Decoding the continuing frenzy around cryptocurrency trading

Even as India considers reining in crypto advertisements, the government is unlikely to go the China way and ban trading in cryptocurrencies. As it gains popularity in India, intermediaries say imminent regulations and minor curbs could boost crypto trading volumes and further mainstream adoption

There is also the parallel universe of decentralised financial (Defi) or alternative financial services building on blockchain applications where customers can transfer, trade or borrow cryptocurrencies

There is also the parallel universe of decentralised financial (Defi) or alternative financial services building on blockchain applications where customers can transfer, trade or borrow cryptocurrencies

Illustration: Chaitanya Dinesh Surpur

The government and the Reserve Bank of India continue to defer announcing their standpoint, or the guidelines and regulations for cryptocurrencies and the intermediaries dealing in these. Trading in these virtual currencies in India is not illegal, but it remains unregulated. And, paradoxically, with each passing week, the frenzy in cryptocurrency trade in India continues to increase, unabated.

There is also the parallel universe of decentralised financial (Defi) or alternative financial services building on blockchain applications where customers can transfer, trade or borrow cryptocurrencies. It is an ecosystem based on public distributed ledgers that allow financial transactions to take place without the involvement of a central authority. Platforms that offer decentralised financing also continue to operate unregulated in India.

Two of India’s cryptocurrency exchanges, CoinDCX and rival CoinSwitch Kuber, have turned unicorn in 2021 after fresh rounds of funding and millions of India’s millennials trading on their platforms. Active traders in India have nearly quadrupled in the most recent September-ended (Q3) quarter with a 271 percent increase for Huobi Global, an international exchange.

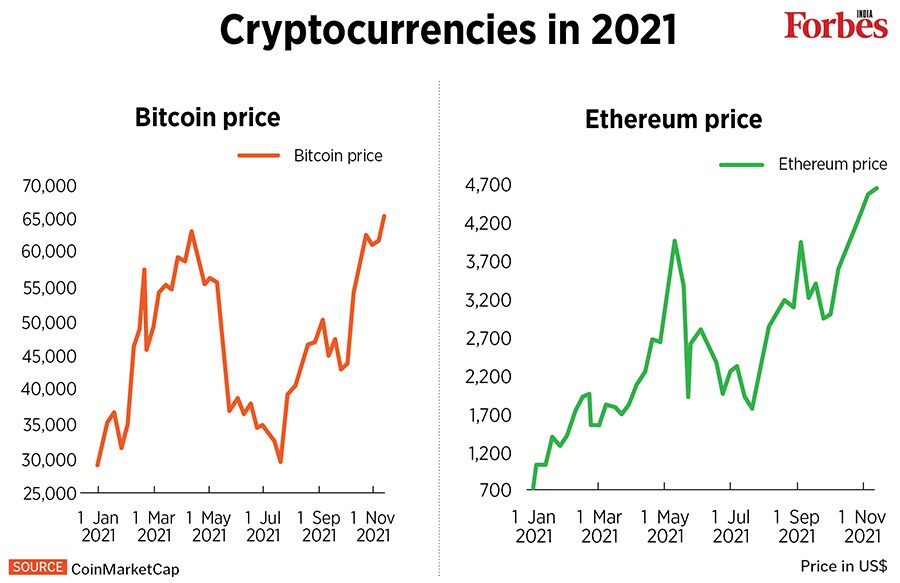

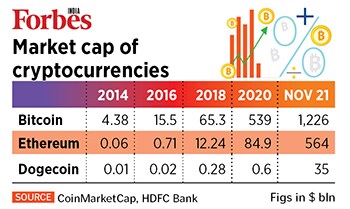

The global cryptocurrency market cap stood at $2.76 trillion on November 12. To put this figure into perspective, the global market cap of all cryptocurrencies is now larger than India’s total GDP in 2020, of $2.62 trillion. The market cap touched the landmark $3 trillion earlier in the week, led by a sharp surge in Bitcoin and Ethereum prices.