New ASCI guidelines for crypto, NFTs: What does it mean for investors, advertisers?

Crypto exchanges, while largely welcoming of the new guidelines, stress on regulators and other stakeholders understanding the nuances of the virtual digital assets space

Finfluencers like Neha Nagar insist on the ‘do your own research’ approach, the ASCI guidelines will further encourage investors to research and understand the risks associated with the crypto and NFT market

Finfluencers like Neha Nagar insist on the ‘do your own research’ approach, the ASCI guidelines will further encourage investors to research and understand the risks associated with the crypto and NFT market

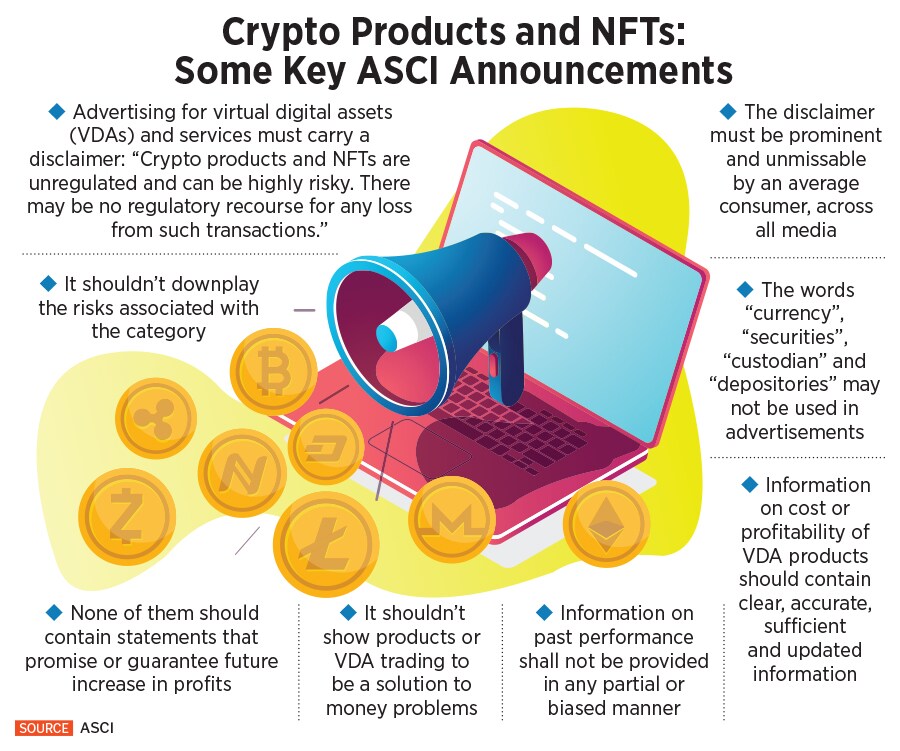

On February 23, the Advertising Standards Council of India (ASCI) announced a set of guidelines for advertising and promotion of virtual digital assets (VDA) and services. So far, a lot of these advertisements do not adequately disclose the risks associated with such products. These guidelines, according to ASCI, are to safeguard consumer interest, and to ensure that ads do not mislead or exploit consumers’ lack of expertise on these products.

“We studied the nature of ads the industry was putting out and the potential for consumers to be misled by certain kinds of claims and promises. In addition, we did extensive discussions with different stakeholder groups and experts, as well as looked at global guidelines,” says Manisha Kapoor, secretary-general, ASCI.

These guidelines will be applicable to all advertisements released or published on or after April 1. Be it a print, video, audio or social media, all advertising for VDA products and services should include a disclaimer: ‘Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.’ This disclaimer is expected to be both unmissable and prominent.

“Unfortunately, several platforms in India have positioned it [VDAs] as a speculative investment instrument, and directly or indirectly pushed the public opinion that you can get 10x, 100x and 1000x returns by investing in this,” says Praphul Chandra, founder and chief scientist, KoineArt ngageN.

Financial influencer [or finfluencer], Neha Nagar’s audience includes a majority of teenagers who are very interested in cryptocurrency, and invest their pocket money there. She says, “They [teenagers] tend to trust some influencers very easily as they want to get rich quick. Therefore, they invest in the tokens suggested by their so-called ‘gurus’ without doing their own research.”

But do these guidelines restrict creative freedom? He feels not. “Sure, 20 percent of the space for any medium might get occupied by these declarations, but the rest is out there to use. The category can still stay creative.” This has been the case for several other regulated products such as mutual funds, insurance and other financial products and services, which come with disclaimers.

But do these guidelines restrict creative freedom? He feels not. “Sure, 20 percent of the space for any medium might get occupied by these declarations, but the rest is out there to use. The category can still stay creative.” This has been the case for several other regulated products such as mutual funds, insurance and other financial products and services, which come with disclaimers.