Can Anil Agarwal's troubled Vedanta find a way out of its misery with a demerger?

The $18-billion group has piled up over $15 billion in debt during its expansion, and the demerger might not be a way out in the immediate future. Here's why

Anil Agarwal, Chairman, Vedanta Resources

Image: KT Watson

Anil Agarwal, Chairman, Vedanta Resources

Image: KT Watson

Anil Agarwal has always been a tough cookie, a survivor of sorts.

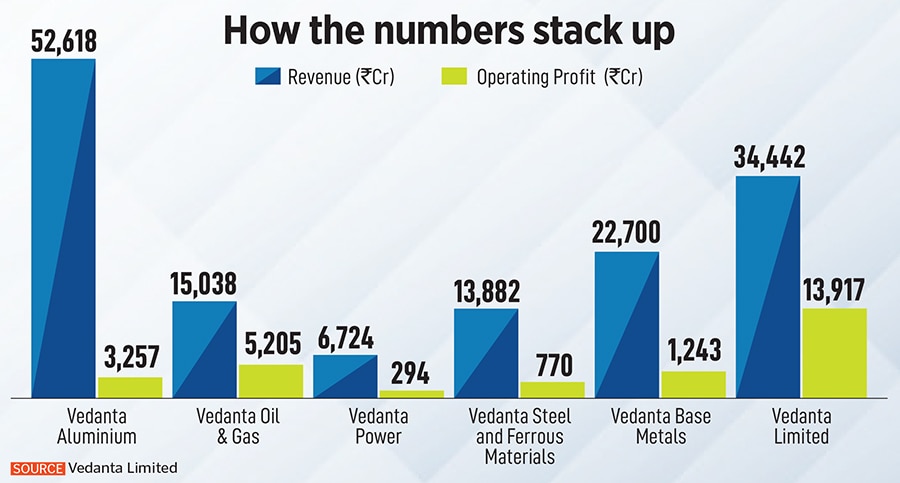

Nothing else can possibly explain how the Bihar-born Agarwal built an empire spanning metals and mining over half a century, after starting as a trader in scrap metal in Mumbai. Today, his diversified conglomerate makes everything from steel and iron ore to aluminium and oil among others, at the $18-billion Vedanta Group. That’s why Agarwal’s remarkable story finds many takers who admire his risk appetite and grit in building up an empire from the bottom.

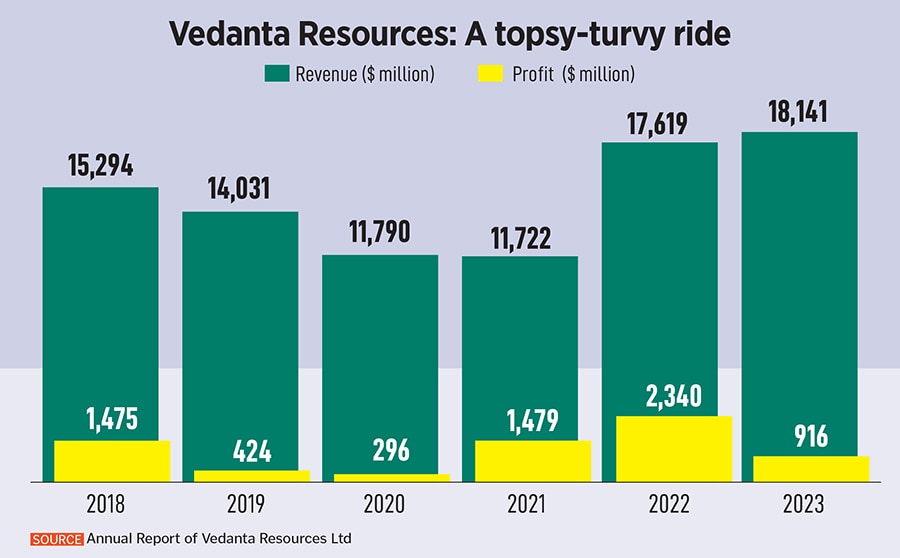

But that phenomenal growth had also come at a cost, something that’s come to haunt him as he turns septuagenarian, and leaving him to slug it out now. Vedanta Resources, Agarwal’s London-based parent company, has a debt problem, with over $15 billion in dues as of March this year, including over $8 billion at Vedanta Limited, the Indian company owned by Vedanta Resources. Vedanta Limited owns assets such as Hindustan Zinc Limited, Bharat Aluminium, Sterlite Copper, and Cairn Oil. As of March 2023, Vedanta Limited had a debt of Rs 66,182 crore ($8 billion), an increase of Rs 13,073 crore ($1.5 billion) since the year before that.

At Vedanta Resources, the parent arm, the standalone debt stood at some $7 billion in March, and Agarwal has been busy firefighting to pare it all down, after growing cynicism around repayment abilities. As of June, that debt level has come down to $5.9 billion. Still, Vedanta’s complex ownership structure involving dividend payments from group companies to keep the coffers running, and immediate debt repayment requirements for its maturing loans has meant that Agarwal just can’t find any breathing space.

Although he has consistently denied that to be the case, it's perhaps that desperation, coupled with a deep desire to veer his business for the future, that has now led the billionaire to go for some serious restructuring of his business, a decade after he went on a consolidation spree.