Can Indian startups take an Uber ride?

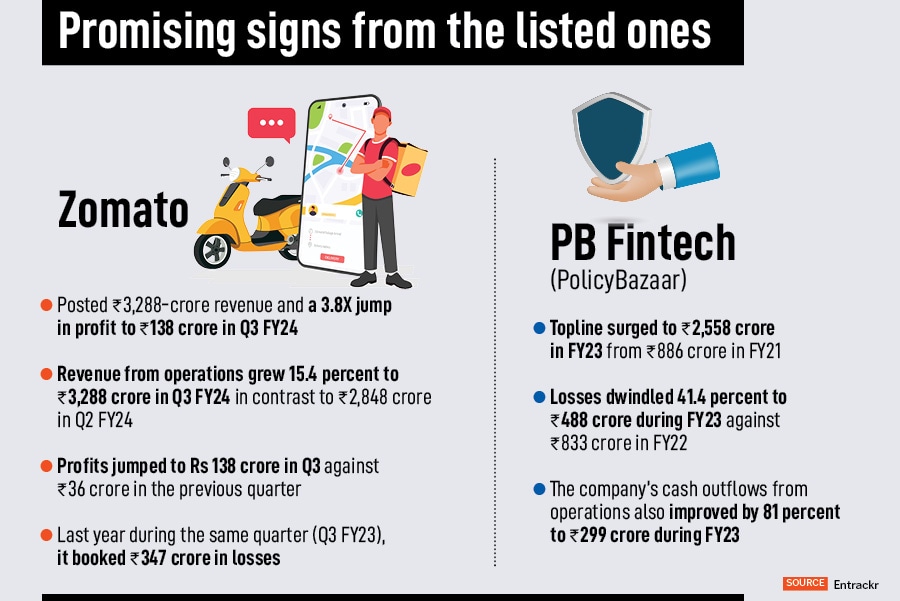

Uber's first annual profit since its public listing in 2019 and Zomato's third consistent quarter of profit have kindled hope for a similar performance by loss-making unicorns and startups

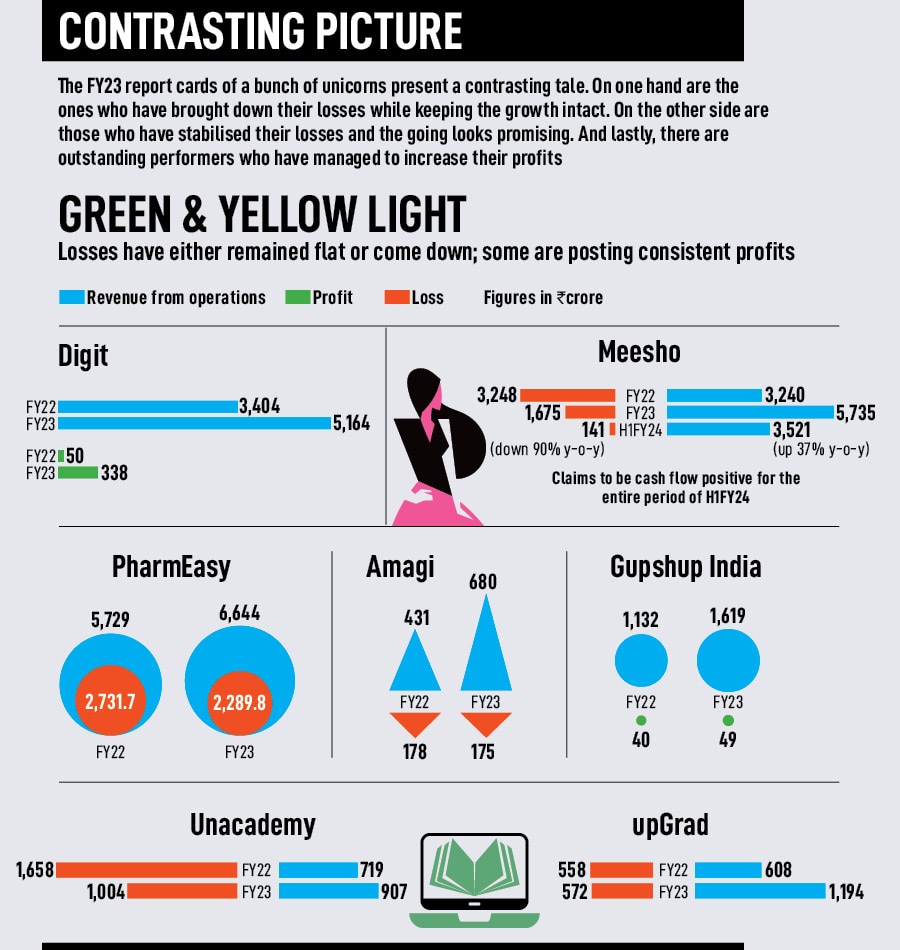

In recent months, the venture capitalist reckons, Indian unicorns have been reporting profits, reinforcing the belief that sustained profitability is not merely a recent development but crucial for enduring success.

In recent months, the venture capitalist reckons, Indian unicorns have been reporting profits, reinforcing the belief that sustained profitability is not merely a recent development but crucial for enduring success.

Uber’s strongest quarter (Q4), first annual profit since it went public in 2019, and phenomenal performance in 2023 has become the talk of the town globally. Back home, in India, a large section of venture capitalists and unicorn founders contend that Uber’s glowing report card offers a deep sense of optimism for a clutch of home-grown startups that have already hit the road to profitability and have been consistently trimming their heavy losses. But before we try to find out whether an Uber-kind of turnaround can be replicated by Indian startups, including unicorns, one must try to figure out how Uber--till 2022, it reportedly accumulated $31.5 billion in operating losses since 2014—posted profit.

To understand and appreciate the transition from ‘red’ to ‘black,’ one needs to revisit the ‘risk factors’ of the IPO prospectus, which Uber filed in April 2019. “We have incurred significant losses since inception,” the ride-hailing major underlined in its filing. The company had incurred operating losses of $4 billion in 2017, and had accumulated a staggering deficit of $7.9 billion till December 31, 2018. The company, it added in the regulatory document, expected its operating expenses to increase significantly in the future. But Uber also underscored a grim reality that no investor would ever like to either read or hear. “We may not achieve profitability,” the company candidly confessed in its filings.

Fast forward to February 2024. Uber posted its first full-year profit since going public in 2019. Dara Khosrowshahi, the chief executive officer of Uber, highlighted the achievement. “We delivered our strongest quarter ever in Q4, capping off our strongest year,” he contended in the latest earnings call after declaring the fourth quarter and annual results. The CEO then went on to explain how the risk—which was so clearly mentioned in the IPO prospectus of 2019—got converted into reward.

The profit, obviously, came on the back of a strong performance. Look at the numbers. Uber crossed 2 billion trips in a single quarter for the first time—an average of nearly 1 million trips per hour—the top-line grew at healthy rate, with over $115 billion in gross bookings, and mobility posted its best quarter ever for gross bookings, MAPCs (monthly active platform consumers), active drivers, adjusted EBITDA, and adjusted EBITDA margin. But the not-so-obvious part is how Khosrowshahi, who became a reluctant CEO in 2017, went about trimming the losses and bringing Uber back into shape.