Vistara has become India's second-largest airline. Can it fly higher from here?

Led by Vinod Kannan, Vistara has emerged out of Covid with a higher market share. But, from hereon, it will also have to stave off competition from a crowded domestic sector and global economic headwinds

Vistara has emerged out of Covid to become India's second-largest airline

Image: Francis Mascarenhas/Reuters

Vistara has emerged out of Covid to become India's second-largest airline

Image: Francis Mascarenhas/Reuters

Vinod Kannan has made it a habit of walking out of turbulence unscathed and, perhaps, even stronger. Back in 2001, barely a month after he began his tryst with aviation as a marketing executive with Singapore Airlines, the global airline industry went into mayhem when, on September 11, 2001, terrorists hijacked four aircraft belonging to American Airlines and United Airlines and crashed them into the iconic World Trade Centre in New York and the Pentagon in Washington DC.

The Bengaluru-born Kannan had just finished his master’s degree in high-performance computing from the Singapore-MIT Alliance, a global partnership in graduate education between MIT, the National University of Singapore (NUS), and Nanyang Technological University (NTU), and joined Singapore Airlines in August. It took almost two years before air travel returned to normalcy since attack.

In 2019, almost two decades after he spent his life rising through the ranks at Singapore Airlines, Kannan shifted to India, only to be welcomed by another global mayhem. Kannan joined Vistara, the joint venture between Singapore Airlines and the Tata Group, as the chief strategy officer in June, six months before the first case of Covid-19 was detected in China. By January 2020, as air travel began to be curtailed, Kannan was elevated as the chief commercial officer and was in the thick of things when air travel came to a standstill in March.

“I took on the commercial role in January 2020 and then everything came crashing down, for the lack of a better word,” the 42-year-old told Forbes India over a virtual interaction. “For two months we couldn’t fly, which was a big shock.”

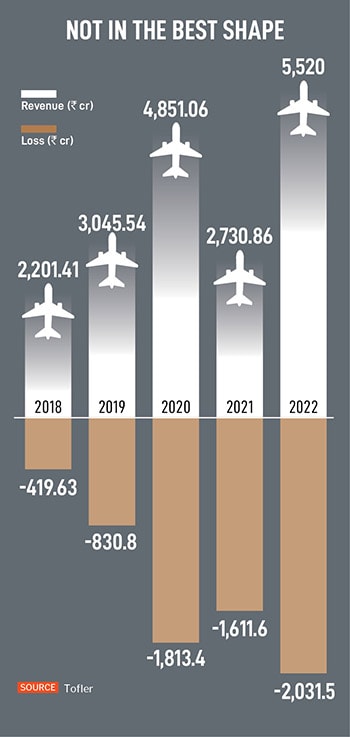

Fast forward two years, Kannan and Vistara seemed to have walked out of the crisis, relatively unscathed and, in the process, mightier than ever before. While many Indian carriers are bleeding, and in some cases even struggling to pay monthly salaries, Vistara became India’s second-largest airline by market share, crossing the significant 10 percent milestone in July. In January 2022, seven years after the Gurugram-headquartered airline first took to the skies, Kannan was appointed the company’s CEO.

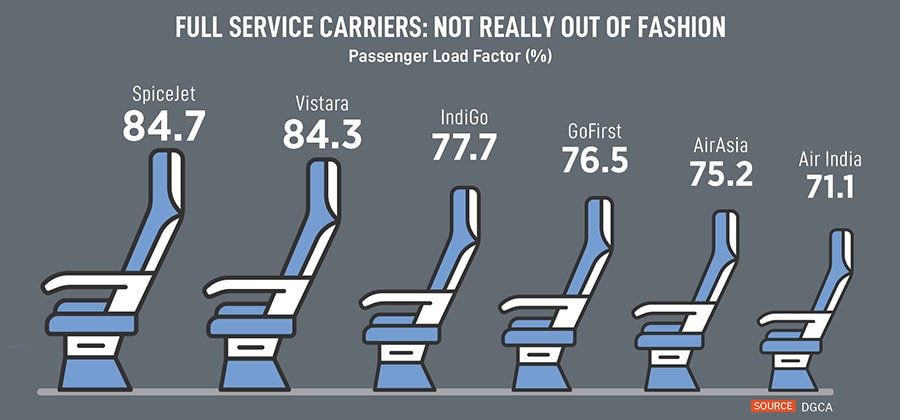

“Vistara’s mandate is to be the best premium airline in the country and hopefully the world someday,” Kannan says. “If you look at where we are today, more than 80 percent of the market is low-cost carriers. That’s not easy to change because all these guys have also ordered aircraft. They're all growing because we expect demand to grow. So, at a high level. I would expect the same kind of share split to take place.”

“Vistara’s mandate is to be the best premium airline in the country and hopefully the world someday,” Kannan says. “If you look at where we are today, more than 80 percent of the market is low-cost carriers. That’s not easy to change because all these guys have also ordered aircraft. They're all growing because we expect demand to grow. So, at a high level. I would expect the same kind of share split to take place.”

Between May and July, for instance, SpiceJet saw nine incidents ranging from smoke in the cabin to the cracking of a windshield and an emergency landing in Karachi, prompting the aviation regulator to ask the airline to fly at 50 percent of its approved flights for two months. Go First, too, has reportedly grounded a fifth of its aircraft due to delays in engines.

Between May and July, for instance, SpiceJet saw nine incidents ranging from smoke in the cabin to the cracking of a windshield and an emergency landing in Karachi, prompting the aviation regulator to ask the airline to fly at 50 percent of its approved flights for two months. Go First, too, has reportedly grounded a fifth of its aircraft due to delays in engines.