Corporate Governance: Will the real independent directors please stand up?

The role of independent directors is clearly defined, yet many of them feel they play a cameo role in a company, often failing to red flag fraudulent activity and serious governance lapses that eventually compromise minority shareholders' interests

Independent directors who are entrusted with the responsibility of being the eyes and ears of investors as they are expected to balance the interests of the management and its shareholders in letter and in spirit

Illustration: Chaitanya Dinesh Surpur

Independent directors who are entrusted with the responsibility of being the eyes and ears of investors as they are expected to balance the interests of the management and its shareholders in letter and in spirit

Illustration: Chaitanya Dinesh Surpur

No promoter or company management would ever deny corporate governance is the cornerstone of an organisation—big, medium, small, public or private. But, in reality, corporate governance is one of the most neglected corners in the overarching framework of ethics and transparency across most firms. Of all the stakeholders, very often, it is the minority shareholders who pay most dearly for this lapse.

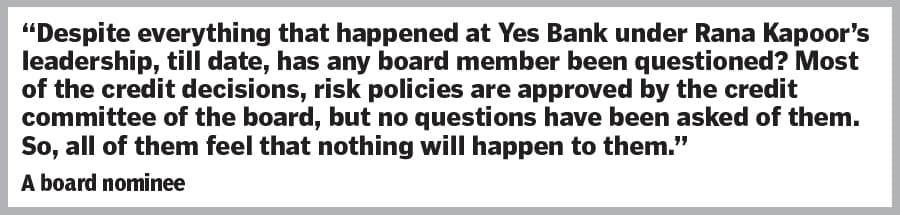

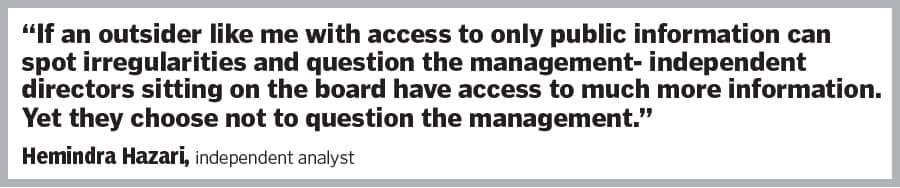

Herein lies the role of independent directors who are entrusted with the responsibility of being the eyes and ears of investors as they are expected to balance the interests of the management and its shareholders in letter and in spirit. In recent years, unfortunately, there have been several glaring instances where the board of directors has evidently failed to do so.

Few weeks ago, the co-founder and CEO of Sequoia Capital-backed fashion technology start-up Zilingo, Ankiti Bose, was suspended—until May 5—for allegedly inflating revenue to boost valuation, among other wrongdoings. Bose, reportedly, is contesting the charges of financial fraud and claims the ‘witch-hunt’ was triggered after she raised harassment complaints against an investor.

People in the know express disbelief that the board, particularly investor nominees, mysteriously failed to notice the mismanagement of millions of dollars, misgovernance, and accounting discrepancies over the years, and was spurred into action only after the whistle-blower complaint in March.

The matter is currently under investigation. Temasek’s Xu Wei Yang, Burda Principal Investment’s Albert Shyy, and Sequoia Capital’s Shailendra Singh, have stepped down from Zilingo’s board amid the probe. A detailed questionnaire sent to Zilingo remains unanswered.