Solid, liquid and Inox: Firing on all cylinders

Inox's mega-merger with PVR in 2022, Inox India's blockbuster listing in 2023, and a dashing report card of the listed entity in FY24... Siddharth Jain has hit a purple patch in his entrepreneurial journey which started in 2001. The dream run, though, masks years of pain and loss that the third-generation founder endured

Siddharth Jain, Promoter, INOX Group

Image: Swapnil Sakhare For Forbes India

Siddharth Jain, Promoter, INOX Group

Image: Swapnil Sakhare For Forbes India

Mumbai, 2024. “It's not that I bought a stock, I sold it, and I made a loss,” stresses Siddharth Jain. “It was not a normal loss,” he underlines, explaining the magnitude of the suffering that he endured for five years. “I just kept trying to fix, fix, fix, and then one fine day, I realised that it just can’t be fixed,” rues the third-generation founder, who goes down memory lane to revisit the first big low moment in his entrepreneurial journey. “It was five years of torture… yeah, it was indeed torture,” reiterates the mechanical engineer, who joined the family business of industrial gases, cryogenic engineering and entertainment in 2001. A few years later, he went on to study MBA from INSEAD in France, and then returned to India in 2006.

Three years later, in 2009, Jain was taking the boldest step of his life. “We must expand and take the brand global,” he told his father Pavan Jain, who gave ample freedom to the young management grad to paint his dream on a wide canvas. “My father and family encouraged me to expand our geographical footprint,” says Jain. It was a gutsy move by Inox Group which didn’t have any operations outside India till 2008.

Twelve months later, Inox India, the biggest maker of cryogenic storage and transportation equipment in the country, was all set to buy an asset in the US. “To go outside India and buy an operational plant in the US was a real bold move,” reckons Jain, who was forewarned by a battery of experts, naysayers, and industry observers about the potential acquisition. “Nine out of 10 foreign acquisitions fail,” they cautioned.

Jain, though, was fearless. And he had his reasons. First, he studied in America. He completed his mechanical engineering from the University of Michigan and worked in the US for two years. “So, I'd spent six years in the US. I knew the country,” he reckons. Second, Jain finished his MBA from INSEAD. “I got tremendous international exposure,” he says. When you deep dive into the case studies of dozens of successful and not-so-successful companies during your MBA days, he points out, they teach you one simple thing: You get to know the problems that they've had, and you know what to do and what not to do when you are running your venture. “I had no fear,” says Jain.

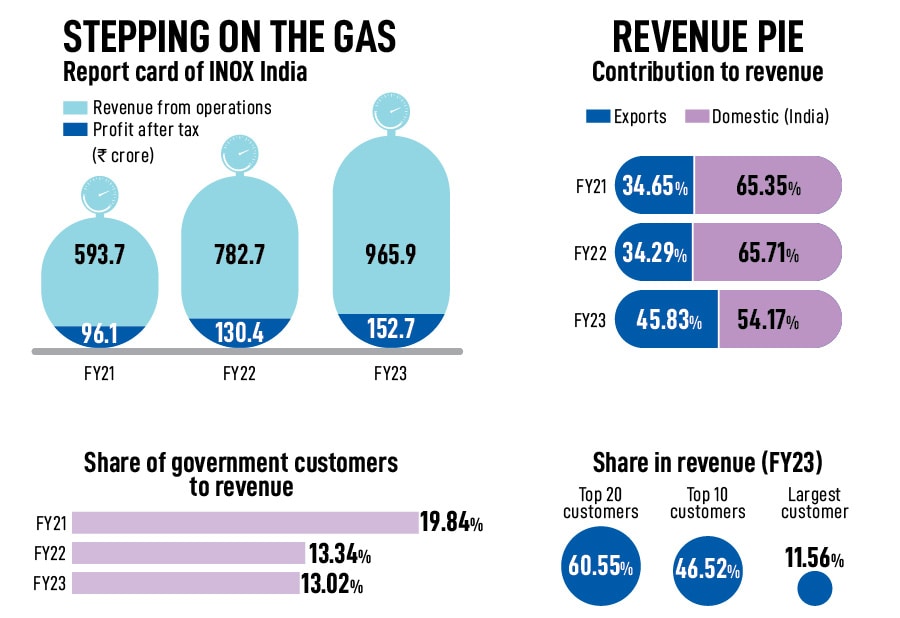

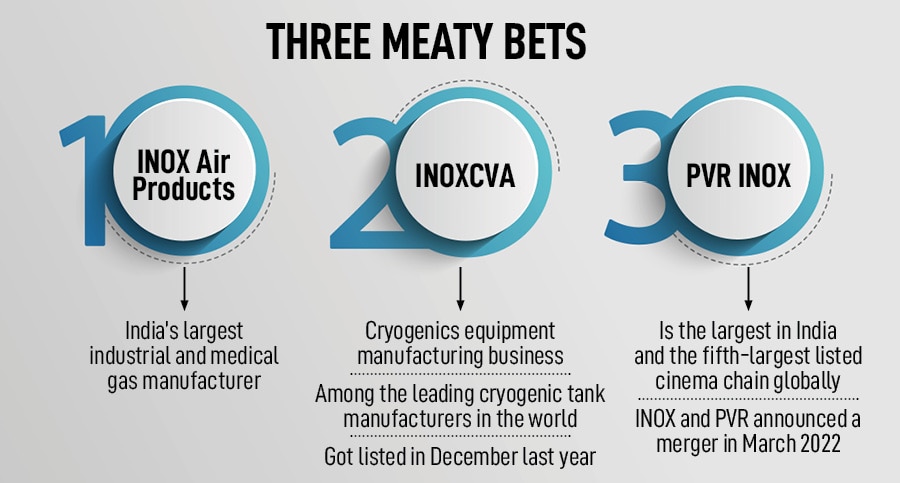

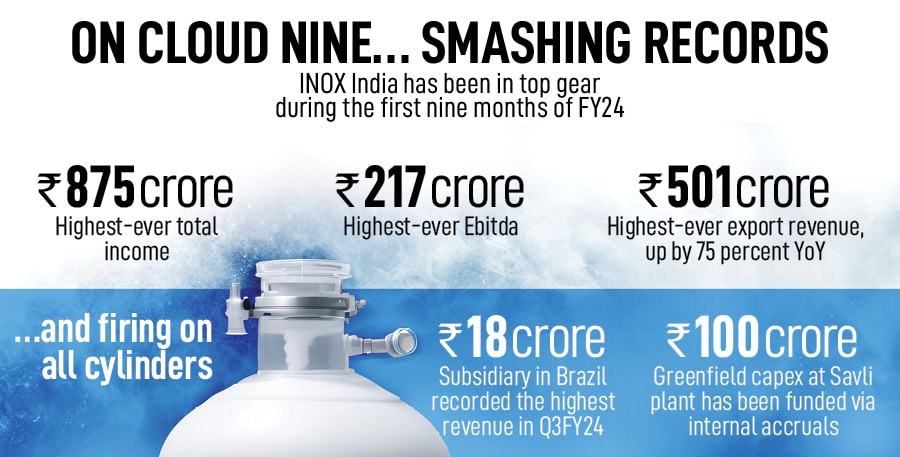

Fast forward to February 2024. Jain is in the midst of a dream run. Inox India had a blockbuster listing towards the fag end of the last year and has continued with its impressive performance by notching record numbers in the first nine months of this fiscal (see box). Inox Air Products has maintained its leading position as the biggest industrial and medical gas manufacturer in India. On the cinema front, Inox and PVR merged operations, and the combined entity is now the biggest in India and the fifth-largest listed cinema chain globally.

Fast forward to February 2024. Jain is in the midst of a dream run. Inox India had a blockbuster listing towards the fag end of the last year and has continued with its impressive performance by notching record numbers in the first nine months of this fiscal (see box). Inox Air Products has maintained its leading position as the biggest industrial and medical gas manufacturer in India. On the cinema front, Inox and PVR merged operations, and the combined entity is now the biggest in India and the fifth-largest listed cinema chain globally.