Elephant, Dragon and the Bald Eagle: How Zetwerk took a six-fold leap as a profitable unicorn

The contract manufacturing marketplace startup has galloped toward a Rs5,000-crore revenue in one fiscal

(L-R): Srinath Ramakkrushnan, Amrit Acharya, Rahul Sharma, Vishal Chaudhary

(L-R): Srinath Ramakkrushnan, Amrit Acharya, Rahul Sharma, Vishal Chaudhary

In August 2020, the ‘elephant’ first came into the picture. India clamped down on import of colour televisions on July 31. For a country, which imported colour TVs worth over $781 million in FY20, the move made ample sense as it was yet another big push towards local manufacturing. For the TV industry, though—which was then estimated to be around Rs15,000 crore—a sudden curb spelled doom. In FY20, players reportedly shipped TVs worth $428 million from Taiwan and $293 million from China. Now, the future suddenly looked uncertain. “Overnight, this (TV) emerged [as] a category for us,” recounts Amrit Acharya, co-founder and chief executive officer of Zetwerk. “Most of the players reached out to us frantically looking for solutions.”

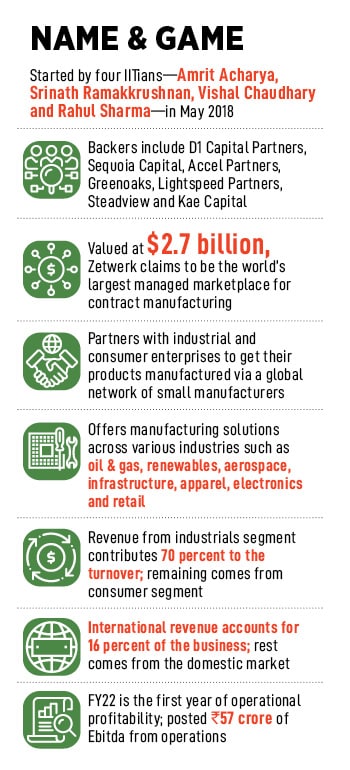

Founded in May 2018 by four IITians—Amrit Acharya, Srinath Ramakkrushnan, Vishal Chaudhary and Rahul Sharma— Zetwerk started as a contract manufacturing marketplace for industrial goods. Till FY20, the startup solely focused on a bouquet of manufacturing solutions ranging from steel pipes to aircraft engine components. Then suddenly, the business plunged into uncertainty as India announced a lockdown to deal with the Covid-19 pandemic in March. Businesses got shut, production halted, and life became unpredictable.

While for most ventures, the pandemic precipitated trouble, for Zetwerk, the headwinds morphed into tailwinds. “Uncertainty,” says Acharya, an electrical engineer from IIT Madras, “is not necessarily a bad thing.” Leaving a cushy job with McKinsey in San Francisco and coming back to India to make a fresh start was as uncertain as it could get. “We took an overnight decision, packed two suitcases, and booked a flight back to India,” he recalls. “All we had was uncertainty,” he says, taking us back to the formative months of Zetwerk.

While for most ventures, the pandemic precipitated trouble, for Zetwerk, the headwinds morphed into tailwinds. “Uncertainty,” says Acharya, an electrical engineer from IIT Madras, “is not necessarily a bad thing.” Leaving a cushy job with McKinsey in San Francisco and coming back to India to make a fresh start was as uncertain as it could get. “We took an overnight decision, packed two suitcases, and booked a flight back to India,” he recalls. “All we had was uncertainty,” he says, taking us back to the formative months of Zetwerk.

The investors were uncertain about the longevity of the business. The absence of an equivalent copycat business model in the US, the complex nature of the manufacturing marketplace, and an operationally-heavy requirement to scale the venture made Zetwerk unpalatable to most funders. Over three dozen rejections by VCs almost shattered the confidence of the co-founders. Acharya’s wife, who back in early 2018 was his fiancée, came up with a comforting assurance. “You don't have to necessarily have all the answers on day one,” she had said. “Trust the process. It’s okay to live with ambiguity.”

Back in 2020, the manufacturing players globally were indeed grappling with loads of ambiguity. And all of it stemmed from the Dragon Land—China—which is the manufacturing powerhouse of the world. The pandemic-induced draconian lockdowns, excessive restrictions and recurrent curbs almost choked the supply pipeline across the world. The fledgling China-Plus-One strategy—wherein companies avoid investing only in China and diversify their businesses to alternative destinations—gathered steam. A dominant chunk of the American and European buyers started aggressively scouting for a new partner to jive. Zetwerk, the Indian ‘elephant’ emerged as the favoured dancing partner. “We happened to be at the right place and at the right time,” reckons Acharya.

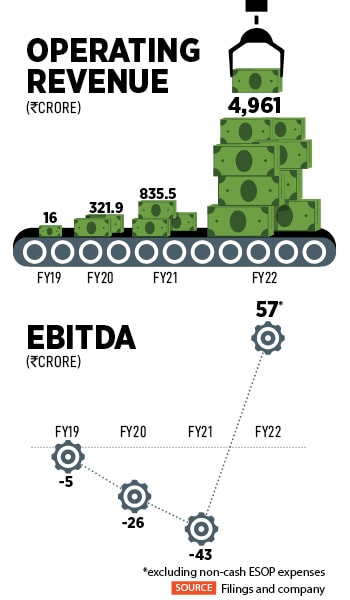

A cocktail of two drugs—China-Plus-One strategy globally, and an import substitution by Indian players domestically—turned out to steroid-induced growth for Zetwerk. Look at the numbers. From Rs 321.93 crore in FY20, operating revenue jumped to Rs 835.5 crore the next fiscal, and then pole-vaulted to Rs 4,961 crore in FY22. While overall losses remained, the startup posted operational profit for the first full year.

A cocktail of two drugs—China-Plus-One strategy globally, and an import substitution by Indian players domestically—turned out to steroid-induced growth for Zetwerk. Look at the numbers. From Rs 321.93 crore in FY20, operating revenue jumped to Rs 835.5 crore the next fiscal, and then pole-vaulted to Rs 4,961 crore in FY22. While overall losses remained, the startup posted operational profit for the first full year. Geographic and category expansion are daunting challenges for any business, especially in manufacturing, where accuracy and speed are of primary importance and supply chains differ radically depending on the product. “However, over the last year Zetwerk navigated new challenges with confidence,” Shah says. The company expanded within the region, scaled across continents, found product-market fit in every new geography, and simultaneously built robust businesses in new markets like apparel, electronics and defence. “As Zetwerk’s network of manufacturing partners expands, we expect the company’s value proposition to grow manifold,” he adds.

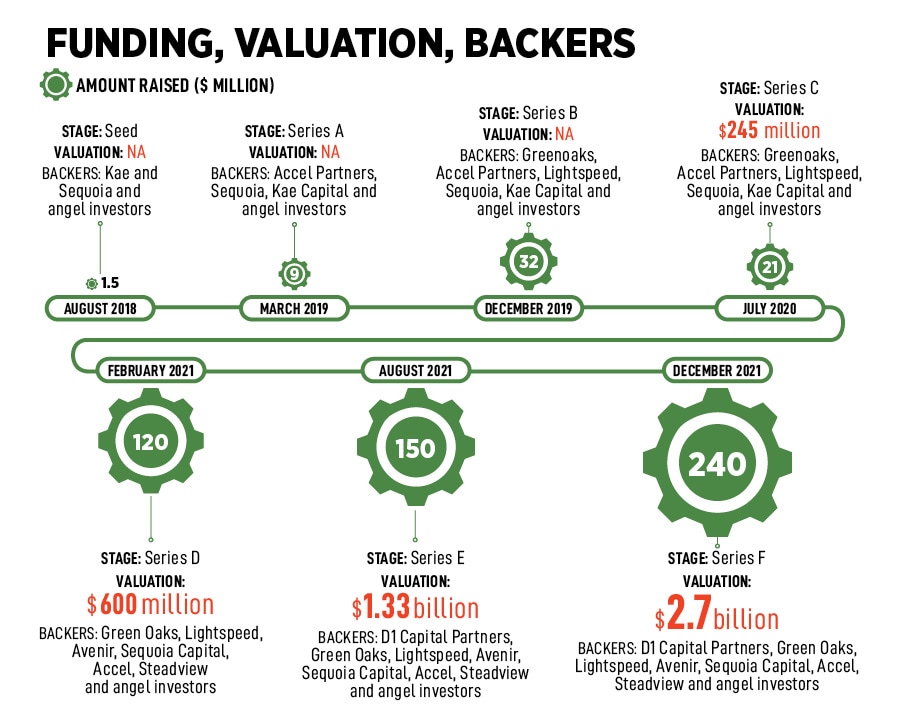

Geographic and category expansion are daunting challenges for any business, especially in manufacturing, where accuracy and speed are of primary importance and supply chains differ radically depending on the product. “However, over the last year Zetwerk navigated new challenges with confidence,” Shah says. The company expanded within the region, scaled across continents, found product-market fit in every new geography, and simultaneously built robust businesses in new markets like apparel, electronics and defence. “As Zetwerk’s network of manufacturing partners expands, we expect the company’s value proposition to grow manifold,” he adds. Acknowledging that the startup is well capitalised—Zetwerk raised $240 million in its Series-F round of funding at a valuation of $2.7 billion last December—Acharya maintains that most of the capital raised is still unspent. “It’s still lying in the bank. We have a very strong balance sheet,” he claims. The startup has been focusing on inorganic growth this year, and it will continue to do so, he informs. “We have enough capital to do all of those things.”

Acknowledging that the startup is well capitalised—Zetwerk raised $240 million in its Series-F round of funding at a valuation of $2.7 billion last December—Acharya maintains that most of the capital raised is still unspent. “It’s still lying in the bank. We have a very strong balance sheet,” he claims. The startup has been focusing on inorganic growth this year, and it will continue to do so, he informs. “We have enough capital to do all of those things.”