LIC: Tough road ahead as stock continues to drag

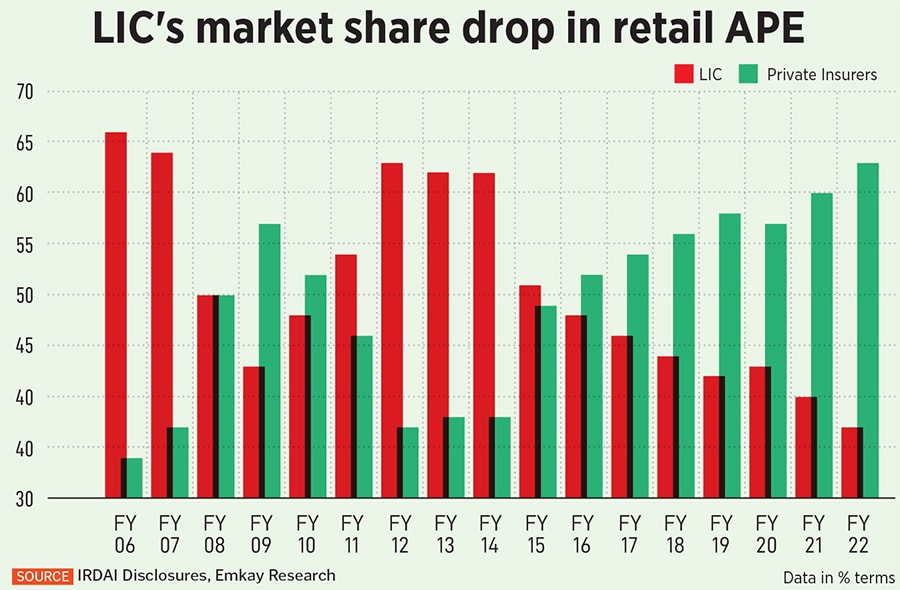

As its stock awaits a fresh embedded value, India's largest insurer wants to strengthen bancassurance and diversify its product mix. But changing the mindset of the organisation and its agents is unlikely to happen soon

LIC stock has edged up just 3.3 percent, much in line with the stock markets and still down 28 percent from its issue price of Rs 949 per share

Image: Niharika Kulkarni / Reuters

LIC stock has edged up just 3.3 percent, much in line with the stock markets and still down 28 percent from its issue price of Rs 949 per share

Image: Niharika Kulkarni / Reuters

Nearly a month after the Life Insurance Corporation (LIC) of India stock was listed on May 17, its chairperson Mangalam Ramasubramanian Kumar did rare media rounds, to clarify to investors why the stock of the country’s largest insurer had eroded 31 percent in value from its issue price—and underperformed market indices by more than five times—during this period.

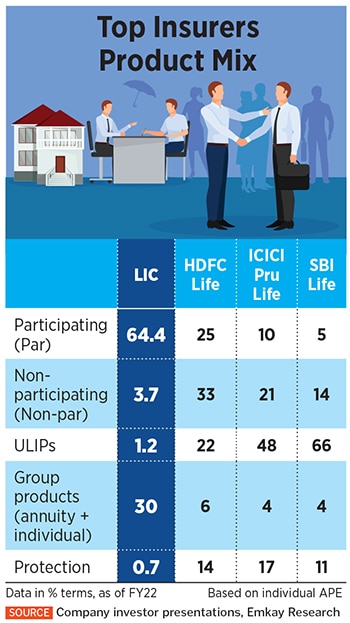

Kumar, an LIC veteran of nearly forty years, gave all the right media bytes, at least from the perspective of a state-owned organisation. He spoke about the need for LIC to change its product mix beyond traditional offerings, the near-term strategy for growth by focusing on Unit Linked Insurance plans (ULIPs) and improving profitability, the push towards bancassurance, going aggressive on digital and the timeline in disclosing embedded value.

LIC’s top leadership has, in previous decades, not spoken publicly on these issues, except in annual reports. But Kumar’s straight talk and favourable analysts’ estimates for the stock are yet to convince investors. A fortnight since then, the LIC stock has edged up just 3.3 percent, much in line with the stock markets and still down 28 percent from its issue price of Rs 949 per share.

Kumar has tried to allay investor concerns, blaming the stock slump on weakening market conditions hurt by rising inflation, as global energy and food prices remain stubbornly high.

Kumar has tried to allay investor concerns, blaming the stock slump on weakening market conditions hurt by rising inflation, as global energy and food prices remain stubbornly high.

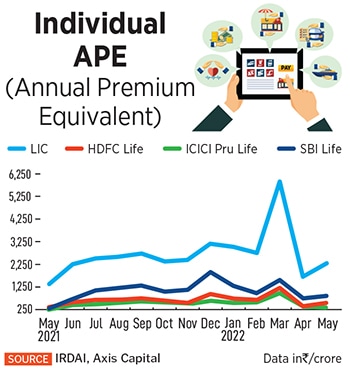

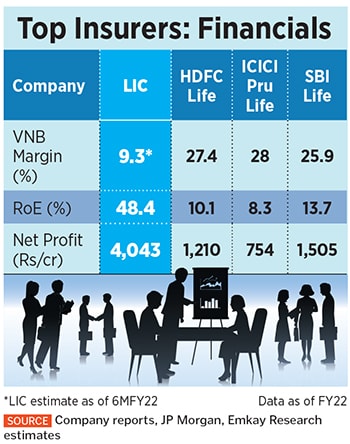

In the quarter gone by, LIC reported its first earnings data since being listed; the year-on-year consolidated net profit for the March-ended quarter fell 17.4 percent and it also showed a lower 69.24 percent 13-months persistency ratio (a key matrix for an insurance company), compared to the previous Q4FY22 quarter. On June 30, LIC failed to announce the embedded value for the previous quarter, despite clear promises by the management earlier. LIC has said the exercise in determining the embedded value “may take some more time to get completed” and is likely to be disclosed on July 15. LIC declined to participate in this story.

LIC can boast of having the highest reach and productivity in selling policies across India, with offices in 91 percent districts in India compared to 81 percent for the entire private sector combined. Its agents’ productivity is the highest at Rs3.93 lakh in new business premium in FY22, followed by SBI Life at Rs 2.81 lakh, according to IRDAI data.

LIC can boast of having the highest reach and productivity in selling policies across India, with offices in 91 percent districts in India compared to 81 percent for the entire private sector combined. Its agents’ productivity is the highest at Rs3.93 lakh in new business premium in FY22, followed by SBI Life at Rs 2.81 lakh, according to IRDAI data.  LIC, which had 70 bancassurance partnerships in FY21, is keen to add more bancassurance and alternative channels to sell more policies. Its current tie-ups are with 57,919 outlets of these banks all over the country. But LIC has not been able to capitalise on these relationships so far. Around 96 percent of LIC’s NBP for individual products is through its agents and only 3.38 percent through banks and alternative channels.

LIC, which had 70 bancassurance partnerships in FY21, is keen to add more bancassurance and alternative channels to sell more policies. Its current tie-ups are with 57,919 outlets of these banks all over the country. But LIC has not been able to capitalise on these relationships so far. Around 96 percent of LIC’s NBP for individual products is through its agents and only 3.38 percent through banks and alternative channels.

In June, Emkay’s Singh initiated coverage on LIC with a hold rating and a target price of Rs875, due to this factor and the possibility of higher volatility in the EV. They have used a 0.9x June 23 P/EV multiple to arrive at the LIC stock target price. Macquarie, after LIC’s listing in May, also initiated an investment into LIC, with a neutral rating and a target price of Rs1,000. They have applied a P/VNB multiple of 10x on FY24E VNB. JP Morgan’s Mundra believes that the markets have mispriced the stock, with a target price of Rs840 for the stock and forecasting a 6 percent FY22-24E growth in business.

In June, Emkay’s Singh initiated coverage on LIC with a hold rating and a target price of Rs875, due to this factor and the possibility of higher volatility in the EV. They have used a 0.9x June 23 P/EV multiple to arrive at the LIC stock target price. Macquarie, after LIC’s listing in May, also initiated an investment into LIC, with a neutral rating and a target price of Rs1,000. They have applied a P/VNB multiple of 10x on FY24E VNB. JP Morgan’s Mundra believes that the markets have mispriced the stock, with a target price of Rs840 for the stock and forecasting a 6 percent FY22-24E growth in business.