India's unicorn party is just getting started

It's pouring unicorns in India...out of 10 born so far this year, six sprung to life in April. The funding bus is set to get more crowded

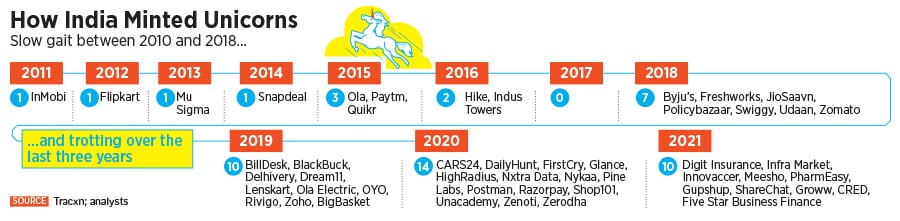

The chances of precipitation were high this month. Though the weather stays pleasant in April—and the likelihood of a downpour towards the fag end of the spring season is rare—the forecast in January made it clear that 2021 would be an exceptional year. “India will have at least 12 unicorns (privately-held firms with a valuation of $1 billion and more) this year,” a joint report by Nasscom and global management and strategy consultancy Zinnov boldly predicted in the first week of January this year. Well, the makers of the report were realistically optimistic. Reason: Last year, 14 startups joined the unicorn club in India as against 10 in 2019. So another 12 over a span of a year was a no-brainer.

January did start on a rainy note. By mid-month, a week after the prediction, Digit Insurance became the first unicorn of the year. By the end of March, the country added three more. The skies looked heavy, and the funding storm was set to pick up furious pace. On the first Monday of April, social commerce startup Meesho stormed into the coveted club. Next day, fintech startup Cred followed suit. On Wednesday, it was the turn of online pharmacy firm PharmEasy. Over the next few days, it started pouring. Social media app ShareChat, online investment platform Groww, and messaging startup Gupshup gatecrashed the party.

In the first nine days of April, India has seen a staggering six unicorns. To put things in perspective, the number is equivalent to what the country logged cumulatively in four years from 2014 till 2017. There is another way to slice the data, though. Ten unicorns that India has seen so far in 2021 is more than the numbers in 2017, and matched the count in 2019 (see box). With eight long months still to go in this year, the unicorn club is all set to get crowded. “It’s great for the ecosystem. Indian startups are coming of age,” reckons Deep Kalra, founder of online travel aggregator MakeMyTrip, which took a decade to turn into a unicorn.

Reasons for a sharp uptick in the birth of unicorns are not hard to find. Prem Pavoor, partner and India head at the venture capital firm Eight Roads Ventures, explains. “This is a consequence of a confluence of supply and demand,” he says. The VC fund happens to be one of the backers of API Holdings, the parent company for PharmEasy—one of the freshly-minted unicorns this month. Icertis, a contract lifecycle management SaaS firm and another portfolio investment of Eight Roads Ventures, has nearly tripled its valuation to $2.8 billion since 2019 when it turned into a unicorn. On the supply side, Pavoor underlines, there have been significant tailwinds driven by the pandemic around penetration and consumption of digital content and enabled services. The lockdown also catalysed an accelerated uptake of enterprise software, where Indian companies are swiftly emerging as global contenders.