RBI: Will keep Arjuna's eye on inflation

The battle against inflation is not over, says the RBI governor, indicating the rate hike cycle has not peaked yet. But economists are hopeful of some respite after a likely 25 bps rate hike in February

RBI governor, Shaktikanta Das

Image: Punit Paranjpe / AFP

RBI governor, Shaktikanta Das

Image: Punit Paranjpe / AFP

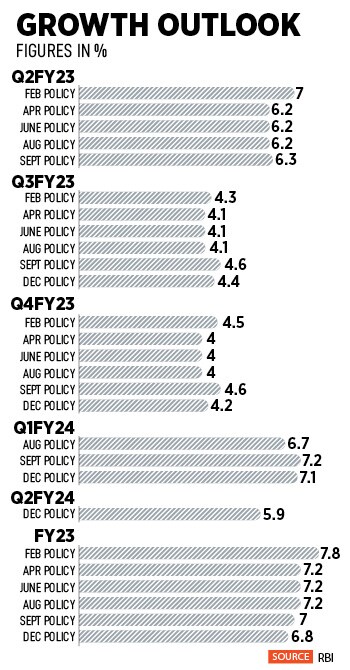

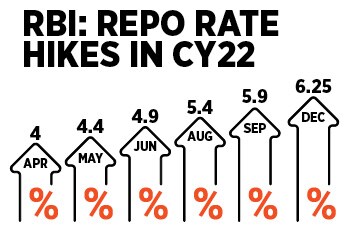

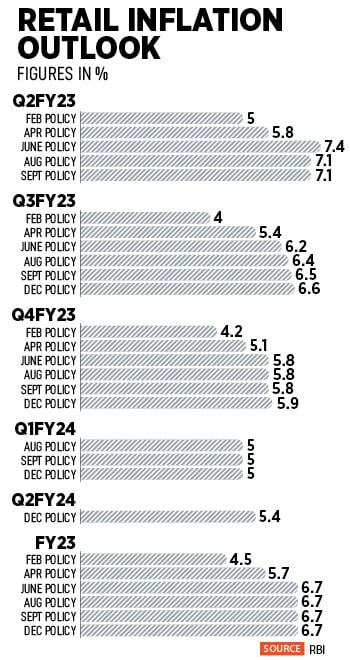

In its December meet, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) raised the benchmark rate by 35 basis points to 6.25 percent while retaining its stance of “withdrawal of accommodation”. It cut its growth outlook to 6.8 percent from 7 percent previously and held its inflation estimate of 6.7 percent for the current fiscal year (see table). Interestingly, on Tuesday, the World Bank increased its FY23 GDP forecast for India to 6.9 percent from 6.5 percent in October.

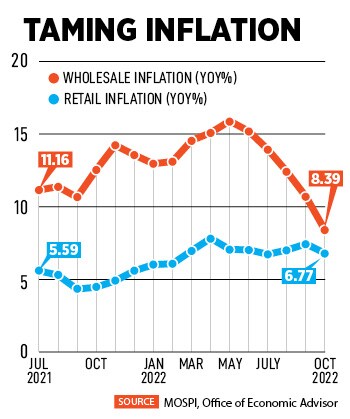

“What do these growth and inflation scenarios convey? GDP growth in India remains resilient and inflation is expected to be moderate, but the battle against inflation is not over. Pressure points from high and sticky core inflation and exposure of food inflation to international factors and weather-related events do remain,” explained Shaktikanta Das, governor of RBI.

Das cautioned that the global economy is still marred by profound shocks and unprecedented uncertainty, but reassured that India’s financial system remains robust and stable, calling it a bright spot in an otherwise gloomy world. “Banks and corporates are healthier than before the crisis,” he added.

As for future guidance on rate hikes, the central bank remained elusive, asserting that it would be nimble in its policy actions and act in the best interest of the economy and the aspect of growth will “obviously” be considered as it monitors inflation dynamics. “The course of our future policy will duly consider new data releases and the evolving outlook of the economy as well as the effect of our past actions,” Das said.

As for future guidance on rate hikes, the central bank remained elusive, asserting that it would be nimble in its policy actions and act in the best interest of the economy and the aspect of growth will “obviously” be considered as it monitors inflation dynamics. “The course of our future policy will duly consider new data releases and the evolving outlook of the economy as well as the effect of our past actions,” Das said.

A year ago, Das had asserted the RBI would do whatever it takes to support durable recovery. “Overarching priority at this juncture [is] to broaden the growth impulses,” Das had said in the last credit policy meeting of 2021.

A year ago, Das had asserted the RBI would do whatever it takes to support durable recovery. “Overarching priority at this juncture [is] to broaden the growth impulses,” Das had said in the last credit policy meeting of 2021. After the US Federal Reserve’s move to hike benchmark rates to arrest 40-year high inflation levels, Das, after months of muted policy response, cracked the whip on rising prices in an off-cycle emergency MPC meeting in May. Until then, ironically, interest rates stood at a historic low of 4 percent, inflation hovered around 7 percent, but growth was stunted with feeble signs of recovery.

After the US Federal Reserve’s move to hike benchmark rates to arrest 40-year high inflation levels, Das, after months of muted policy response, cracked the whip on rising prices in an off-cycle emergency MPC meeting in May. Until then, ironically, interest rates stood at a historic low of 4 percent, inflation hovered around 7 percent, but growth was stunted with feeble signs of recovery. Nomura says India’s growth rate cycle has peaked and a broad-based slowdown is underway. “While lower inflation should help support private consumption in coming months, the lagged effects of tighter financial conditions and weak global demand will weigh on both investment and exports, while the post pandemic catch-up in services is largely complete. We expect GDP growth to slow from 6.8 percent year-on-year in 2022 to a below-consensus 4.7 percent in 2023,” its economists say.

Nomura says India’s growth rate cycle has peaked and a broad-based slowdown is underway. “While lower inflation should help support private consumption in coming months, the lagged effects of tighter financial conditions and weak global demand will weigh on both investment and exports, while the post pandemic catch-up in services is largely complete. We expect GDP growth to slow from 6.8 percent year-on-year in 2022 to a below-consensus 4.7 percent in 2023,” its economists say.