- Home

- UpFront

- Take One: Big story of the day

- Jet Airways 2.0 was supposed to be a dream come true. Can it really fly out in 2023?

Jet Airways 2.0 was supposed to be a dream come true. Can it really fly out in 2023?

The airline's plan to relaunch operations comes at a time when the aviation sector is in the midst of serious churn, and experts say extensive planning, adequate capitalisation and a well-defined path to profitability will be key to revival

Manu Balachandran is a writer for Forbes India, based in Bengaluru. At Forbes India, Manu writes on automobiles, aviation, pharmaceuticals, banking, infrastructure, economy and long profiles among many others. He also moderates many of Forbes India's CEO and CXO events and hosts Capital Ideas, a podcast on the most riveting success stories from the business world. He has previously worked with Quartz, The Economic Times and Business Standard in Mumbai and New Delhi. Manu has a master's degree in journalism from Cardiff University and a degree in economics from the Loyola College. When not chasing stories, he is most likely obsessing over Formula 1 (Read: Lewis Hamilton), historical events and people, or planning long weekend drives from Bengaluru

Jet Airways has not flown since April 2019 and is now targeting to take off as early as April 2023.

Image: Ritesh Uttamchandani/Hindustan Times via Getty Images

Jet Airways has not flown since April 2019 and is now targeting to take off as early as April 2023.

Image: Ritesh Uttamchandani/Hindustan Times via Getty Images

Finally, there is some hope for the embattled airline, Jet Airways. After four years of being stuck in limbo, the country’s once-largest private airline is all set to make a comeback to the Indian skies in 2023. A regional bench of the country’s National Company Law Tribunal (NCLT) in Mumbai, on January 13, finally allowed the transfer of ownership of Jet Airways to the Jalan-Kalrock Consortium (JKC) more than two years after it was declared the winning bidder.

Related stories

With that move, the consortium says it is ready to re-launch the airline as early as April this year. “With the NCLT latest directions, we intend to fly in Q2–2023,” a spokesperson for the Jalan-Kalrock Consortium tells Forbes India.

That could happen unless, of course, the lenders now challenge the NCLT decision at an appellate tribunal or even the Supreme Court. “With the support of all our partners and stakeholders, we are fully geared up and ready to get the airline in the skies,” the spokesperson adds.

In October 2020, the consortium had been recognised as the successful bidder for the bankrupt airline. Back then, the consortium led by Murari Lal Jalan, a relatively unknown businessman with business ties to the UAE and Uzbekistan, had offered a total infusion of Rs 1,375 crore, including Rs 900 crore towards capex and working capital, and Rs 475 crore to settle claims of the creditors. The lenders had agreed to the plan submitted by the airline, which was later approved by the NCLT in 2021. Lenders were to also receive a 9.5 percent stake in the airlines and a part of the payment to lenders is from the sale of property owned by Jet Airways.

“JKC is fully committed to the revival of Jet Airways and all payments will be made in full compliance with the court-approved resolution plan,” the spokesperson adds. The approved plan also had a clause that stated that the amount infused by the consortium for the settlement of claims of all stakeholders would be limited to Rs 475 crore.

But over two years since, the airline just couldn’t find a way to fly, a period during which the Indian government sold Air India to the Tata Group and Akasa airline took to the skies. That’s because, for several months, the consortium and the lenders, led by the State Bank of India, were engaged in a tiff over the transfer of ownership to the consortium after the lenders said that the consortium had failed to meet all the conditions precedent mentioned in the plan.

“This is the first airline that is being revived by the Insolvency and Bankruptcy Code (IBC) court process and some delays are always expected as there is no precedent for this in India,” the spokesperson for JKC adds. “But we also believe that all delays are in the past now and all stakeholders now need to look in the future to get the airline back into the skies, which we all are committed to do.”

The relationship between the two parties seemed on track until early 2022, after which it went sour. Among other issues were payment of dues and uncertainty over who pockets the income from the rental of an aircraft that Jet Airways owned. The lenders had also claimed that the consortium hadn’t met the conditions precedent. Later, the National Company Law Appellate Tribunal (NCLAT) also directed the consortium to pay unpaid provident fund and gratuity dues of employees of the carrier, which the consortium had challenged since the approved plan by NCLT had only accounted for Rs 52 crore towards such payment.

The conditions precedent included getting the AOC (air operator’s certificate), approval of the business plan from the Directorate General of Civil Aviation (DGCA) and the Ministry of Civil Aviation (MoCA), slot allotment approval, international traffic rights, and approval of the demerger of the ground handling business into Airjet Ground Services Ltd (AGSL), a subsidiary of Jet Airways AGSL.

Also read: Air India: Will we see a new avatar of the beleaguered airline in 2023?

So far, the Jalan-Kalrock consortium has deposited bank guarantees worth Rs150 crore with the lenders. As per the resolution plan, the consortium has to make cash payments of Rs185 crore to financial creditors within 180 days from the effective date. The effective date is a term from when the winning bidder has to infuse funds into the company and make certain payments to the stakeholders, including payments to employees and workmen, and other operational creditors.

The recent order has given the consortium six months from November 16, 2022, to make payments to lenders. “We have always maintained that the quantum of liabilities assumed by JKC under the resolution plan is capped,” the spokesperson adds. “We are engaging with all stakeholders on this and exploring all options, and we are sure that the solution will protect all stakeholders.”

That could well mean that there is a glimmer of hope on the horizon. “It is hard to ascribe a timeline to any matter with Indian courts,” says Satyendra Pandey, managing partner for aviation services firm AT-TV. “Even so, given the amount of effort that has been put in, coupled with the fact that the Jet revival will set a precedent for future restructuring, we are of the opinion that the airline will indeed take to the skies this year.”

Can Jet Airways Finally Take Off?

Jet’s plan to relaunch operations in 2023 comes at a time when the Indian aviation sector is in the midst of some serious churn.

“While much speculation abounds, fact is that the consortium came in, a team was hired, systems, processes, procedures laid down, letters of intent signed, and the AOC was revived,” Pandey adds. “And this was done after a successful bid for the grounded airline which was carried out in a fairly public manner. As such, there is clearly an intention to restart the airline from the consortium's side.”

But over the past few months, some of the hires by the company have either left the company or been sent on leave without pay. Among others, reports suggest that Nakul Tuteja, the vice president of human resources and administration, has left the organization, in addition to HR Jagannath, the vice president of engineering. Ronit Baugh, the head of communications too left the airline recently to join Air India. Additionally, the airline has also come under pressure from vendors with whom the airline had tied up for services including catering and call centre management, among others.

“How fast the airline can return to the skies now depends on how the lenders take the issues forward and whether they challenge the recent order,” Vinamra Longani, head of operations at Sarin & Co, a law firm specialising in aircraft leasing and finance. “If not, resuming the process to restart operations and getting back on track should happen soon. They have been looking to sell tickets at the earliest.”

“While some people have left, Sanjiv is still around,” another aviation sector expert says on the condition of anonymity. “He is an old and experienced hand, and they should be up to meet any challenge as long as he is there.” Kapoor took over as the CEO of Jet Airways last year after briefly working at Oberoi Hotels & Resorts as its president. An aviation veteran, he was the chief commercial officer of Vistara and chief operating officer of SpiceJet before his current tenure.

“While some people have left, Sanjiv is still around,” another aviation sector expert says on the condition of anonymity. “He is an old and experienced hand, and they should be up to meet any challenge as long as he is there.” Kapoor took over as the CEO of Jet Airways last year after briefly working at Oberoi Hotels & Resorts as its president. An aviation veteran, he was the chief commercial officer of Vistara and chief operating officer of SpiceJet before his current tenure.

As part of the tiff between the lenders and the consortium, earlier this month, the NCLT-appointed Resolution Professional (RP) Ashish Chhawchharia had asked the airline to refrain from calling Kapoor as its CEO and instead refer to him only as CEO designate. In return, the consortium shot off a strongly worded rebuttal.

"In the event, there exists no monitoring committee resolution which authorises you to write to Mr. Kapoor, your letter under reference shall be considered as null and void and you are advised to refrain from communicating on behalf of Jet Airways until authorised by all required members of the monitoring committee," the letter from representatives of Jalan-Kalrock consortium said.

Among other points of contention between the lenders and the consortium, apart from meeting the conditions precedent was also the collection of lease rental from an aircraft that Jet Airways owned. Under its original promoter Naresh Goyal, Jet Airways had bought an A330 aircraft which was then leased to Etihad Airways, which subsequently leased it to Air Serbia. After the repayment of the loan, over the past few months, rental incomes have been coming to the airline and a dispute arose over who was to use the funds—the consortium or the lenders.

Also read: Vistara has become India's second-largest airline. Can it fly higher from here?

“Jet 2.0 by no means will have an easy ride, but one tends to forget that two other airlines at the present time have an extremely fragile balance sheet and are actively sourcing emergency credit lines from the government under the ECLGS scheme,” adds Pandey. “For Jet 2.0, extensive planning, adequate capitalisation and a clear and well-defined strategy will be key to revival.”

Either way, for now, the airline is mum on its aircraft orders going forward. “We will share all details in due course,” the airline spokesperson says in response to plans for aircraft acquisition. While the company had received its air operator’s permit in May last year from the DGCA, the airline had earlier announced plans to begin operations with a fleet of six narrow-body aircraft after which it was looking to grow to more than 50 aircraft in three years and more than 100 in 5 years.

“The management will have to regroup, rethink and possibly recapitalise,” adds Pandey. “With the AOC already in place, one of the largest hurdles has already been cleared. But getting back in the skies is only one part of the challenge. Jet 2.0 will have to clearly show a path to profitability in a market environment that has drastically changed in the last 18 months.”

Tough Fight

Even if everything goes well according to plan and the airline begins operating as early as April this year, the model that the airline is likely to follow remain rather unknown.

Jalan-Kalrock’s approved resolution plan had said that it intended to restart Jet’s operations with six routes from Mumbai and a single route to/from Delhi immediately upon achievement of the Effective Date, leading to 14 routes, comprising eight routes from Mumbai and six routes from Delhi by the end of year one from the Effective Date. The airline is attempting to start international operations once it gets to 20 aircraft as mandated by the government.

Also read: The Tatas got lucky with an expatriate CEO once. Can Air India's Älker Ayci repeat the feat?

“They must be prepared for a hostile environment,” adds Longani. “In the past, the Indian aviation space had the might of a cash-rich Indigo (among others) to deal with, but now there is also a strong Air India backed by Tata Group. They must make their intentions clear on their model and whether they will be a hybrid carrier or a full-service one or a low-cost one. That will determine who they will go up against, and in any case, will risk losing money at least in the near term.”

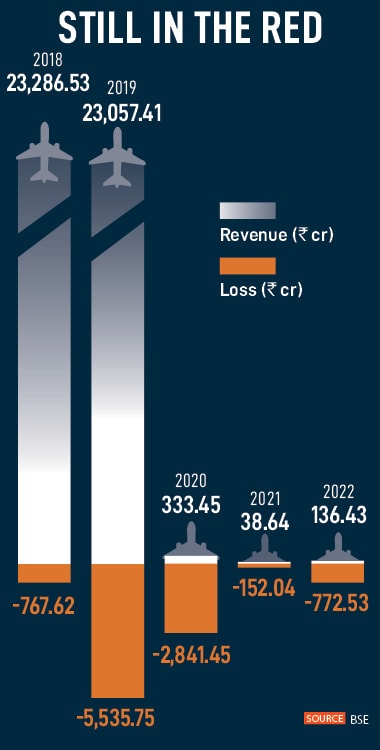

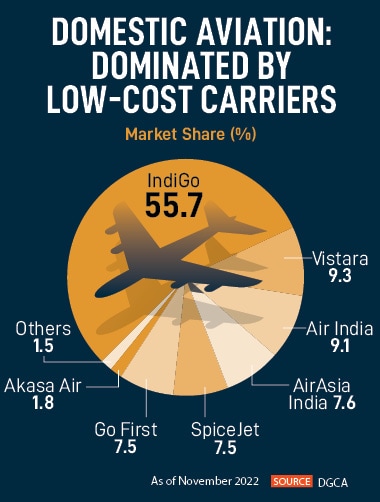

In its past avatar, the airline had been a full-service carrier and had dabbled with a low cost operation under JetLite. Today, India’s domestic aviation market is led by low-cost carriers that control as much as 80 percent of the market, led by market leader IndiGo which corners nearly 60 percent of the market share.

Then, among the full-service carriers, Air India and Vistara have taken steps to merge, making it the largest full-service carrier in the country, backed by the might of the Tata Group and Singapore Airlines. In September last year, Air India unveiled a new plan titled Vihaan.ai, which translates to the dawn of a new era in Sanskrit. In addition, the Tata group intends to operate a full-service carrier under Air India and a low-cost arm comprising AirAsia India and Air India Express.

“We’ve been very clear that it’s a five-year programme,” Campbell Wilson, the new CEO of Air India had told Forbes India in an earlier interview. “The first six months are about addressing the accumulated grievances and issues that have historically been holding the airline back, address them at war scale, and then move on to an 18-month programme of investing in systems, people, aircraft, training, internal products to make a clear statement of intent. Then the subsequent couple of years is the climb phase which is where we do all those million and one little things that are necessary to go from very good to world-class.”

“We’ve been very clear that it’s a five-year programme,” Campbell Wilson, the new CEO of Air India had told Forbes India in an earlier interview. “The first six months are about addressing the accumulated grievances and issues that have historically been holding the airline back, address them at war scale, and then move on to an 18-month programme of investing in systems, people, aircraft, training, internal products to make a clear statement of intent. Then the subsequent couple of years is the climb phase which is where we do all those million and one little things that are necessary to go from very good to world-class.”

IndiGo, meanwhile, has been expanding at breakneck speed and the airline currently boasts a fleet of over 300 aircraft, the highest in the country. The airline operates the Airbus A320 CEO and NEO, the A321 NEO, and the ATR 72-600 aircraft. The airline has a domestic market share of 56.2 percent, ferrying over 65 lakh passengers a month. The airline operates over 1,600 plus daily flights and connects 76 domestic destinations and 26 international destinations.

All that means the competition is only going to get tougher for Jet Airways as it looks at a launch this year. And, in that process, the consortium and the lenders must now find a way to see eye to eye on issues if Jet 2.0 needs to become a force to reckon with. “The resolution plan submitted to the NCLT by the new owners and duly approved by the lenders (which includes leading public sector banks) dictates the use of money,” adds Longani. “The consortium and the lenders will need each other for the foreseeable future, which is why one would hope they can get over the past and work together to revive one of India's most loved airlines.”

The hard work is all done. It’s all about burying egos and differences to finding the right throttle to fly out of turbulence again. “Many business people who are inexperienced in the industry have tried operating an airline before,” says Shukor Yusof, founder and analyst of Malaysia-based aviation consultancy firm Endau Analytics. “As long as one has very deep pockets and a good management, success can be achieved. But not immediately. Patience and timing and much luck are essential. Running an airline isn’t for the faint-hearted.”