Cars, Bikes & OLX: Inside CarTrade's 'classified' act

Vinay Sanghi's audacious move to buy the biggest online classifieds brand in India can put CarTade in fifth gear. The massive opportunity, though, can also put India's first listed used and new car platform in a spin if it slips in execution. Will Sanghi's gambit pay off?

Vinay Sanghi, chairman and managing director, CarTrade Tech. Image: Mexy Xavier

Vinay Sanghi, chairman and managing director, CarTrade Tech. Image: Mexy Xavier

Dubai, March 2023. Both the parties started the conversation on an apprehensive note. And it was natural. Vinay Sanghi, a veteran in the game of buyouts—he bought online classifieds portal CarWale in 2016, automobile valuation platform Adroit in 2017, and vehicle auctioning platform Shriram Automall India in 2018—was about to meet the potential seller for the first time. The seasoned entrepreneur, who got CarTrade listed in 2021, was trying to read the minds of the negotiator. The biggest risk for a seller, underlines the chairman and managing director of CarTrade, is to find out if the buyer is serious about the transaction.

Sanghi was dead serious. His envious past in cracking deals meant that he had boldly ticked the box of ‘seriousness’. The founder outlines other usual questions that bug a prospective seller: Do they have money? Are they capable of pulling off this transaction? What will they do with the employees? “In a way, they will try to judge you on all aspects,” says Sanghi, who was in Dubai in the third week of March to attend his board meeting. A stickler for discipline, Sanghi’s track record of all his acquisitions had one common trait: Planning. Nothing was random.

Meanwhile, in Dubai, it all started with a random call. “You can call it chance or serendipity,” says the founder, alluding to his interest in exploring the latest buyout offer. “OLX is looking to sell the auto business in India. Would you be interested?” uttered the voice from the other side of a phone call. “Are you serious?” asked Sanghi. “Obviously, it interested me straightaway,” he recalls. The meeting was fixed at Waldorf Astoria Hotels & Resorts, and Sanghi was about to meet Robin Voogd, head of the classifieds vertical at Naspers, and head of M&As and strategy at OLX.

Meanwhile, in Dubai, it all started with a random call. “You can call it chance or serendipity,” says the founder, alluding to his interest in exploring the latest buyout offer. “OLX is looking to sell the auto business in India. Would you be interested?” uttered the voice from the other side of a phone call. “Are you serious?” asked Sanghi. “Obviously, it interested me straightaway,” he recalls. The meeting was fixed at Waldorf Astoria Hotels & Resorts, and Sanghi was about to meet Robin Voogd, head of the classifieds vertical at Naspers, and head of M&As and strategy at OLX.

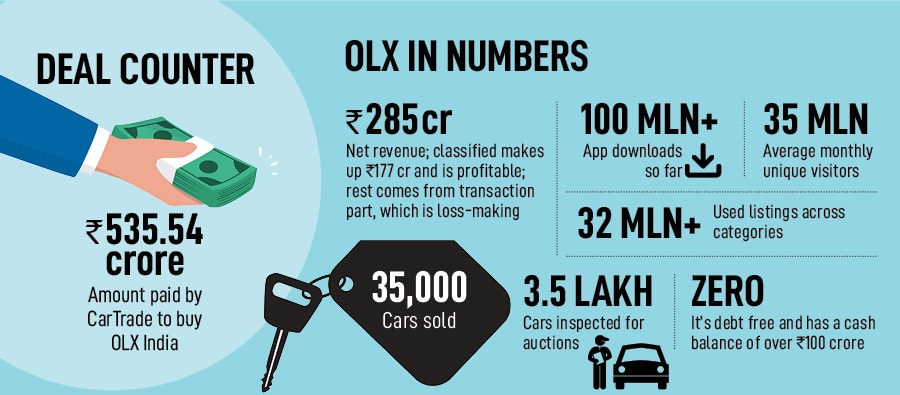

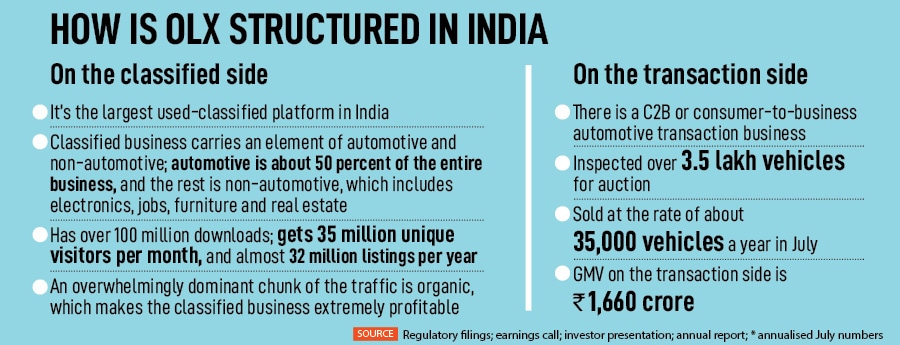

The meeting started, and even the battle-scarred founder started getting fidgety. “Why are they selling the auto vertical?” was a natural question to ask. The biggest online classifieds player in India had put its C2B (consumer-to-business) automotive transaction business on the block. “Is there anything wrong with the venture?” Sanghi wondered, as he got sucked in a vortex of queries. “What will happen to the classifieds side? Would users not get confused if there are two OLX entities? How will it impact business?” he wondered. The meeting lasted for 90 minutes, and over the next few weeks, OLX put its classifieds part also on sale. The picture was now complete, and Sanghi’s not-so-guarded apprehensions turned into unabashed excitement. “This could be the opportunity of a lifetime,” he reasoned with himself.

Also read: How India's booming auto sector brought big gains for its parts suppliers