China's reopening: How the biggest investment theme of the year flopped

China reopened its economy with a roar but twelve months later most investors are twiddling their thumbs as the fire fizzled out amidst unfolding economic chaos. But a new $112 billion stimulus package hopes to boost the economy in the coming year

As per the World Bank, China’s recovery from coronavirus induced setbacks, among other shocks, remains ‘fragile’, impacted by pain in the property sector and weak global demand for exports, low consumer confidence, and high levels of debt.

Image: Shutterstock

As per the World Bank, China’s recovery from coronavirus induced setbacks, among other shocks, remains ‘fragile’, impacted by pain in the property sector and weak global demand for exports, low consumer confidence, and high levels of debt.

Image: Shutterstock

Last December, the world had pinned its hopes on a China-led recovery. After thousand days of lockdown enforced by its government’s draconian zero-Covid policies, the world’s second largest economy was opening its borders for business, and this was seen as a lifeline for a global economy that was navigating demand headwinds.

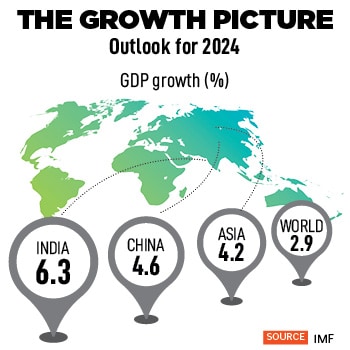

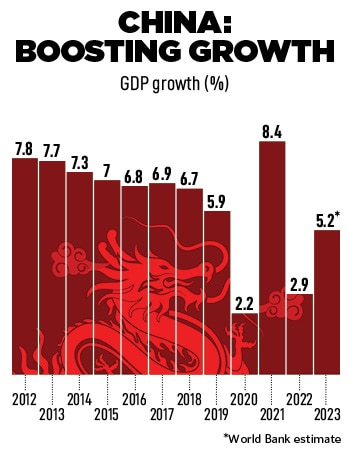

Economists widely estimated that Chinese households had accumulated savings of around RMB 7 trillion during the three years of the pandemic which, they believed, would help to boost domestic consumption levels to the pre-pandemic level of eight percent and Gross Domestic Product (GDP) growth of five percent in CY23.

But a year later, as per the World Bank, China’s recovery from coronavirus induced setbacks, among other shocks, remains ‘fragile’, impacted by pain in the property sector and weak global demand for exports, low consumer confidence, and high levels of debt. It expects the Chinese economy to slow down to 4.5 percent next year and 4.3 percent in 2025.

Evidently, the reopening thesis did not fully play out and China finds itself on the brink of a confidence trap: “China has seriously disappointed investors. The reopening trade was wildly enthusiastic in January, but since then has totally turned around,” Washington-based global emerging financial markets investment firm Kleiman International’s Managing Partner Elizabeth Morrissey tells Forbes India.

“There seems to be a persistent lack of confidence among consumers, homebuyers, corporates and investors. Weak expectations could be reinforcing each other and become entrenched and self-fulfilling,” Citibank said in a report earlier this year.

Aswath Damodaran, professor of finance, NYU Stern School of Business highlights the dark side of operating in a regime where a government sets the rules without any legal or political challenge. “Take a look at what's happened to the big Chinese tech companies, Alibaba, Tencent… they lost basically 60-80 percent of value and their pathway to being trillion-dollar companies. So, I think that businesses are recognising, at least in the last two or three years, the downside of being in an authoritarian [country],” he explains.

Aswath Damodaran, professor of finance, NYU Stern School of Business highlights the dark side of operating in a regime where a government sets the rules without any legal or political challenge. “Take a look at what's happened to the big Chinese tech companies, Alibaba, Tencent… they lost basically 60-80 percent of value and their pathway to being trillion-dollar companies. So, I think that businesses are recognising, at least in the last two or three years, the downside of being in an authoritarian [country],” he explains.