HDFC Bank Q3FY24 earnings rock stock markets, raising some near-term concerns

Weaker margins and a high credit-to-deposit ratio spooks analysts, but medium to long term fundamentals for the bank stay strong

The HDFC Bank reported a year-on-year 24 percent growth in net interest income at Rs284.7 billion and net profit of Rs163.8 billion, up 34 percent, but based on successive quarters, both income and profit grew just 3.8 and 2 percent respectively.

Image: Dhiraj Singh/Bloomberg via Getty Images

The HDFC Bank reported a year-on-year 24 percent growth in net interest income at Rs284.7 billion and net profit of Rs163.8 billion, up 34 percent, but based on successive quarters, both income and profit grew just 3.8 and 2 percent respectively.

Image: Dhiraj Singh/Bloomberg via Getty Images

HDFC Bank, India’s largest private lender, slid 8.97 percent intra-day on Wednesday, dragging the entire stock markets down with it, after reporting weaker than expected earnings in some matrix for its December-ended Q3FY24 earnings.

The stock contributed to over 50 percent of the fall to both the Nifty 50 and the Nifty Bank indices, while erasing over 1 lakh crore of market cap in a single day. By the end of the trading day, HDFC Bank closed down 8.16 percent at Rs1,570 at the NSE. The NSE 50 closed down 460 points or 2.09 percent at 21,571.95 and the BSE Sensex index down 1,628.02 points at 71,500.76 on Wednesday.

The HDFC Bank reported a year-on-year 24 percent growth in net interest income at Rs284.7 billion and net profit of Rs163.8 billion, up 34 percent, but based on successive quarters, both income and profit grew just 3.8 and 2 percent respectively.

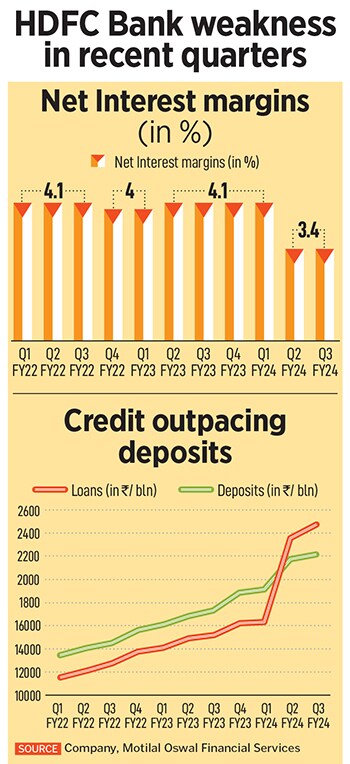

“Margins were largely flat – and slightly below expectations – at 3.4 percent even as the bank deployed excess liquidity and significantly drew down the LCR [liquidity coverage ratio],” says Nitin Aggarwal, head-BFSI (institutional equities) at Motilal Oswal Securities said.

This is what spooked analysts as the Bank’s LCR has come down from 121 percent in the last quarter. This is the matrix which requires banks to maintain high quality liquid assets (HQLAs) to meet 30 days net outgo under stressed financial conditions.

The CD ratio has been on the Reserve Bank of India’s radar for several months now and it has indicated that it wants the ratio to be between 75-80 percent.

The CD ratio has been on the Reserve Bank of India’s radar for several months now and it has indicated that it wants the ratio to be between 75-80 percent.