How Meesho's big, bold bets took it close to $5-billion valuation at lightning speed

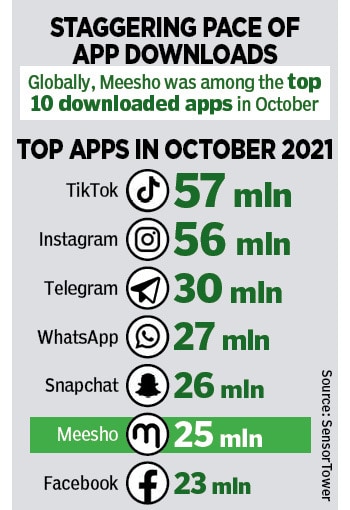

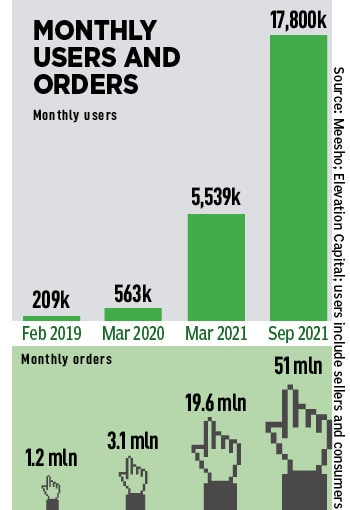

The speed of app downloads has been equally matched by the startup's pace of funding. Can the internet commerce platform maintain the momentum?

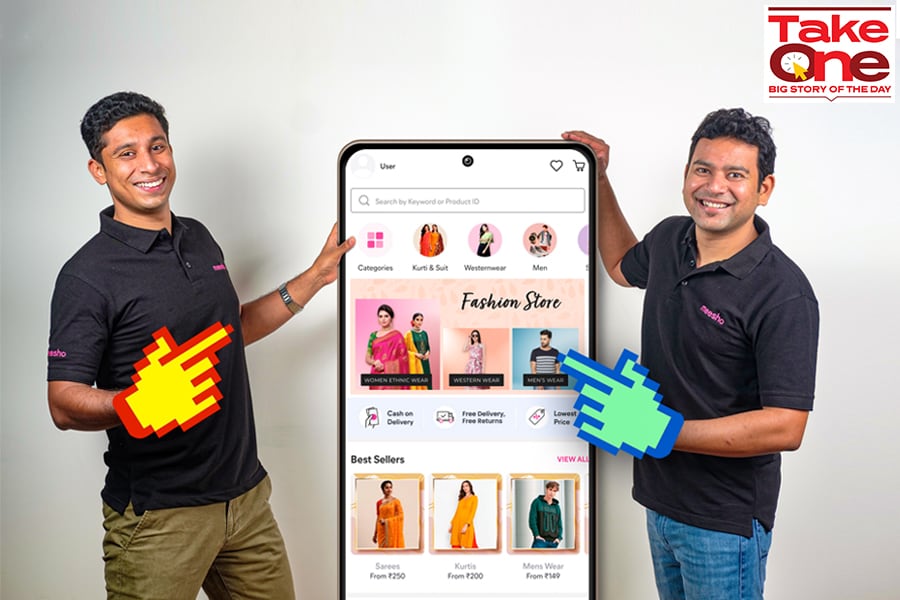

Meesho cofounders Vidit Aatrey and Sanjeev Barnwal

Meesho cofounders Vidit Aatrey and Sanjeev Barnwal

October 2015, Koramangala, Bengaluru

The shopaholic duo arrived around noon. It was a bright Sunday afternoon, and the local neighbourhood market was steadily swelling up with a rousing stream of festive crowd. Though with deep pockets, most of the buyers were bargain hunters. Standing cheerfully outside a garment’s store, Vidit Aatrey and Sanjeev Barnwal had their pockets loaded. The IIT grads were patiently waiting to strike a deal. “Please don’t come here,” the duo pleaded to a shopper who just entered the store. The shopkeeper looked bemused.

Aatrey, though, flashed a broad smile. Possessed with a missionary zeal, he took out a pamphlet from his pocket and handed it over to the customer. “Don’t shop from here,” read the leaflet. “Please visit our app to buy fashion products” was the message conveyed to the perplexed buyer. “You will find this shop on our app,” he informed politely. Over the next couple of hours, the friends continued with their passionate plea to persuade shoppers not to shop from the store. “No one was coming to our app,” recalls Aatrey, who had rolled out Fashnear, a hyperlocal fashion discovery platform, along with Barnwal a month back. “And we didn’t know how to get people to our online app.”

Meanwhile, the offline gambit to get people online continued. Markets kept changing—at times the venue was a shopping mall—but the methodology remained the same: Targeting one shop a day. For the lucky ones who did come online to place an order, the enterprising duo figured out one more ‘wow’ service: The ‘try-and-buy’ option. Both used to go to a shop, pick up a product and then deliver it to the customer. “We'd stand outside the house, and wait for feedback,” recounts Aatrey.

After four months, the duo lost steam. The business didn’t scale, and consumers exhibited muted interest. Reason was simple. In fashion, Aatrey underlines, people want a wide range of options and having products just from a local market was not what the doctor ordered.

After four months, the duo lost steam. The business didn’t scale, and consumers exhibited muted interest. Reason was simple. In fashion, Aatrey underlines, people want a wide range of options and having products just from a local market was not what the doctor ordered.

Aatrey figured out a jugaad. He used WhatsApp and Google spreadsheet to run the app. “We created a WhatsApp group and added all these homemakers on a daily basis,” he recalls. The plan was to give them access to all the supply that Meesho had on its platform, and let the micro entrepreneurs sell them. The logistics too was taken care by the social commerce platform. For four months, the business ran on WhatsApp. “In four months, the business doubled every month,” he says. And this was happening without any new app or website, no coding and zero marketing. Barnwal was convinced. Now the team rolled out a new app. “This was Meesho 2.0,” says Aatrey “We were confident of a good show.”

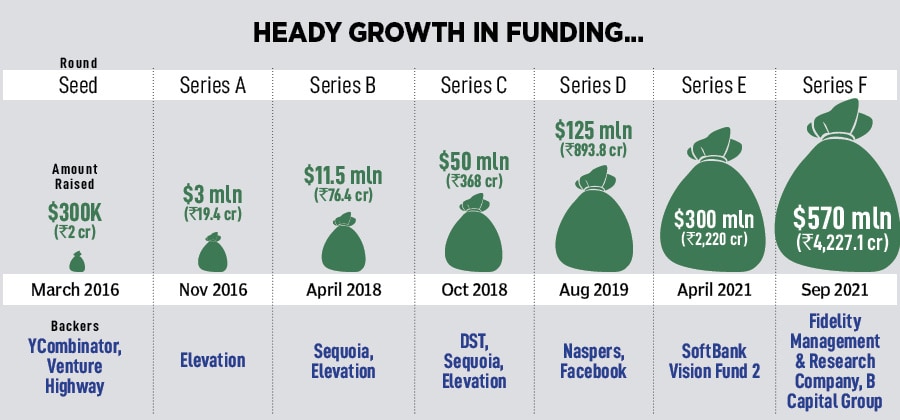

Aatrey figured out a jugaad. He used WhatsApp and Google spreadsheet to run the app. “We created a WhatsApp group and added all these homemakers on a daily basis,” he recalls. The plan was to give them access to all the supply that Meesho had on its platform, and let the micro entrepreneurs sell them. The logistics too was taken care by the social commerce platform. For four months, the business ran on WhatsApp. “In four months, the business doubled every month,” he says. And this was happening without any new app or website, no coding and zero marketing. Barnwal was convinced. Now the team rolled out a new app. “This was Meesho 2.0,” says Aatrey “We were confident of a good show.”  Interestingly, Meesho was about to enter into a different trajectory. In Series D, its valuation jumped to $700 million in 2019, and Meesho becomes Facebook’s first India investment. Early this year, in a Series E round in April, the valuation soared to $2.14 billion. Five months later, Meesho got valued at $4.9 billion when it raised its Series F round in September.

Interestingly, Meesho was about to enter into a different trajectory. In Series D, its valuation jumped to $700 million in 2019, and Meesho becomes Facebook’s first India investment. Early this year, in a Series E round in April, the valuation soared to $2.14 billion. Five months later, Meesho got valued at $4.9 billion when it raised its Series F round in September.

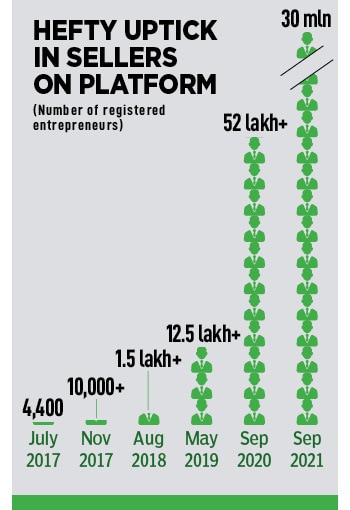

What made Kabir Narang, founding general partner at B Capital Group, join the party was the way the startup was democratising ecommerce. He explains. The local craftsperson in Jaipur, the trader in Mumbai, and the neighbourhood store owner in Coorg were increasingly looking to leverage digital channels to grow. Meesho, he lets on, was helping small sellers benefit from the digital revolution. “This is the reason why we invested,” he says, adding that Meesho has scaled to India’s largest reseller-based platform with positive unit economics. The startup has leveraged its scale to enable low-cost fulfilment at zero commissions for their suppliers, helping them come online. It set the flywheel at an even faster pace by expanding to serve direct consumers early this year. “Meesho has been trending as one of the top apps in Google Play Store,” he says.

What made Kabir Narang, founding general partner at B Capital Group, join the party was the way the startup was democratising ecommerce. He explains. The local craftsperson in Jaipur, the trader in Mumbai, and the neighbourhood store owner in Coorg were increasingly looking to leverage digital channels to grow. Meesho, he lets on, was helping small sellers benefit from the digital revolution. “This is the reason why we invested,” he says, adding that Meesho has scaled to India’s largest reseller-based platform with positive unit economics. The startup has leveraged its scale to enable low-cost fulfilment at zero commissions for their suppliers, helping them come online. It set the flywheel at an even faster pace by expanding to serve direct consumers early this year. “Meesho has been trending as one of the top apps in Google Play Store,” he says.