Crypto and Web3 startups in India attract funding despite the broad sell-off in digital assets

The meltdown is just a bump in the road, according to experts. There's plenty of capital available in the system for early-stage startups and the funding indicates investors' long-term bullishness

Bitcoin apart, all cryptocurrencies, including ether, matic, cardano and dogecoin, have shed 50 to 90 percent of their value since late last year

Illustration: Chaitanya Dinesh Surpur

Bitcoin apart, all cryptocurrencies, including ether, matic, cardano and dogecoin, have shed 50 to 90 percent of their value since late last year

Illustration: Chaitanya Dinesh Surpur

As the price of bitcoin, the world’s most actively traded cryptocurrency, fell to $17,628 over the weekend—its lowest since November 2021—it sent the markets into a tizzy. Bitcoin apart, all cryptocurrencies, including ether, matic, cardano and dogecoin, have shed 50 to 90 percent of their value since late last year. So much so that the market value of all traded cryptocurrencies has tumbled from a peak $3.2 trillion last November to below $1 trillion.

But despite the broad sell-off in digital assets, crypto and Web3 startups in India are still attracting funding.

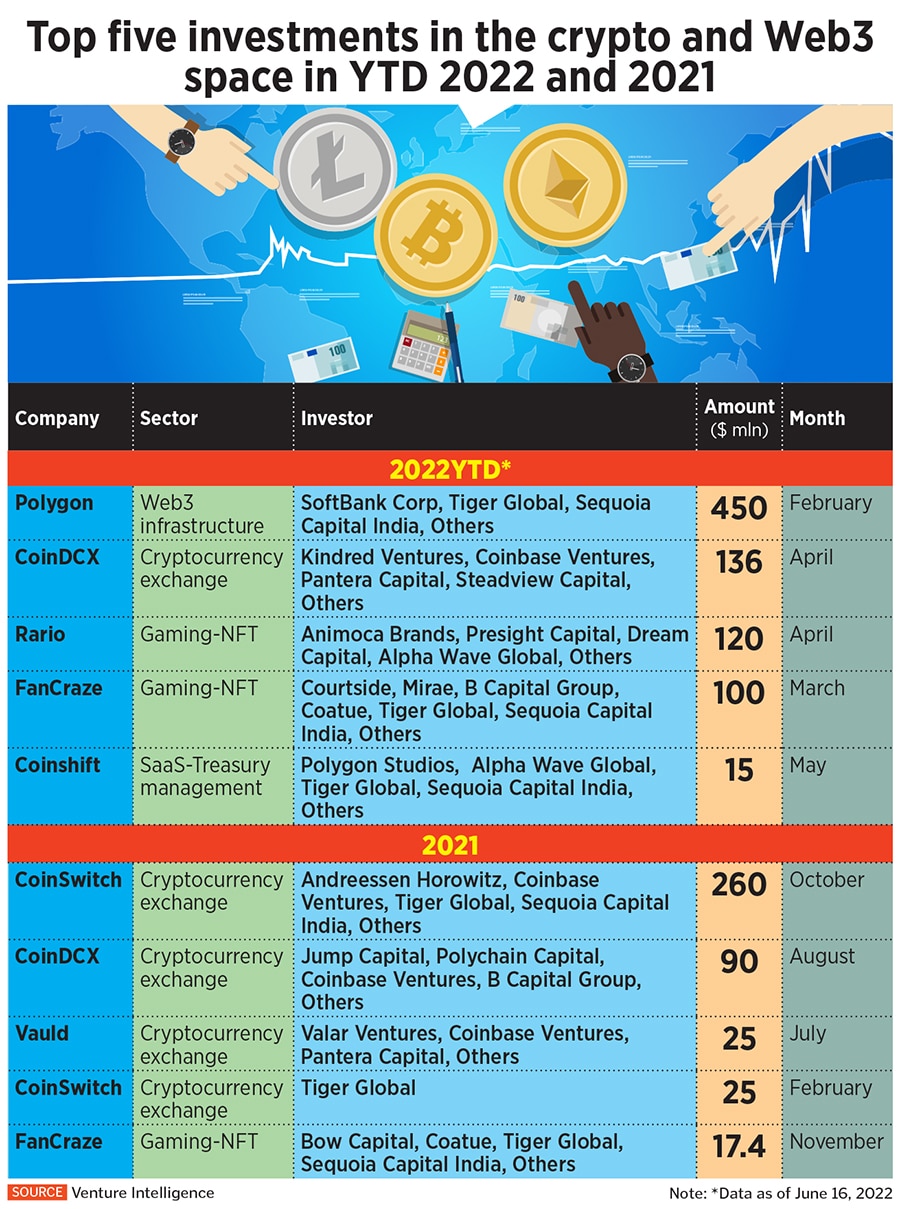

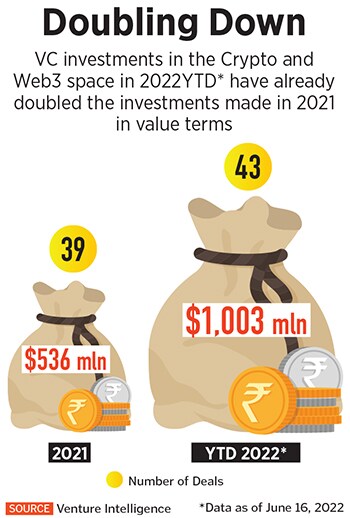

Consider this: Crypto and Web3 startups have already—in the six months of 2022—raised more than $1 billion in funding across 43 deals. In 2021, by comparison, the space attracted $536 million across 39 deals, according to data provider Venture Intelligence. Top deals include Polygon’s $450 million fund raise by SoftBank, Tiger Global and Sequoia India in February, cryptocurrency exchange CoinDCX’s $136 million fund raise in April and treasury management platform Coinshift’s $15 million fund raise in May, even as TerraUSD, the so-called stable coin which promised to match the value of the US dollar, collapsed, wiping out investors of more than $40 billion.

A handful of early-stage startups have also attracted funding of late. Zeeve, a Web3 equivalent of what Amazon’s AWS is to present day companies, raised $2.65 million in seed funding from Leo Capital and Blu Ventures, US-based General Catalyst led a $2.5 million round in Stan, its first in what it says will be many Web3.0 bets in India, and Nume Crypto, a Web3 payments startup, raised $2 million from Sequoia India in June.

Moreover, while some startups like Hyderabad-based Vauld, a cryptocurrency exchange backed by Coinbase Ventures, have laid off staff—in this case 30 percent of their headcount or roughly 30 to 35 people—most others are hiring. WaxirX and CoinDCX, two of the largest crypto exchanges in India have said that they will continue hiring people despite seeing a drop in trading volumes given the turmoil in the broader market as well as India’s 30 percent tax levy on cryptocurrency trading and other regulatory challenges. “We are hiring and on track with our plan to become a 1,000-employee organisation by the end of the year [from 500 at present]. This is the time to build,” says Sumit Gupta, co-founder and CEO of CoinDCX.

However, within the Web3 space, VCs are being “choosy and selective” about where they’re deploying their monies. Startups in the infra space, which could include launching a blockchain protocol like Polygon, or cloud and automation services startups like Zeeve, analytics players etc are getting heightened interest from VCs, says Chamria. However, NFT marketplaces and Metaverse-based startups are seeing a slowdown in investment. “Infra players don’t see much excitement during bullish times and neither do they see much discouragement during bearish times,” he says.

However, within the Web3 space, VCs are being “choosy and selective” about where they’re deploying their monies. Startups in the infra space, which could include launching a blockchain protocol like Polygon, or cloud and automation services startups like Zeeve, analytics players etc are getting heightened interest from VCs, says Chamria. However, NFT marketplaces and Metaverse-based startups are seeing a slowdown in investment. “Infra players don’t see much excitement during bullish times and neither do they see much discouragement during bearish times,” he says.