Madhabi Puri Buch: A curious case of knots and tangles—the story so far

Sebi Chairperson Madhabi Puri Buch is embroiled in allegations, raising several questions on integrity, transparency and competency of the market regulator

Sebi Chairperson Madhabi Puri Buch has denied all allegations against her husband and her, calling them false, malicious and derogatory

Image: Getty Images

Sebi Chairperson Madhabi Puri Buch has denied all allegations against her husband and her, calling them false, malicious and derogatory

Image: Getty Images

Colleagues of Madhabi Puri Buch, chairperson of the Securities and Exchange Board of India (Sebi), feel that problem-solving with her is like peeling an onion. It makes everyone cry during the process, but by the time peeling layer after layer of the onion is done, there is no problem left. Buch’s statement in a convocation address at IIM-Ahmedabad (IIM-A), her alma mater, on March 30 somewhat summaries the situation she now finds herself in. Her comment was in reference to the process of how India became the first large market in the world to move to T+1 settlement cycle for shares (later to optional T+0 settlement).

Though both Sebi, and separately Buch along with husband Dhaval Buch, have denied all the allegations made by Hindenburg Research and the opposition Congress party, it remains to be seen if there are any investigations conducted by the government to prove otherwise. Despite an attack on the integrity of Sebi, the government has remained silent for over a month.

On September 16, Finance Minister Nirmala Sitharaman commented that the Sebi chairperson and her husband have been responding to some of the allegations, and are defending themselves by presenting facts to counter the claims of the Congress. “I think the facts have to be considered,” she said in response to a query on the matter at a Network18 event.

On August 10, Hindenburg had issued a statement accusing Buch of conflict of interest in Adani Group and the regulator’s investigations in it.

Sebi responded by saying that the market watchdog has adequate internal mechanisms for addressing issues relating to conflict of interest, which include disclosure framework and provision for recusal. “It is noted that relevant disclosures required in terms of holdings of securities and their transfers have been made by the chairperson from time to time. The chairperson has also recused herself in matters involving potential conflict of interest,” Sebi said.

However, the worms are still crawling out of the can. The accusations are serious and threaten to have an irreversible consequence on the guardian of capital markets, raising doubts and suspicion on its capabilities, competencies and effectiveness. Until an external independent body carries out a detailed investigation, or the government takes a stand on the accusations, the investors will be uncertain if Sebi, under the leadership of Buch, was able to stand true to the words of the preamble it pledges: “To protect the interests of investors in securities and to promote the development of, and to regulate the securities market.”

Sebi responded to the Hindenberg allegations in a press statement on August 11, and said that investors should remain calm and exercise due diligence before reacting to such reports. “Investors may also like to take note of the disclaimer in the report that states that readers should assume that Hindenburg Research may have short positions in the securities covered in the report,” it said.

Though surprised at the series of allegations, markets’ participants have not yet reacted or responded to them. “There are definitely shocking accusations against the Sebi chief, but those are not considered true by the markets until investigated and proven,” says a veteran markets investor who does not want to be named. “All the allegations made by the opposition party are detailed and classified information. Shouldn’t we also ask about the credibility of their source of such sensitive information?”

The mudslinging and accusations against the Sebi chief come prior to the end of her three-year term in March 2025. Buch, 58, took over as head of the market regulator in March 2022, achieving many firsts. She is not only the youngest Sebi chief, but also the first woman to lead the market regulator in India and the first person from the private sector in the role. All her predecessors were bureaucrats.

Buch started her career in 1989 with ICICI Bank and later served as CEO of ICICI Securities from February 2009 to May 2011. From April 2017 to March 2022, she was wholetime director of Sebi.

Also read: Should the SEBI chief step down?

‘Conflict of interest’

In a series of allegations, Hindenburg claimed whistleblower documents revealed that Buch and her husband had stakes in both obscure offshore entities (Bermuda and Mauritius funds) used in the Adani money siphoning scandal. “We find it unsurprising that Sebi was reluctant to follow a trail that may have led to its own chairperson,” the short-seller said in its report.Shriram Subramanian, founder of InGovern Research, a corporate governance advisory firm, however, questions the basis of the allegations of conflict of interest against Buch. He says that the data points used for the allegations against Buch and her husband are mere inferences of conflict of interest, and seem to have no logical explanations. Conflicts of interest occur when there is gain made by the decisions taken by a person of authority. “In these allegations, no gain has been ascribed, so how are these conflicts of interest?” he asks.

Hindenburg has also accused Sebi, saying the implementation of the REIT regulations as well as changes in such regulations had resulted in significant benefit to large multinational financial conglomerates.

Subramanian adds that Sebi has an institutional mechanism with the involvement of wholetime directors or senior officials in all the investigations or decisions taken by it as a market regulator. “None of the orders are at the sole discretion of the chairperson alone,” he says.

In a personal statement, Buch said that all allegations against her were completely false, malicious and derogatory. About the conflict of interest with several listed companies, she stated that she has never dealt with any file involving Agora Advisory, Agora Partners, the Mahindra Group, Pidilite, Dr Reddy’s, Alvarez & Marsal, Sembcorp, Visu Leasing or ICICI Bank at any stage after joining Sebi.

“Our income tax returns clearly have been obtained by adopting fraudulent means and illegally. This is a clear breach of not only our right to privacy (which is a fundamental right) but also a violation of the Income Tax Act,” the Buchs said in a statement.

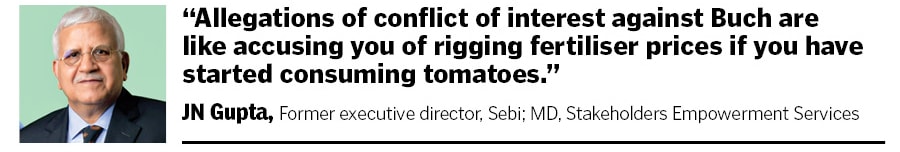

JN Gupta, former executive director of Sebi and MD of proxy advisory firm Stakeholders Empowerment Services, also feels that the accusations of conflict of interest against Buch do not hold ground and should be viewed keeping an eye out for the motive behind such accusations. “In this matter, the allegations of conflict of interest against Buch are like accusing you of rigging fertiliser prices if you have started consuming more tomatoes,” Gupta says.

Strict Boss

During this time, ‘employee discontent’ charges against Buch also cropped up. On August 6, Sebi employees had reportedly written a letter to the finance ministry, expressing their concerns about “toxic work culture”, while putting forth other demands. On September 4, Sebi had issued a statement rebutting allegations of employee mistreatment, which was followed by a protest of employees demanding the resignation of Buch. Sebi had said that the complaints of the employees were influenced by external elements.In another twist, on September 16, Sebi withdrew its earlier press statement, saying it was amicably addressing concerns of protesting employees on “internal” matters.

However, in Buch’s own words in her address at the IIM-A convocation, “I am afraid I have a long list of colleagues as well as bosses who would testify to the fact that I am not only a very difficult boss to work for, but also a very difficult subordinate... because I just won’t give up... until a problem has been dissected to the last degree.”

Buch has been a taskmaster and has implemented many regulatory changes in capital markets in India, which has been ballooning multiple times in market cap and trading volumes. Under her leadership, Sebi has tightened regulations on initial public offerings (IPOs), future and options (F&O), standardising ESG norms, and introduced the T+0 settlement for Indian securities, which is the first in the world.

She took over as Sebi chairperson at a time when the market watchdog was under scrutiny over its handling of the National Stock Exchange (NSE) case and lapses around it between 2010 and 2015. Buch isn’t the only Sebi lead to have been embroiled in controversies. CB Bhave (2008-2011) moved to head Sebi from the National Securities Depository Limited (NSDL), raising questions on conflict of interest in the case against NSDL, from which he later recused himself.

UK Sinha (2011-2017) faced public interest litigations on charges of his Sebi colleague alleging that he was pressured by government to go soft against high-profile corporates.

Blind Trust

According to Subramanian, it is common practice across all financial institutions and banks that the executives disclose holdings and assets of their entire family to the internal compliance department, and such a mechanism exists in Sebi too. “These disclosures are not in public domain. Casting aspersions against one individual does not help anyone. One is not aware of what assets are held be senior executives and heads of even other regulatory bodies like the RBI, IRDA, CCI, etc,” he adds.The global practice is to create a blind trust for any official in influential positions. A blind trust is a vehicle used most often by public officials designed to separate the official from the management and knowledge of her assets. This avoids a conflict of interest as prohibited by the law.

All senior appointees’ regulators need to move their investments into blind trusts, where the shareholdings, investments and financial assets are managed by a third party, without any periodic reporting. “The trustee manages the trust without informing the beneficiaries (the regulator), who have no knowledge or control over the assets,” Subramanian explains. He adds that creating blind trusts will mitigate any such allegations of conflicts of interest.

For now, as the mudslinging continues, without an independent investigation, the uncertainties also remain. Perhaps, Buch is following her own mantra of “do what is right, no matter how hard” and “leave no stone unturned, no matter how hard”, as she said in her student address at IIM-A earlier this year.