Flipkart, pound of flesh & Tiger's meaty bets

Although Flipkart is the blockbuster exit for Tiger Global in India, it has made handsome returns from Delhivery, PB Fintech and Zomato too. But it will be tough to find another Flipkart in its current portfolio

L to R: Vedantu’s Vamsi Krishna, Unacademy's Gaurav Munjal, Byju’s Byju Raveendran

Photo imaging: Kapil Kashyap

L to R: Vedantu’s Vamsi Krishna, Unacademy's Gaurav Munjal, Byju’s Byju Raveendran

Photo imaging: Kapil Kashyap

Tiger doesn’t talk. But when it does, the roar reverberates. “Returns on capital in India have sucked historically,” Scott Shleifer reportedly lamented on an investor call this February. With global internet leaders—Google, Facebook, Alibaba or Tencent—revenue for Tiger got bigger than cost more than a decade ago, the partner at Tiger Global elaborated. With a great legacy of 17 to 18 years of materially profitable internet companies, returns on equity and returns for investors have been really high. “But that did not happen in India,” he reportedly said on the call, as quoted by TechCrunch. “Returns on capital for investors like us have been below average… way below,” he reckoned. “But that’s the past.”

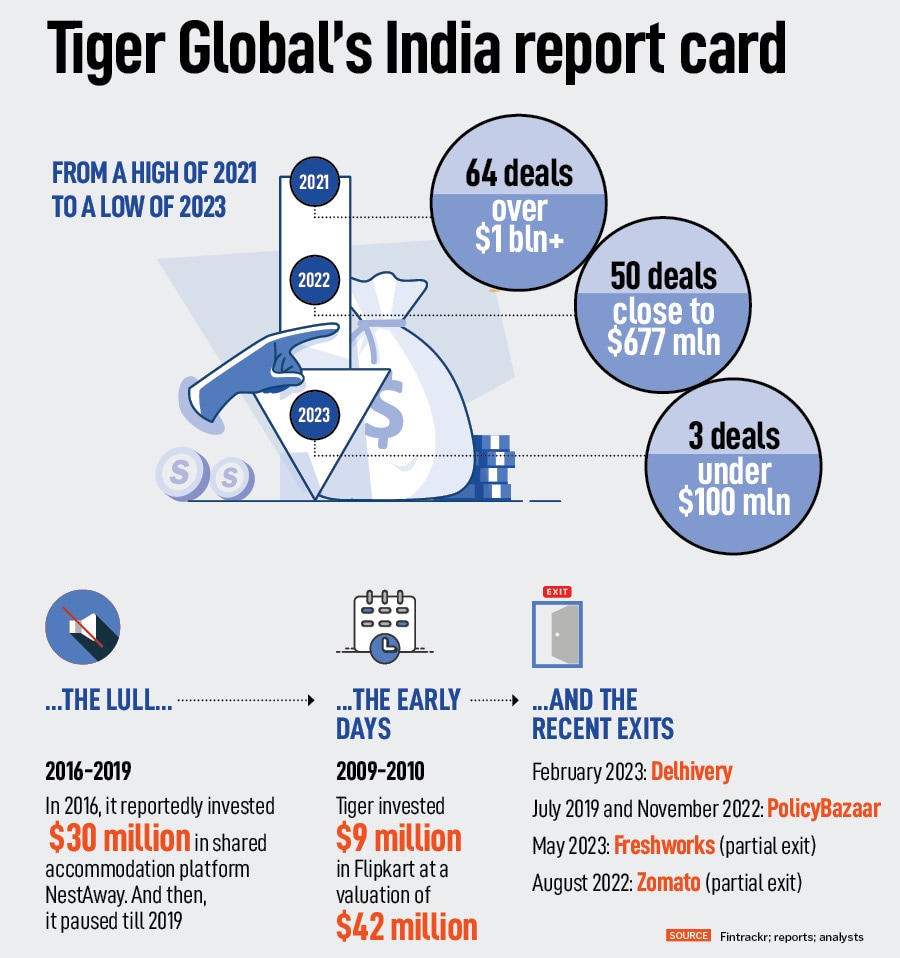

Five months later, the present indeed is a stark and refreshing contrast. An investment made in ecommerce firm Flipkart way back in 2009-10—over the next decade, Tiger Global ended up pumping in around a $1 billion in the etailer—has reportedly fetched the American investment and hedge fund biggie around $3.5 billion. The exit happens to be Tiger’s biggest in India. No wonder, Shleifer quickly switched his mood—lament to exuberance—and dwelled upon the potential of India during the investor call mentioned above. “We think it [India] will be the best place to invest,” he underlined, adding that the fund bought 16 to 17 percent of Flipkart for $8 million in 2010, 10 percent of Infra.Market came for $8 million, and a third of Upstox for $50 million. “Both the firms raised capital in their most recent rounds at over $2.5 billion valuation,” he stressed.

Back in India, analysts and industry watchers decode Shleifer’s mood, and reckon that a “Flipkart-kind of exit” must be viewed as an exception rather than the rule for Tiger. They start by pointing out one of the big misses of Tiger in the ecommerce space. In 2015, Flipkart rival ShopClues raised $100 million in its Series D round led by Tiger Global. Started in 2011, ShopClues had scaled at an aggressive pace, and reportedly had 40 million visitors per month in 2015. The etailer also claimed to have over 1 lakh sellers, 10 million products, and a reach across 25,000 cities.

The following year, in 2016, ShopClues turned unicorn. It was valued at $1.1 billion, and Tiger participated in the new funding round. Widely dubbed as the “next Flipkart”, ShopClues, though, flamed out over the next few years. In 2019, it was sold to a Singapore-based company in a fire sale. In FY20, ShopClues had an operating revenue of Rs 89.1 crore and a loss of Rs 51.5 crore. Tiger’s big bet, and hunt for another Flipkart ended in a dampener.

Take, for instance, the edtech space, which has dramatically crashed over the last 18 months. Tiger’s three meaty bets—Byju’s, Unacademy and Vedantu—have laid off thousands, and are trying hard to survive the funding winter as revenue dips and students flock to schools, colleges and offline coaching centres. “Where is the next Flipkart?” asks another VC. Tiger, he reckons, has been in exit mode in India. Over the last 18 months or so, he points out, the global investment major has made exits from the startups that got listed. It has exited from PB Fintech, the parent entity of PolicyBazaar; it made a partial exit from Freshworks and brought down its stake; it has also exited Delhivery. The interesting part is that it made money in all these exits.

Take, for instance, the edtech space, which has dramatically crashed over the last 18 months. Tiger’s three meaty bets—Byju’s, Unacademy and Vedantu—have laid off thousands, and are trying hard to survive the funding winter as revenue dips and students flock to schools, colleges and offline coaching centres. “Where is the next Flipkart?” asks another VC. Tiger, he reckons, has been in exit mode in India. Over the last 18 months or so, he points out, the global investment major has made exits from the startups that got listed. It has exited from PB Fintech, the parent entity of PolicyBazaar; it made a partial exit from Freshworks and brought down its stake; it has also exited Delhivery. The interesting part is that it made money in all these exits.