Digital currencies: Why the RBI needs to bite the bullet

With a successful pilot in the wholesale segment, the RBI's intent towards digital currencies is clear. The challenge remains in the retail segment, where cash remains popular and where it will have to push out private digital currencies

CBDCs will be a major source of innovation and will have new payment and money features and functionalities, such as programmability

CBDCs will be a major source of innovation and will have new payment and money features and functionalities, such as programmability

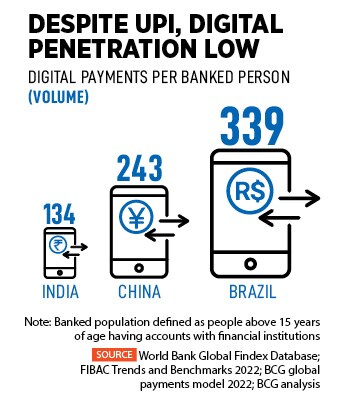

The rapid acceptance of electronic money kept in bank accounts, mobile banking applications and credit cards is changing the way people think about money, compared to traditional forms such as currency notes or coins. And it is quite likely that in 2023—if future pilots carried out by the Reserve Bank of India (RBI) run without glitches and the bank decides on the final design—that central bank digital currency (CBDC) could become an additional way in which we make monetary transactions.

As of now, there are 98 countries that are in the process of exploring CBDCs, according to the Atlantic Council tracker. Of these, 11 countries have launched a CBDC, including the Bahamas, Eastern Caribbean islands and Jamaica. China, Russia, South Korea and Thailand have conducted pilots for their respective digital currencies, but are yet to officially launch them, while the people of Nigeria have rejected their country’s digital currency.

Well received in India

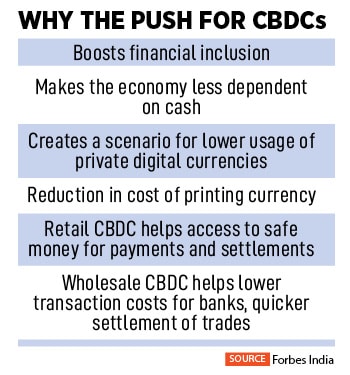

Given this scenario, the RBI is, in typical manner, taking calibrated steps to launch CBDCs. It is currently exploring the option to implement CBDCs in two forms: Account-based wholesale CBDC, and token-based retail CBDC. On November 8, the RBI will end its week-long first interbank pilot for the wholesale segment of the digital rupee (e₹-W), for settlement of secondary market transactions in government securities (G-Secs).Trading volumes in the pilot project ranged between Rs 260 crore and Rs 530 crore daily between November 1 and 7 on the NDS-OM-CBDC platform, operated by the Clearing Corporation of India (CCIL), indicating that it has been well received. Other wholesale transactions, cross-border payments and a separate retail CBDC pilot will be launched shortly, the central bank has said.

Nine banks participated in the recent wholesale pilot, with the aim to reduce transaction costs and make transfer of money possible in real-time. The monthly billing from each bank to the CCIL is substantial, considering the normal transaction charge of Rs 200 on a Rs 5-10 crore transaction.

Currently, all banks buy and sell bonds to and from the CCIL, which sends details of debits and credits to each bank daily and settlement is done the next day. “CBDCs’ biggest positive is that G-Secs get settled on T+0 and not the current T+1,” says Amit Sureka, Yes Bank’s financial markets country head. Yes Bank is one of the nine banks—alongside State Bank of India, HDFC Bank, ICICI Bank, IDFC First Bank, HSBC India, Bank of Baroda, Kotak Mahindra Bank and Union Bank of India—identified for participation in the pilot project.

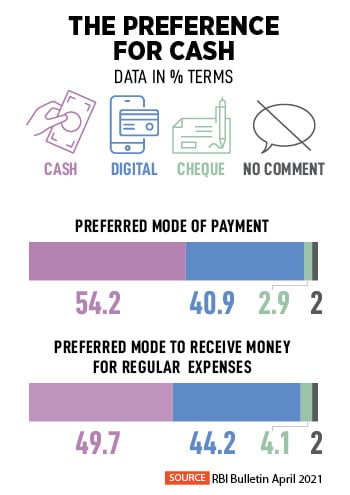

Currently, all banks buy and sell bonds to and from the CCIL, which sends details of debits and credits to each bank daily and settlement is done the next day. “CBDCs’ biggest positive is that G-Secs get settled on T+0 and not the current T+1,” says Amit Sureka, Yes Bank’s financial markets country head. Yes Bank is one of the nine banks—alongside State Bank of India, HDFC Bank, ICICI Bank, IDFC First Bank, HSBC India, Bank of Baroda, Kotak Mahindra Bank and Union Bank of India—identified for participation in the pilot project. But while digital transactions are on the rise, cash in the economy has also increased. “The growing use of electronic medium of payment has not yet resulted in a reduction in the demand for cash,” said RBI’s fintech department in a CBDC concept note released in October.

But while digital transactions are on the rise, cash in the economy has also increased. “The growing use of electronic medium of payment has not yet resulted in a reduction in the demand for cash,” said RBI’s fintech department in a CBDC concept note released in October. Gauri adds that the RBI move signals that India is ready to adopt blockchain. It is like putting banking on the blockchain, using technologies and ensuring regulation and security. Experts indicate that India’s government could announce more moves in the FY24 Union Budget.

Gauri adds that the RBI move signals that India is ready to adopt blockchain. It is like putting banking on the blockchain, using technologies and ensuring regulation and security. Experts indicate that India’s government could announce more moves in the FY24 Union Budget.