Between Air India and IndiGo, India's skies are headed for a duopoly. What's this new reality?

With almost 90 percent of the market firmly under their control, they have the distinct advantage of shaping up the aviation sector over the next few years. The well-funded and well-managed airlines are already flexing their muscles with aircraft purchases and by launching new routes

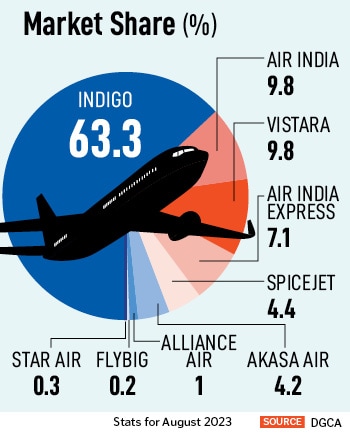

India’s aviation sector is moving into something of a duopoly. With IndiGo having a market share of 63.3 percent and Air India Group having another 25.7, the two airline companies corner 89 percent of the domestic market.

Image: Punit Paranjpe

India’s aviation sector is moving into something of a duopoly. With IndiGo having a market share of 63.3 percent and Air India Group having another 25.7, the two airline companies corner 89 percent of the domestic market.

Image: Punit Paranjpe

As if it wasn’t clear all this while, it’s best to reiterate that the Indian skies are nothing, but an enigma. A conundrum, perhaps, that lured many a billionaire to have their fingers burnt rather badly.

From the likes of the flamboyant Vijay Mallya of the ill-fated Kingfisher Airlines to the cautious and wily Naresh Goyal of Jet Airways, and the blue-blooded Nusli Wadia of Go First, India’s skies have a history of bringing death knell to many. Some of that, of course, was their own doing with ill-advised and irrational business propositions, but the turbulent skies have had their fair share. Today, Mallya is a fugitive, Goyal is languishing in jail and Wadia is banking on his real estate empire to keep his Bombay Dyeing empire running.

Then there are those like deceased billionaire Rakesh Jhunjhunwala, who braved the brouhaha to bet on the Indian skies only to face severe turbulence later. Akasa is currently fighting tooth and nail against some of its pilots who have left the airline en masse, disrupting the airline’s operations and hitting its market share considerably. Akasa was one of the world’s fastest-growing airline after starting in 2022 before disruptions hit the airline in September.

That’s why it’s not surprising that the number of airlines in India has been steadily declining even though the country will likely add 2,000-odd aircraft in the next 20 years. Consider this: Five years ago, India’s skies boasted Jet Airways, Air India, Vistara, AirAsia India, Go First, SpiceJet, TruJet, Zoom Air and Air Deccan. Five years later, the Tata group, with all its financial might behind it, will cut down four airlines that it owns into two. The Tata group will operate Air India and Air India Express after it bought Air India from the government and brought three other airlines into its fold, including Vistara, AirAsia India and Air India Express.

The Nusli Wadia-owned Go First has shut down operations, and so has Jet Airways, while SpiceJet is on a wing and a prayer with dwindling market share. Air Deccan, Zoom Air, and TruJet are history too. Two regional airlines, Star Air and Fly Big ferry, carry minuscule passengers annually.

In effect, that only means one thing. India’s aviation sector is moving into something of a duopoly. With IndiGo having a market share of 63.3 percent and Air India Group having another 25.7, the two airline companies corner 89 percent of the domestic market. “This duopoly has emerged at a time when the market dynamics are quite volatile,” says Satyendra Pandey, managing partner, aviation services firm AT-TV. “As of now, the country has two airlines that are in separate stages of the insolvency process; a startup airline coming up on one year of operations; and an airline that is sourcing significant funds from the Emergency Credit Loan Guarantee Scheme.”

In effect, that only means one thing. India’s aviation sector is moving into something of a duopoly. With IndiGo having a market share of 63.3 percent and Air India Group having another 25.7, the two airline companies corner 89 percent of the domestic market. “This duopoly has emerged at a time when the market dynamics are quite volatile,” says Satyendra Pandey, managing partner, aviation services firm AT-TV. “As of now, the country has two airlines that are in separate stages of the insolvency process; a startup airline coming up on one year of operations; and an airline that is sourcing significant funds from the Emergency Credit Loan Guarantee Scheme.”

According to a turnaround plan at Air India, the airline has set itself clear milestones focussed on growing its network and fleet, developing a revamped customer proposition, improving reliability and on-time performance, and taking a leadership position in technology, sustainability and innovation, while aggressively hiring industry talent. Over the next five years, the airline will also look to increase its market share to at least 30 percent in the domestic market. Already, it has invested $400 million in completely new interiors for the airlines’ existing wide-body aircraft, new seats and new in-flight entertainment in addition to spending another $200 million on IT infrastructure.

According to a turnaround plan at Air India, the airline has set itself clear milestones focussed on growing its network and fleet, developing a revamped customer proposition, improving reliability and on-time performance, and taking a leadership position in technology, sustainability and innovation, while aggressively hiring industry talent. Over the next five years, the airline will also look to increase its market share to at least 30 percent in the domestic market. Already, it has invested $400 million in completely new interiors for the airlines’ existing wide-body aircraft, new seats and new in-flight entertainment in addition to spending another $200 million on IT infrastructure.