- Home

- UpFront

- Take One: Big story of the day

- More people are buying ultra luxury homes in India. Here's why

More people are buying ultra luxury homes in India. Here's why

Real estate developers are rethinking design and functionalities in order to cater to demands of a ‘larger-than-life living experience’ by luxury home buyers, but there are a few points to remember before you make that investment

Darielle Britto is a Special Correspondent for Forbes India, where she writes about the intriguing luxury lifestyle world and is also part of the web team. She has extensive experience in journalism focusing on long-from written features. Her work has been featured in Daily News Analysis, Hindustan Times and other prominent Indian publications. When not in search of a compelling story, she enjoys being a shutterbug.

- Abhishek Agarwal: Creating wealth by offering health

- Top bridal and fashion jewellery trends dominating this season

- Living that luxe life: Around the world in a private jet

- Trinetra Haldar Gummaraju: Reimagining and recreating, again and again

- The Paris Haute Couture week debut was a moment of great pride for Tanishq: Garima Maheshwari

- No longer a mere possession: Rich millennials are overhauling the luxury yacht industry

- Glamping the great outdoors in uber luxury

- Inside the world of bespoke private jet tours that could rewrite how the rich travel and holiday

- Road less travelled: Why Indians are embracing the allure of luxury road trips

- Living that luxe life: Around the world in a private jet

A view of India Sotheby's International Realty hosted/ Listed Villa in Alibaug. An increasing number of people are buying ultra-luxury homes in India, which has resulted in a market boom. Image: Courtesy India Sotheby's International Realty

A view of India Sotheby's International Realty hosted/ Listed Villa in Alibaug. An increasing number of people are buying ultra-luxury homes in India, which has resulted in a market boom. Image: Courtesy India Sotheby's International Realty

The demand for luxurious residences that offer a unique living experience has been growing in the Indian market over the last few years. An increased number of high-net-worth individuals, rapid urbanisation, and rising incomes are just some of the factors contributing to that growth.

The experience of the pandemic has also left many people feeling a strong sense of home ownership, and a desire to have more square footage for work and education requirements.

Related stories

“Because the mid and premium segment consumers have other resources to tap into, they are still able to go ahead with their desire for home ownership by tapping into other resources that they have access to,” says Vivek Rathi, director-research, Knight Frank India, a property consultancy.

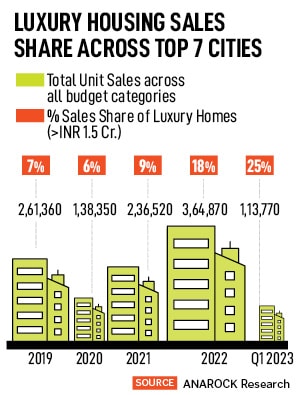

If the numbers are anything to go by, India’s luxury residential market is booming. Post-pandemic, the segment performed remarkably well, with overall sales share rising steeply across the top seven cities.

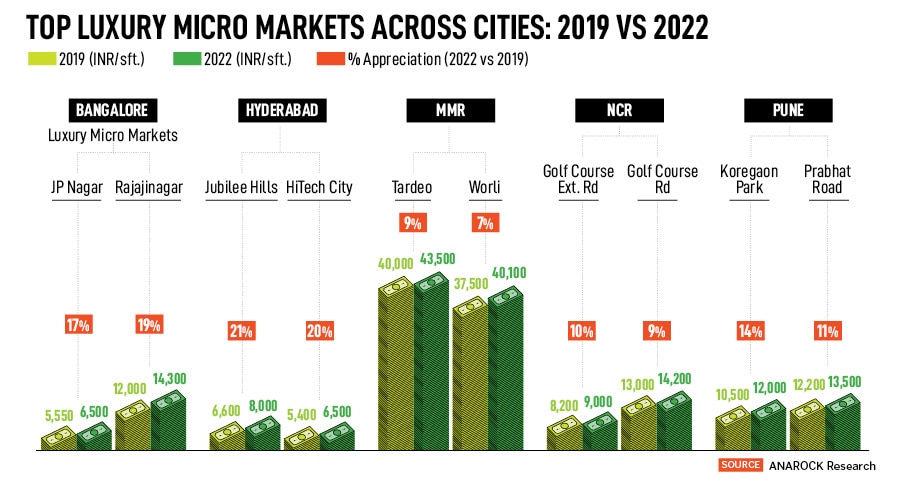

Out of the total 3.65 lakh units sold across the top seven cities in 2022, about 18 percent (approximately 65,680 units) were in the luxury category, reveals research conducted by real estate consultancy firm Anarock Group. Contrastingly, of the total 2.61 lakh units sold in 2019, just seven percent (approximately 17,740 units) were in the luxury category.

“After a stupendous performance in 2022, the bull run in luxury sales continued in Q1 2023 as well despite property price rise,” says Anuj Puri, chairman, Anarock Group. “And most recently, out of the total 1.14 lakh units sold across top seven cities in Q1 2023, at least 25 percent were in the high-ticket segment priced Rs1.5 crore.”

Puri adds that the demand for luxury real estate is expected to persist, “with over 60 percent of ultra-high-net-worth individuals (UHNIs) and HNIs surveyed intending to purchase a property”.

The government’s announcement in the Union Budget to cap capital gains at Rs10 crore, which came into effect from the current financial year in April, could be another reason for high sales in this segment. “To save tax on capital gains, the HNIs across top cities rushed in to close luxury housing deals before the financial year ended in March,” says Puri, who is still waiting to see if this will have a major impact on this segment.

Regardless, Amit Goyal, CEO, India Sotheby's International Realty believes the post-pandemic revival in luxury home sales could last for a few more years if India continues to have economic growth of about 6.5-7 percent as forecast by the Reserve Bank of India (RBI).

Generally, Lodha's average unit costs of luxury range from Rs35 crore at Lodha Ciel to Rs125 crore at Lodha Malabar Image: Courtesy Lodha

Generally, Lodha's average unit costs of luxury range from Rs35 crore at Lodha Ciel to Rs125 crore at Lodha Malabar Image: Courtesy Lodha

“According to our survey, 34 percent of HNIs and UHNIs have indeed bought luxury real estate between April 2021 and December 2022,” says Goyal. “As many as 61 percent of the respondents said they were looking to buy right-priced real estate in 2023 -24. For the India Sotheby's Luxury Outlook Report 2023, they reached out to their one lakh-plus clients. About 500 UHNIs and HNIs participated in the survey and shared their feedback.

Deal sizes in the luxury real estate segment depend on the square footage of the home and the number of bedrooms.

“Generally, our average unit costs of luxury ranges from Rs35 crore at Lodha Ciel to Rs 125 crore at Lodha Malabar," says Prashant Bindal, chief sales officer, Lodha, Mumbai. "So, an average deal value may vary from Rs35 crore to Rs350 crore depending on the number of units purchased."

While S Raheja Realty’s typical deal size is generally between Rs7-8 crore, India Sotheby's International Realty has found the price range of Rs4-10 crore has attracted the highest interest among home buyers for their property investments.

“Also, as many as 33 percent of HNIs and UHNIs are willing to spend more than Rs10 crore to acquire the ideal luxury property,” reveals Goyal. According to Business Standard, high-net-worth individuals (HNIs) are investors who own liquid assets valued between Rs5 lakh and Rs5 crore, while ultra-high-net-worth individuals (UHNWIs) are investors who own more than Rs25 crore in liquid assets.

While it is an exciting time to be in this space, there are some things to be aware of before you make that bid.

Also read: Swanky homes, pools, gourmet meals: Co-living goes luxe and stylish New Light by S Raheja. Today's luxury property buyers are looking at larger-than-life living experiences and multi-functional spaces in addition to luxury amenities and exclusivity. Image Courtesy: S Raheja

New Light by S Raheja. Today's luxury property buyers are looking at larger-than-life living experiences and multi-functional spaces in addition to luxury amenities and exclusivity. Image Courtesy: S Raheja

Assess your Portfolio

About three-fourths of the respondents of the Luxury Outlook Survey 2023 by India Sotheby’s International Realty say they consider real estate as an important hedge against inflation and believe it will do well in the current financial year.

The HNIs and UHNIs are starting to see residential real estate as a favourable avenue for end-use and investment purposes.

“The key attribute that appears in our research on wealthy clients was the hedge against inflation that this asset class provides,” says Rathi. “This is an asset which is able to pass through all the price rises, which are happening in the economy over a long term period.”

UHNIs and HNIs, who own multiple properties and are looking to acquire new property should take stock of their existing portfolio.

“We strongly believe that HNIs and UHNIs with multiple properties should assess their real estate portfolio to eliminate underperforming properties and invest in better quality real estate in prime locations with high potential for capital appreciation and rental income,” says Goyal. “Such a strategic approach will result in significant benefits for them.”

New Catchword: Long-term

Puri urges potential buyers to be aware that real estate investment no longer works on the whims and fancies of speculators. The days of reaping fast and massive profits from real estate have given way to more realistic expectations on the returns on investment—ranging between 8-10 percent.

“The new catchword for investment horizons is ‘long-term’, as in 5-10 years, for decent returns to accrue from a residential property investment in India,” says Puri.

Rising Inflationary Trends

Now may be the best time to purchase homes, believes Puri, due to the current rising inflation trends of raw materials, like steel, cement, and labour costs.

“Developers are compelled to further increase property prices,” he says. This ultimately has pushed developers to pass on the extra costs to the homebuyers. Hence, now is the best time to buy.

(Left) Isprava's Estate De Frangipani in Goa features a blend of Indo-Portuguese design and colonial British design with world-travelled art and decor collectables. Isprava's Gleneagle in Coonoor is a reflection of luxury property buyers seeking to integrate local elements and global inspirations into their bespoke living spaces. Image: Courtesy Isprava Group

(Left) Isprava's Estate De Frangipani in Goa features a blend of Indo-Portuguese design and colonial British design with world-travelled art and decor collectables. Isprava's Gleneagle in Coonoor is a reflection of luxury property buyers seeking to integrate local elements and global inspirations into their bespoke living spaces. Image: Courtesy Isprava Group

Appeal of bespoke second homes

Many with the financial wherewithal, Puri says, have their eye on a second home as a home away from home.

Isprava Group, which focuses on non-urban luxury real estate, has seen its home values multiply manifold in the last three years largely because of the appeal of the homestay model.

“A homeowner can leverage to ensure their asset provides not only great capital appreciation but also consistent rental yields,” says Dhimaan Shah, founder and group COO, Isprava Group. “This trend is particularly true in Goa and Alibaug, where the return on investment in luxury real estate is remarkably high, whether through property appreciation or regular rental income.”

The company has sold 350 homes worth more than $300 million spread across Goa, Alibaug, the Nilgiris, and Kasauli. Isprava properties typically start from Rs7 crore and go up to Rs45 crore, depending on location, size, and amenities.

Area Watch

It's all about the location when it comes to real estate, particularly where there is strong economic momentum.

India Sotheby’s International Realty’s survey reveals Delhi-NCR, Mumbai, Goa and Bengaluru remain the top four locations for respondents to buy real estate.

“The most significant factors that impact property prices are the property's location, the surrounding neighbourhood, available amenities, connectivity to the city centre, and accessibility to business hubs,” says Goyal.

Meanwhile, Hyderabad and Pune are likely to see consistent growth in the luxury segment in the next few years.

“These destinations will continue to see growth driven by the IT/ITeS sectors,” says Puri. “Here, the average residential prices range between Rs 4,800 per sq. ft. to Rs6,150 per sq. ft.”

Isprava has plans to expand in the core markets of Goa, Alibaug, Coonoor, and Kasauli. These unspoiled areas offer affluent buyers seclusion and privacy.

“In Goa, certain micro markets like Moira, Aldona, Nachinola, Reis Magos, Siolim, and Mandrem are experiencing rapid growth,” says Shah. “Another hypermarket is Alibaug, which is quickly becoming the most sought-after location for the affluent set [of people from] Mumbai, as well as NRIs.”

Uber-luxury developer Viceroy Properties' flagship project Viceroy Savana in Kandivali East sold out in under 24 months while commanding a significant price premium in Kandivali, Mumbai Image: Courtesy Viceroy Properties

Uber-luxury developer Viceroy Properties' flagship project Viceroy Savana in Kandivali East sold out in under 24 months while commanding a significant price premium in Kandivali, Mumbai Image: Courtesy Viceroy Properties

Mumbai: Crème de la Crème

The City of Dreams is a major market and is expected to see an above-average increase in property prices in the luxury home segment.

Globally, Mumbai's prime property market has witnessed a price appreciation of 6.4 percent, moving it up to the 37th position on the Prime International Residential Index (PIRI) 100 in 2022 as opposed to 92nd in 2021, according to Knight Frank’s The Wealth Report 2023. Knight Frank also reports Mumbai is expected to witness an appreciation of three per cent in 2023.

“What we see is this market in 2023 will have increasing headwinds in terms of increasing interest rates and some amount of business or economic uncertainty that is coming in which will kind have a cautious optimistic stand by most stakeholders including consumers,” says Rathi.

The consumer will look for value maximisation opportunities. “All these buoyant market ensures that new projects will come in with the higher amount of features and amenities associated with its pricing,” says Rathi.

For Bindal of Lodha Mumbai, this city has become one of the country’s most important real estate markets, with high demand for premium properties in prime locations.

“We recently had three deals, each worth more than Rs350 crore, at Lodha Malabar,” he says.

Uber-luxury developer Viceroy Properties has experienced exceptional demand and sales momentum for its flagship project, Viceroy Savana (263 flats, offering 2 BHK and 3 BHK apartments ranging from 750 sq. ft. to 1200 sq. ft. carpet area), situated in Kandivali East.

The project sold out in under 24 months while commanding a significant price premium in Kandivali. “Since its launch in December 2019, the project has generated sales exceeding approximately Rs850 crore and a total of approximately 325,000 sq. ft. in carpet area sold thus far,” reveals Cyrus Mody, managing partner, Viceroy Properties.

Recently, construction began on the developer’s second project, Viceroy Privé, a stand-alone signature residential tower in Thakur Village, Kandivali East, designed for 61 bespoke 4 BHK apartments and 5 BHK duplexes—approximately 1.48 lacs sq. ft. carpet area for sale—in the most sought-after location in the western suburbs of Mumbai. “With an estimated sales value of approximately Rs400 to Rs450 crore, the 4 BHK and 5 BHK residences range from 2300-3200 sq. ft and priced Rs8 crore onwards,” says Mody, adding that more than 53 percent of the inventory was already sold in the first week of launch.

Also read: Realty Bites: Homebuyers pay a heavy price for incomplete houses

Reimagining Spaces

The pandemic greatly affected our view of all aspects of our lives, including how we view space. While exclusivity, high-quality amenities, swimming pools, gyms, spas, and concierge services in high-end locations are part of the expectations that come with high-priced properties, buyers these days are looking for larger-than-life living experiences and multi-functional spaces.

And developers are taking note by reimagining the overall design to incorporate outdoor spaces in residential plans making living spaces more functional and comfortable.

“They are luxury properties tailor-made for comfort, safety and security, featuring world-class amenities and spacious living spaces surrounded by greenery,” says Ram Raheja, managing director, S Raheja Realty, whose upcoming projects are in Mumbai’s Bandra West, Santacruz West and JVPD areas. “Their modern features include flexible planning, rooftop zen gardens with brunch pools, fully-equipped gymnasiums, valet parking services, automated car parking towers, tall ceilings and many others.”

Well-travelled luxury property buyers in India are also seeking to integrate local elements and global inspirations into their bespoke living spaces. “For instance, one of our clients in Goa asked us to design their home with an exquisite blend of Indo-Portuguese design, French-Chateau architecture, and African tribal-inspired accessories, set against a nuanced pastel colour palette,” says Shah. “Similarly, one of our homes in Coonoor has been structured around a Colonial British design, complemented by carefully curated world-travelled art and decor collectables, evoking a sense of history and nostalgia that is truly exceptional.”

What about the Environment?

In the Luxury Outlook Survey 2023 conducted by India Sotheby's International Realty (ISIR), 11 percent of respondents cited sustainable features such as renewable energy, water recycling, and waste management as crucial factors driving their property purchase decisions.

“This marks a significant increase from the five percent figure recorded in the previous year's luxury residential survey by India SIR,” says Goyal.

Developers are also integrating natural elements into building environments to enhance occupants' connection with nature.

Also read: Luxe, Add To Cart, Buy—Would You Spend Rs1 Crore On Furniture Online?

Also read: Luxe, Add To Cart, Buy—Would You Spend Rs1 Crore On Furniture Online?

Lodha has implemented several initiatives to reduce the carbon footprint of its projects by incorporating rainwater harvesting, water conservation systems, and using renewable energy sources such as solar power.

“The use of high-performance glass for windows helps reduce energy consumption by lowering heat during summer months while maintaining warmer internal temperatures in winter,” Modi.

Natural materials are sustainable choices that offer aesthetic value by adding warmth and sophistication to luxurious interiors.

“There is also a growing preference for natural materials such as wood, stone, and marble, which are believed as more environmentally friendly and sustainable,” Bindal.

Points to Remember

Home buyers should have a clear idea of what they are looking for and establish a list of properties. Investors should also consider what type of property will remain in demand in the future and is likely to provide a better return.

Understand the differences between an in-construction property and ready-to-move-in property.

“When it comes to luxury homes, the neighbourhood plays a huge part in the experience, so understand the neighbourhood first,” explains Raheja. “Then there are investment, financing and taxation related nitty gritty regarding which they need to stay updated.”

If you find the right property, Goyal says, don't delay making an offer "in the current market where inventory is declining, and options are limited."