Packing a bunch: 10club, and its '1 to 10' game

Bhavna Suresh and her 10club gang is playing a differentiated ecommerce roll-up game, which is not tied to recurring fund raise and the valuation flywheel. Can the 'lean and mean' strategy pay off?

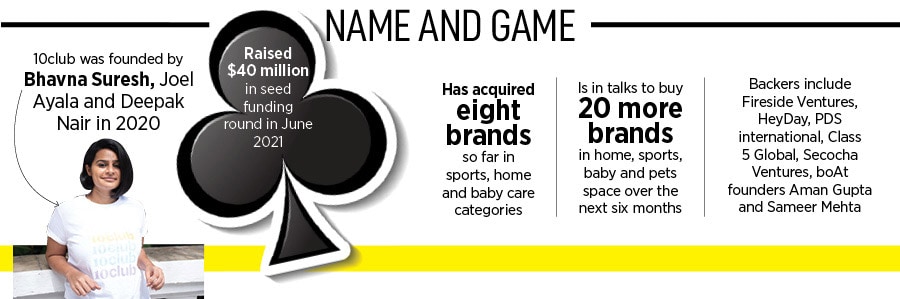

Bhavna Suresh, cofounder and CEO of 10club

If you are in the business of acquisitions—which all ecommerce roll-up players inherently are—then these are the two golden rules that you must never forget. First, always mind, and master, your own business. Second, know the flip side of funding, acquisitions and valuations. Bhavna Suresh, who is into her third stint as an entrepreneur, knows both by heart. The thing with valuation, reckons the co-founder of 10club, is that the minute you get it very quickly, you have to start burning money to keep up with the growth. “This makes the business model a little tricky,” she maintains.

Started by Bhavna, Joel Ayala and Deepak Nair in October 2020, 10club is an ecommerce roll-up startup that raised a hefty $40 million in seed round last June. Though it turned out to be India’s largest seed round, the funding dwarfed in comparison to what its rivals notched up. Take, for instance, Mensa Brands. Started last May, the Thrasio-style startup raised $135 million in November and raced into the $1-billion club in just six months, making it the fastest unicorn of India.