If Trump does not come back, the situation could get worse: Mark Mobius

The emerging markets investment veteran expects a correction of 15 to 20 percent if US President Donald Trump loses the November election and contests the outcome, although Mobius is optimistic of an economic recovery in most countries, including India and China

The US-China trade war has pushed the focus towards India; where India is offering incentives – to companies moving out of China – and wanting to set up manufacturing facilities in India.

The US-China trade war has pushed the focus towards India; where India is offering incentives – to companies moving out of China – and wanting to set up manufacturing facilities in India.Image: Mexy Xavier

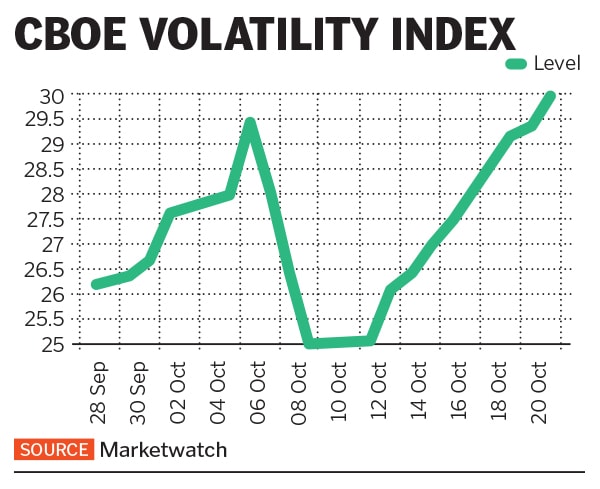

As the US elections draw nearer, emerging markets investment veteran Mark Mobius warns of a sharp 15 to 20 percent correction for global markets if the poll results are legally contested. The Dow Jones index was up 0.11 percent, S&P 500 index up 0.17 percent while the Nasdaq down 0.29 percent in early trade Friday after the final US Presidential debate ended Thursday, where President Donald Trump faced uncomfortable questions surrounding Covid-19 and the economy. Democratic Presidential nominee Joe Biden leads Trump in the national polling averages, but his overall lead has narrowed in recent days. Global market volatility will remain a constant next year too, Mobius tells Forbes India, speaking from Athens in Greece on a Zoom call. And despite most governments having got their Covid-19-induced lockdown policies wrong, there will be no option but to open up most economies and sectors next year, leading to a sharp bounce back in growth. Mobius forecasts India’s economy to bounce back towards the early part of 2021, led by services. He, however, wants India to become aggressive in raising capital overseas. India currently constitutes the highest geographical weightage in the portfolio Mobius Capital Markets manages for its clients. Edited excerpts from an interview:

Prior to the elections, the focus is back on the US. How do you read the on-ground situation after a dramatic pull back from the poor high-frequency indicators seen in June?

This year is very much a write-off. All economies will be witnessing negative growth. But we can look forward to a big recovery in calendar year 2021, simply as the economies open up and we move from negative to relative stability. The equity markets are telling us that we are going to have a great year ahead. We are in a situation where people and economies are getting ready for the recoveries. Some of this will depend on whether US President Donald Trump gets re-elected. But if Trump does not get re-elected, the US markets probably will not fare well. The US public is looking forward to a comprehensive tax cut policy under Trump and will be disappointed if he fails to come back to power.

It will be even more negative if the election result is a hung one. The markets do not like uncertainty, so if Trump does not come back, the situation could get worse. If this happens, in terms of size, we could see a correction of 15 to 20 percent. It is a real concern. One must remember that Trump did not win the popular vote in the 2016 elections.

JP Morgan Asset Management’s Maria Toschi observed that since 1932, an incumbent US president has never failed to win a re-election unless a recession occurred during their time in office. How are investors viewing Trump?

Investors will not give him a fair chance if they do not believe that he can get the economy moving. The good news for Trump is that he recovered quickly from Covid-19. Fresh Covid lockdowns are getting the markets nervous, which is why Trump demands a wider opening up of the economy. Unless the markets (sectors) are open and we do away with lockdowns, economies are not going to fare well. Oddly, the Democrats want stricter mandates, restrictions and lockdowns, which the man on the street does not want.