New mutual funds are hungry for a slice of the pie

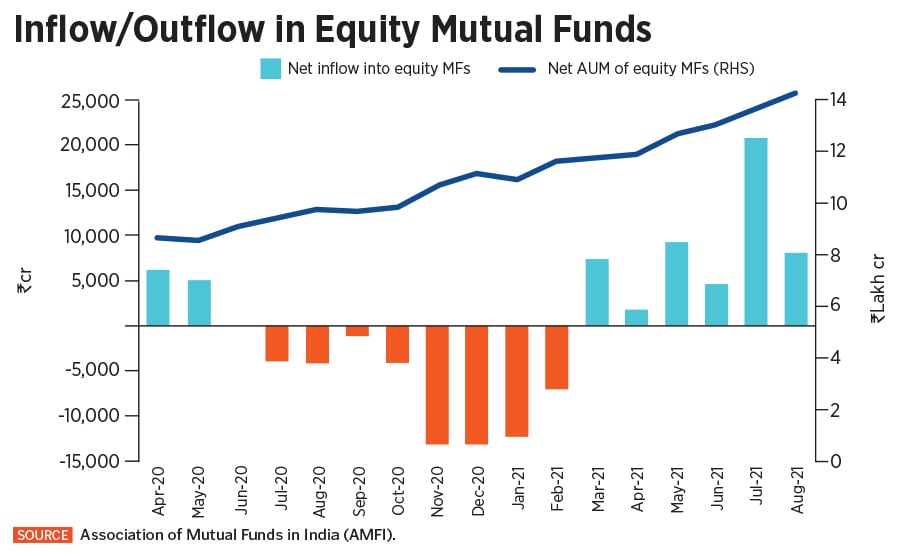

A new breed of mutual fund houses, from fintech firms to discount brokers, is rushing to get a foothold into the expanding mutual fund industry. But will investors show the maturity to stay invested, amid stretched valuations and uncertain near-term returns?

At least seven to eight companies have lined up plans to launch mutual fund schemes soon

At least seven to eight companies have lined up plans to launch mutual fund schemes soon

India’s newest set of mutual fund investors will look back at the current phase—with stock market indices at record highs, valuations stretched and investing with a new set of technology focussed mutual funds—as both challenging and a test of sorts. They will choose to invest with financial services players who have almost no track record in mutual fund investing, at a time when future returns will always be challenging.

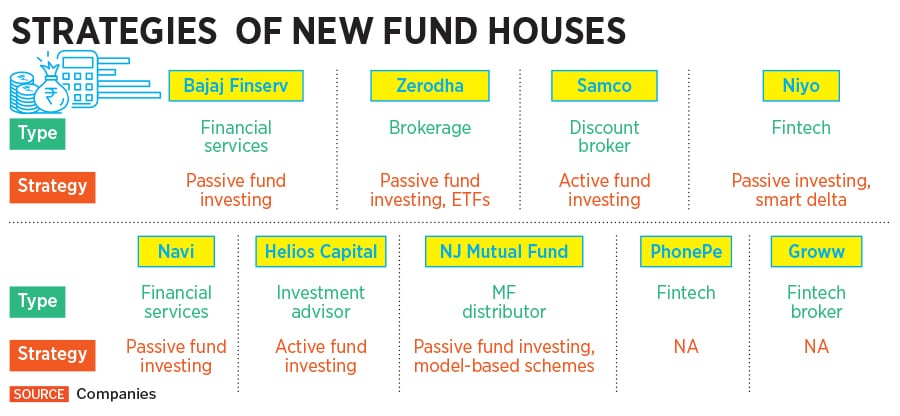

At least 7-8 companies have lined up plans to launch mutual fund schemes soon, in a market already crowded by nearly 1,500 schemes across debt, equity, hybrid, ETFs and ELSS segments from 45 asset management firms.

Zerodha, Navi Technologies, Samco and Bajaj Finserv are planning to launch their own schemes in coming months. NJ Mutual Fund comes from India’s largest mutual fund distributor NJ India Invest and has announced the launch of a balanced advantage fund for October. Fintech firms Niyo, Groww and PhonePe have all firmed up plans to apply for a mutual fund licence with the Securities and Exchange Board of India (SEBI) by the year end.

The entry of new mutual funds has been welcomed. “It will not only bring in more choice for investors, but will also bring costs down. India is not a saturated market at all, so the entry of more players can expand the market, even for existing players,” says Kaustubh Belapurkar, director-manager research at Morningstar India.