Tech5: Quad leaders announce Cancer Moonshot, race begins to buy Intel

Forbes India's daily tech news bulletin with five headlines that caught our attention

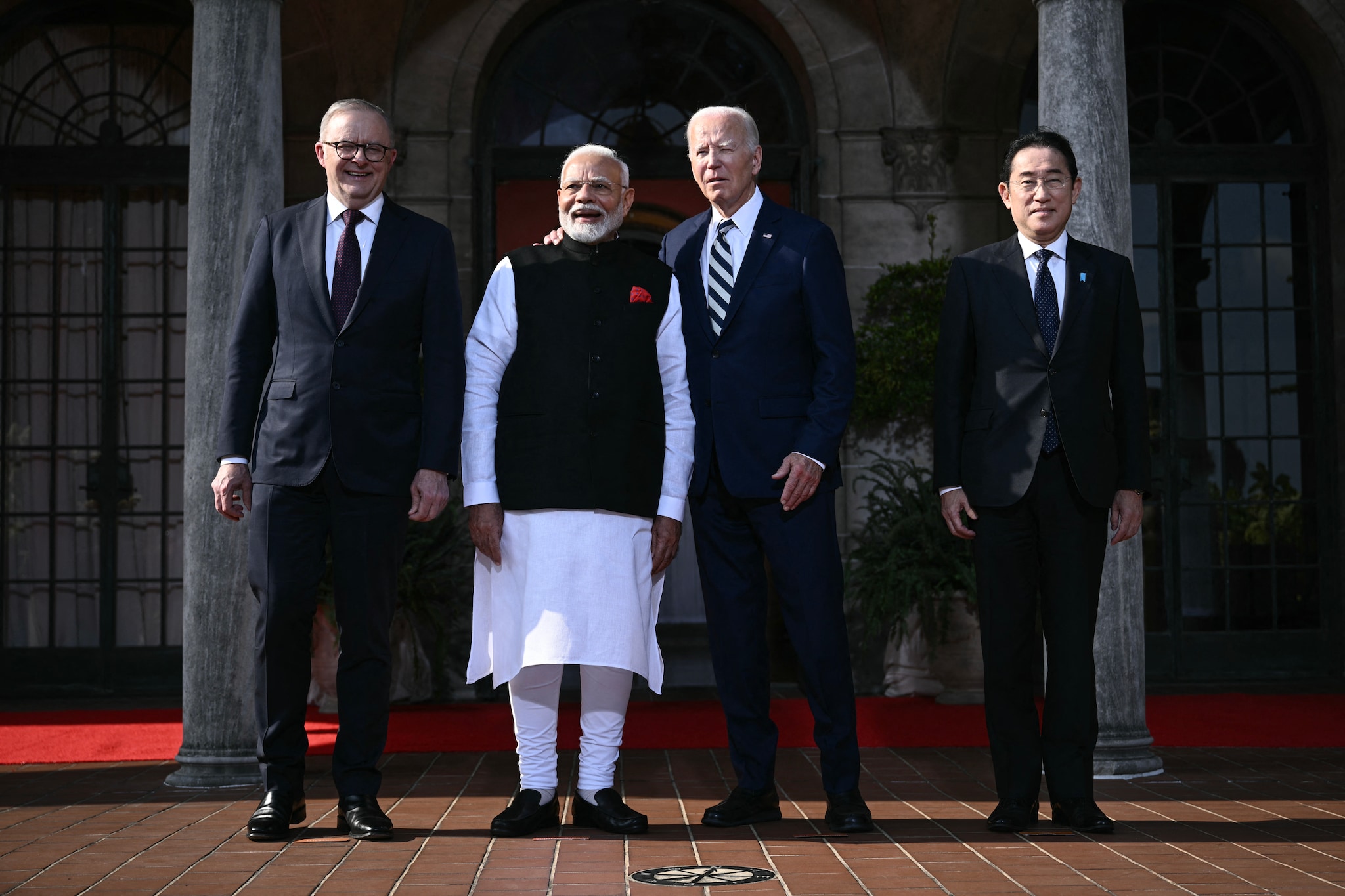

US President Joe Biden (3R) participates in a Quadrilateral Summit family photo with Australian Prime Minister Anthony Albanese (L), Indian Prime Minister Narendra Modi (2L), and Japanese Prime Minister Fumio Kishida (R) at the Archmere Academy in Wilmington, Delaware, on September 21, 2024. Image: Brendan Smialowski / AFP

US President Joe Biden (3R) participates in a Quadrilateral Summit family photo with Australian Prime Minister Anthony Albanese (L), Indian Prime Minister Narendra Modi (2L), and Japanese Prime Minister Fumio Kishida (R) at the Archmere Academy in Wilmington, Delaware, on September 21, 2024. Image: Brendan Smialowski / AFP