Metro's small big play: Cash, carry and kiranas

The Indian arm of German wholesale retailer is betting big on its kirana play to widen its reach. Can Metro Cash & Carry aggressively pursue its bullish intent?

Yeshwanthpur, Bengaluru. It was a baffling, yet a valid question. “Why should kiranas come to buy from you when we have such a great distribution network,” asked the chief executive officer of one of the top FMCG companies in India to his counterpart in Metro Cash & Carry India. “These guys (kirana owners) are effectively served by us. Aren’t they?” he smirked and looked inquisitively.

The conversation took place in early 2019 when the FMCG CEO was visiting the 1.30 lakh sq ft flagship outlet of Metro Cash & Carry India, the local arm of German wholesale retailer Metro AG located at Yeshwanthpur in Bengaluru.

Arvind Mediratta, who was at the receiving end of the probing queries, smiled. The managing director and chief executive officer of Metro Cash & Carry India pointed towards one of the kirana owners who had overloaded his shopping trolley. “He doesn’t need to bother about bulk orders. The goods will get delivered within 24 hours,” he added.

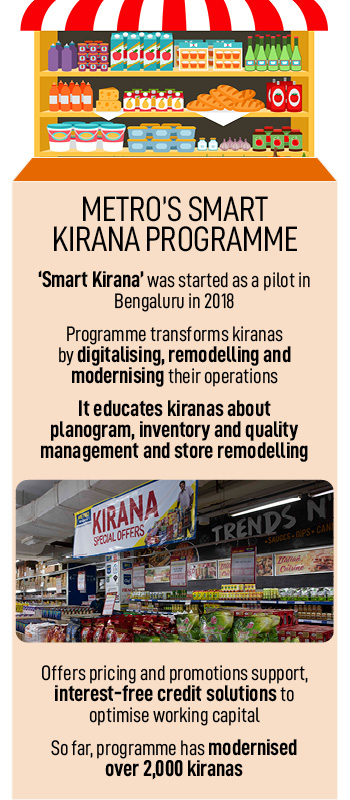

A year later, in Shahdara, Delhi, it was Manoj Narang’s turn to face some critical questions. “Narang sahab, why don’t you stock some frozen snacks, and ready-to-cook products,” the store manager politely asked the 50-year-old kirana owner who had his shop in Delshad Garden, some 15 minutes from Metro’s first outlet in Delhi which was rolled out in 2012. The manager spent a good thirty minutes talking to the second-generation entrepreneur, figuring out his pain points and bottlenecks hampering growth in revenue.

Fast forward to Zirakpur, some 40 minutes from Chandigarh. Manohar Chaddha was struggling to find the right answers. “If you are selling baby diapers, then why aren’t you able to sell milk powder and other baby care products,” asked one of the customer care executives of the Metro store. On his daily visit to the mom-and-pop stores to take orders, the executive tried to reason with

Fast forward to Zirakpur, some 40 minutes from Chandigarh. Manohar Chaddha was struggling to find the right answers. “If you are selling baby diapers, then why aren’t you able to sell milk powder and other baby care products,” asked one of the customer care executives of the Metro store. On his daily visit to the mom-and-pop stores to take orders, the executive tried to reason with

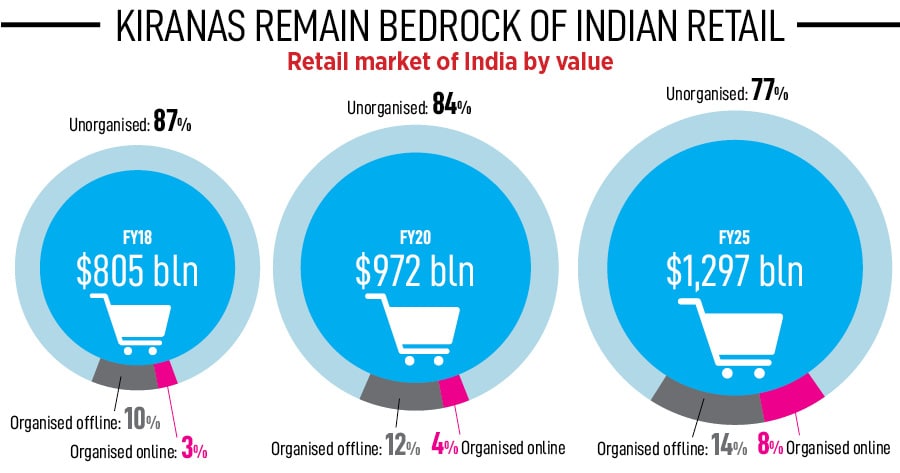

For suitors like Metro, who are aggressively wooing kiranas with unique and customised services, offers and products, the future prospects are promising. By 2025, according to estimates by consulting firm Redseer, the Indian retail market will increase to $1,297 billion in value, of which organised

For suitors like Metro, who are aggressively wooing kiranas with unique and customised services, offers and products, the future prospects are promising. By 2025, according to estimates by consulting firm Redseer, the Indian retail market will increase to $1,297 billion in value, of which organised

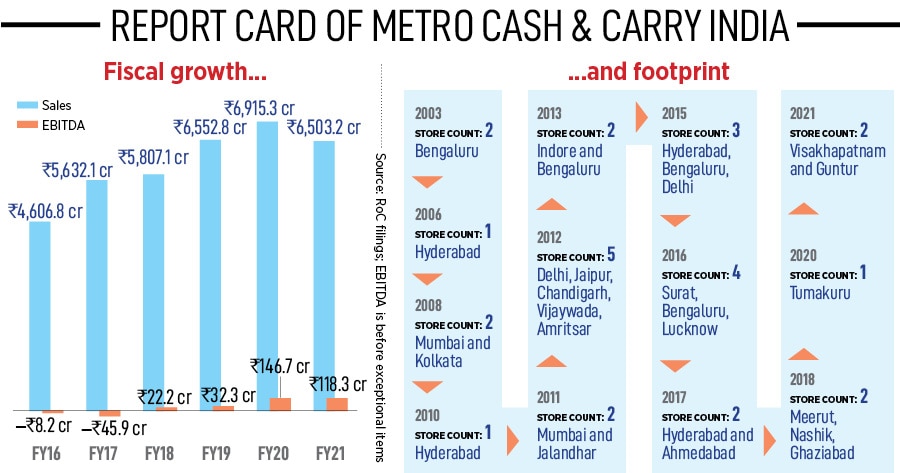

But is slow speed hurting Metro? There were recent reports that the Indian business was under review. The global spokesperson, though, rubbished such reports. "At Metro, we regularly assess our international portfolio. India is an important part of our portfolio,” said the executive in an email. “The Indian subsidiary is growing and is profitable. We are bullish on our India business and continue to expand,” he added.

But is slow speed hurting Metro? There were recent reports that the Indian business was under review. The global spokesperson, though, rubbished such reports. "At Metro, we regularly assess our international portfolio. India is an important part of our portfolio,” said the executive in an email. “The Indian subsidiary is growing and is profitable. We are bullish on our India business and continue to expand,” he added.