Can Ola kickstart India's electric vehicle revolution?

At a time its ride-hailing business is limping back to normality after months of Covid-induced lockdown, the company is building the world's largest two-wheeler factory and has already launched two vehicles from its stable

Bhavish Aggarwal, chairman and group CEO, Ola

Bhavish Aggarwal, chairman and group CEO, Ola

For nearly a decade, Bhavish Aggarwal had built up a reputation for shaking up the country’s ride-hailing industry. The 11-year-old Ola, which Aggarwal founded three years after graduating from college, had started much before global ride-hailing major Uber made inroads into India. Uber was launched in the US in 2009 while Ola was launched in India in early-2011. By the time Uber landed in India in 2013, Ola had already had a headstart in one of the world’s largest ride-hailing markets, and had steadily grown into a force to reckon with.

As a result, the company corners much of the market share in India, having recorded around 1.5 billion bookings on the platform, translating to over 28 million in a week, before the pandemic wreaked with the economy. While the ride-hailing business is slowly limping back to normalcy, the canny Aggarwal also used the past few months to diversify Ola’s business into the fledgling electric vehicle industry in India.

“The need to transform mobility to electric is there, and we can see what's happening with pollution, so we have to build for the future paradigm, we have to build for future technology, and in mobility, it has to be electric,” Aggarwal had told Forbes India in March. “It absolutely has to be done as fast as we can.”

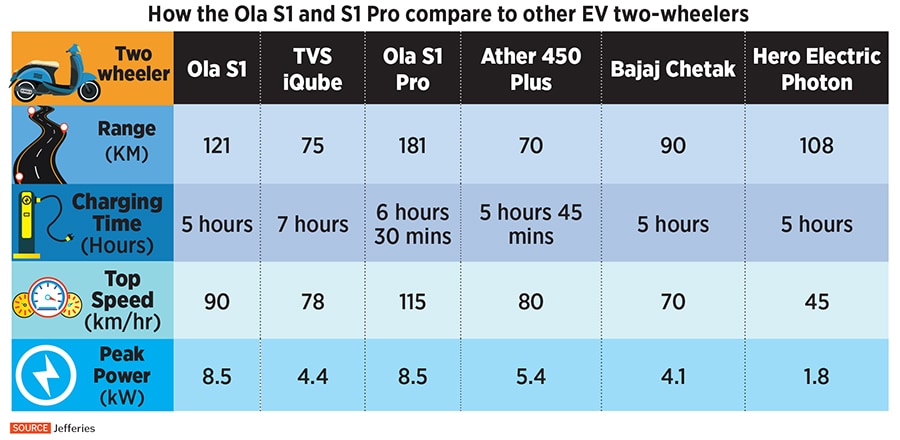

Since then, the company has been working at a breakneck pace, and in nine months since it announced its plans to build what’s touted as the world’s largest two-wheeler factory, Aggarwal launched the first of its two-wheelers from the company’s stable—the Ola S1 and Ola S1 Pro, which it hopes will help kickstart a much-needed electric vehicle revolution in India.

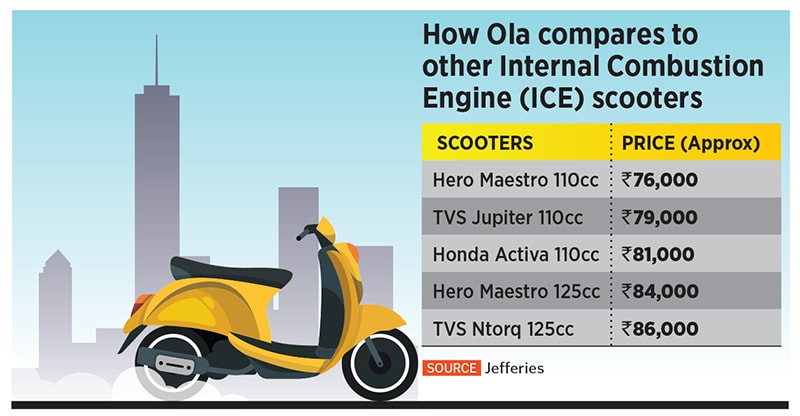

“Ola S1 comes at a revolutionary price of Rs 99,999 onwards,” Aggarwal said at the time of launch. “In states with active subsidy grants, Ola S1 will be much more affordable than many petrol scooters. For instance, after state subsidy in Delhi, the S1 would cost just Rs 85,009 whereas in Gujarat it would be only Rs 79,000.”

Already, Ola received upwards of 100,000 orders the day it had opened its booking, in late July. While the company hasn’t divulged the total orders it has received so far, it plans to start delivery from October. “About 80 percent of the vehicles sold in India today are two-wheelers and despite that only 12 percent of India owns a two-wheeler,” Aggarwal had said at the time of the launch. “These vehicles consume 12,000 crore litres of fuel every year and are responsible for 40 percent of air pollution.”

Already, Ola received upwards of 100,000 orders the day it had opened its booking, in late July. While the company hasn’t divulged the total orders it has received so far, it plans to start delivery from October. “About 80 percent of the vehicles sold in India today are two-wheelers and despite that only 12 percent of India owns a two-wheeler,” Aggarwal had said at the time of the launch. “These vehicles consume 12,000 crore litres of fuel every year and are responsible for 40 percent of air pollution.”