Cars24 takes the global route

The used-car selling platform is steering into foreign markets to fulfil its international ambitions. Will the Indian unicorn's gambit pay off?

Vikram Chopra, Co-Founder & CEO, Cars24

Vikram Chopra, Co-Founder & CEO, Cars24

Image: Amit Verma

The ‘question and answer’ session was slated to start at 9.30 am Australian time. Olga Rudenko was punctual. On a bright Monday morning last October, the Australian opened her laptop, grabbed a warm cup of coffee and logged on to a Zoom call. The interviewers were running a bit late. “My alarm clock ran out of battery,” rued Vikram Chopra at 4.45 am in India. He hurriedly called Mehul Agrawal. “Olga is waiting. Let’s hurry,” he said in a groggy voice. The duo finally came online after 25 minutes. “Sorry for being late,” Agrawal apologised once the interview began at 9.40 am Australian time.

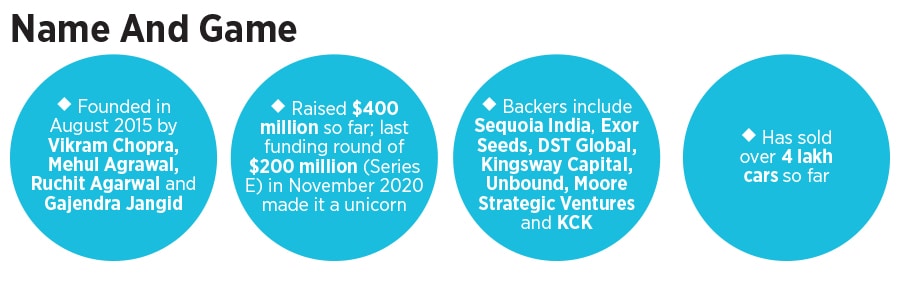

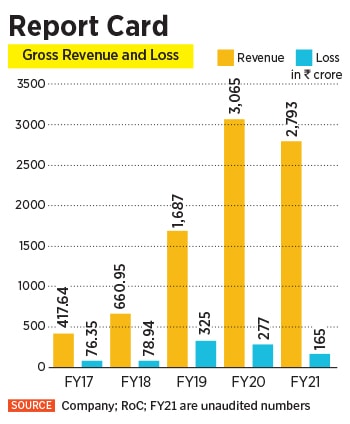

The co-founders of Cars24, a used-car selling platform which turned unicorn last November after it raised $200 million in a Series E round led by billionaire Yuri Milner's fund DST Global, were just getting a hang of one of the flip sides of synchronising global operations sitting from their Indian headquarters in Gurugram. “We knew the time lag would be one of the irritants,” accepts Chopra.

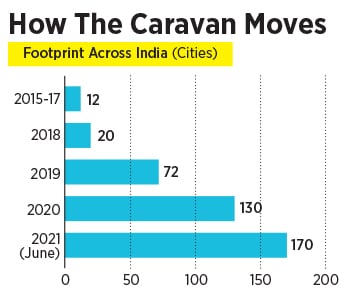

Back in August 2015, there was another ‘lag’ that Chopra and Agrawal, along with their friends—Ruchit Agarwal and Gajendra Jangid—had to contend with when they started Cars24. They were late in the game. The three big boys—CarWale, CarDekho and CarTrade—in the used car market had a massive head start. While CarWale opened its account a decade back in 2005, CarDekho and CarTrade started in 2008 and 2009, respectively. “The odds were heavily stacked against us,” recalls Chopra. Scepticism, therefore, was natural. ‘Is there a room for one more used car player?’ and ‘Are you not too late in the game?’ were some questions hurled at them by venture capitalists (VC) and analysts.