace of progress in implementing sustainability strategies.

Asked if they thought that sustainability strategies in the industry were being implemented at the right pace, they chose “too slow” as their response. The other two choices were “at the right pace” and “too fast.”

“The aviation industry is focused on the goal of achieving net zero CO2 emissions by 2050, while also recognising the need to accelerate efforts,” Allen Paxson, vice president and general manager of commercial programs strategy at GE Aerospace, said in a report that pulled together the results of the study.

The survey was commissioned by GE’s aviation business. In November 2021, GE announced a plan to split itself into three standalone businesses around health care, power and energy, and aviation and aerospace. In January this year, GE announced the completion of the separation of the health care business.

The findings also show that companies are backing their commitments with investments. Nearly 90 percent of respondents confirmed having a sustainability strategy in place, with more than 70 percent reporting a significant or moderate impact on their investment and operational decisions.

The findings also show that companies are backing their commitments with investments. Nearly 90 percent of respondents confirmed having a sustainability strategy in place, with more than 70 percent reporting a significant or moderate impact on their investment and operational decisions. The company and its commercial partners, including Safran Aircraft Engines in France, and science and tech collaborators including NASA, the US space agency, are developing hydrogen as well as hybrid-electric engines. These are, however, a decade or more away from becoming commercial products.

The company and its commercial partners, including Safran Aircraft Engines in France, and science and tech collaborators including NASA, the US space agency, are developing hydrogen as well as hybrid-electric engines. These are, however, a decade or more away from becoming commercial products.