IndiGo has beaten Air India to the mother of all aviation deals. Now, the rivalry is getting real

IndiGo's new order of 500 A320 family aircraft indicates the growth potential of the Indian aviation market

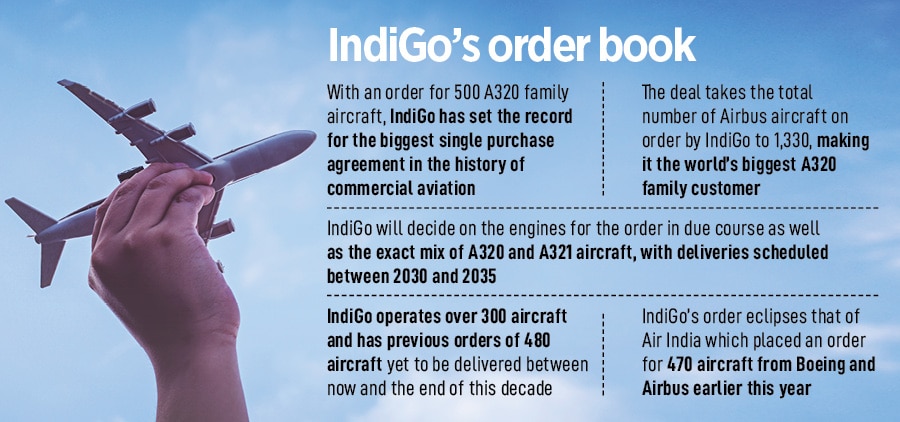

With a firm order of 500 A320 family aircraft, IndiGo has set the record for the biggest single purchase agreement in the history of commercial aviation.

Image: Arun Sankar / AFP

With a firm order of 500 A320 family aircraft, IndiGo has set the record for the biggest single purchase agreement in the history of commercial aviation.

Image: Arun Sankar / AFP

India’s largest airline, IndiGo, has come out with all guns blazing to set the Paris Air show on fire.

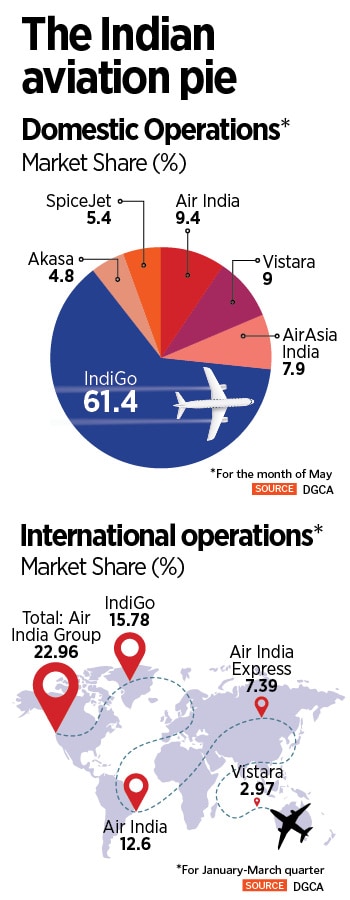

A few months after Air India placed what was then referred to as the mother of all aviation deals with its 470 aircraft order with Boeing and Airbus, IndiGo—India’s largest airline by market share and fleet size—has upped the game a notch, and sent a clear message of intent to the world, which had been a tad bit awestruck with Air India’s turnaround plans.

With a firm order of 500 A320 family aircraft, IndiGo has set the record for the biggest single purchase agreement in the history of commercial aviation. The deal would mean the airline will now have 1,330 aircraft on order from Airbus, making it the world’s biggest A320 family customer.

And that’s not all. Rumour mills are abuzz about another likely purchase from IndiGo, this time for a few wide-bodied aircraft, typically used for long-haul flights, which could be signed in Paris. IndiGo’s 1,330 aircraft order from Airbus involves the short-haul, narrow-bodied A320 family.

“An order book now of almost 1,000 aircraft well into the next decade enables IndiGo to fulfil its mission to continue to boost economic growth, social cohesion, and mobility in India,” said Pieter Elbers, CEO of IndiGo, in a statement. It’s still unclear how much IndiGo will have to cough up for the deal, although bulk deals such as these are often heavily discounted.

“Essentially, IndiGo has locked in delivery slots for the next decade by way of this order,” says Vinamra Longani, head of operations at Sarin & Co, a law firm specialising in aircraft leasing and finance. “The large order book of close to 1,000 Airbus aircraft implies IndiGo may continue to use the sale and leaseback model to finance its fleet acquisition. This is a model that has worked well for the airline and one it has mastered to perfection.” In a sale and leaseback model, an airline acquires the aircraft and sells them to a lessor, before leasing it back for use. The sale is usually at a profit and helps with cash.

“Essentially, IndiGo has locked in delivery slots for the next decade by way of this order,” says Vinamra Longani, head of operations at Sarin & Co, a law firm specialising in aircraft leasing and finance. “The large order book of close to 1,000 Airbus aircraft implies IndiGo may continue to use the sale and leaseback model to finance its fleet acquisition. This is a model that has worked well for the airline and one it has mastered to perfection.” In a sale and leaseback model, an airline acquires the aircraft and sells them to a lessor, before leasing it back for use. The sale is usually at a profit and helps with cash.