In full throttle: How 'kam peeta hai' propelled Suzuki Access 125 to number 2 in the pecking order

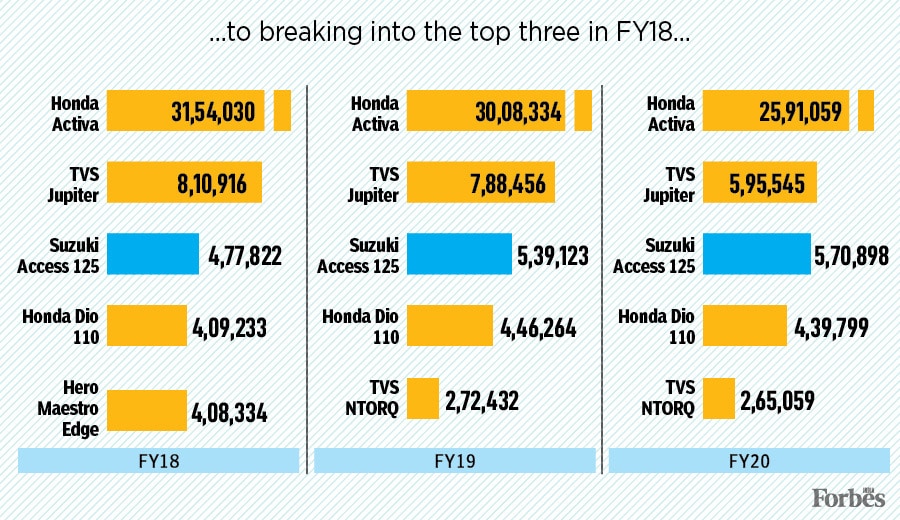

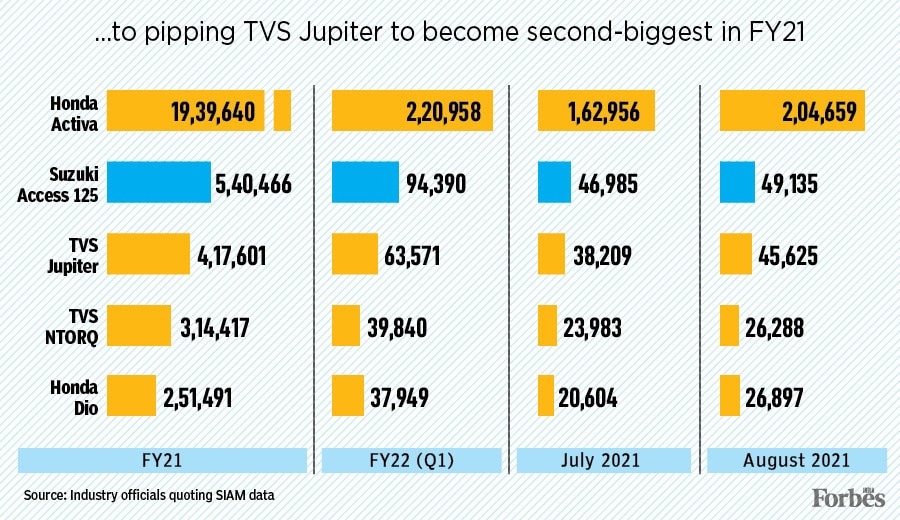

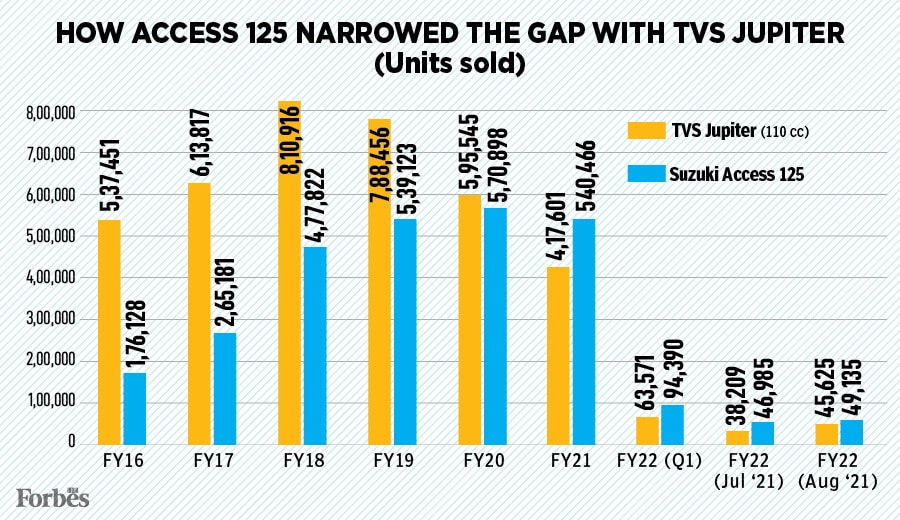

From a distant Number 5 in 2015, Suzuki Access 125 toppled TVS Jupiter to become the second-biggest scooter brand in India. Can it now take the crown from the formidable Honda Activa?

Devashish Handa, Vice President (Sales, Marketing, & After Sales) at Suzuki Motorcycle India Private Ltd at Suzuki Motorcycle’s service station in Gurugram, India on 5th August, 2021; Image: Amit Verma

Devashish Handa, Vice President (Sales, Marketing, & After Sales) at Suzuki Motorcycle India Private Ltd at Suzuki Motorcycle’s service station in Gurugram, India on 5th August, 2021; Image: Amit Verma

In September 2007, the Japanese baby was born in India with a definite name: Access 125. The name, interestingly, was not only self-explanatory, but also outlined the game that the newborn gearless scooter was about to play. Access 125 was the first scooter in the 125 cc segment, a category that Suzuki Motorcycle India created. While the wholly-owned arm of the Japanese Suzuki Motor was way ahead of time—scooter market in India was, and is still, dominated by 110 cc—Suzuki knew that the premature baby had a good chance of turning into a teen sensation if it mastered the right game.

For close to a decade, Access 125 stayed in the hunt. What was missing, though, was a sharp strategy to win the game. The stunted growth was largely due to the erroneous perception that a scooter with a stronger engine would consume more fuel. “More power was perceived as more fuel, and higher cost of ownership,” rues Devashish Handa, vice president (sales, marketing and after sales) at Suzuki Motorcycle India.

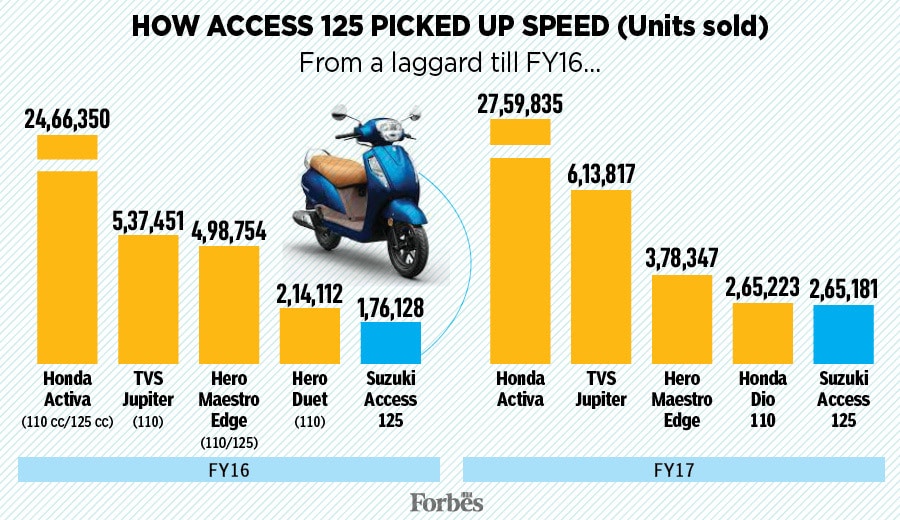

Consumers largely stayed apprehensive, and there was no easy acceptance. In FY16, while the Japanese counterpart Honda had a thumping grip over the scooter market with Activa—over 24.66 lakh—the second in the pecking order was TVS Jupiter with 5.37 lakh, followed by Hero Maestro Edge and Hero Duet with 4.98 lakh and 2.14 lakh, respectively. Access 125, in contrast, was a distant number five—1.76 lakh (see box).

Meanwhile, in the same year, Access 125 switched into a celebratory mode. The next year, it was turning 10, and Suzuki decided to prepare for the birthday blast by loading the young one with cool features: A more powerful engine, quicker acceleration and a higher fuel efficiency which was a few notches above what it was born with. “It was reengineered. There was a major upgradation from frame to the engine,” says Handa. The scooter was spruced up in styling, looks, features and rider ergonomics. The idea was to make it more appealing to the consumers. Finally, the value proposition that a potential scooter buyer looks at from the lens of a family scooter, stresses Handa, fell in place.