Tech & small towns: StanChart's India game plan?

Unlike rival Citibank, Standard Chartered Bank has the option to explore retail banking more aggressively. Backed by a digital thrust, CEO Zarin Daruwala has more opportunities than challenges ahead of her

Image: Debajyoti Chakraborty/NurPhoto via Getty Images

Image: Debajyoti Chakraborty/NurPhoto via Getty Images

When Citibank announced, on April 15, the shuttering of its consumer banking business across several countries, including India and China, the glaring reality surfaced—once again—that the preferences which foreign banks once enjoyed in India in the retail banking space have completely vanished.

Over the past two decades, the massive domination that Indian private banks such as HDFC Bank and ICICI Bank have come to command in retail, has led foreign banks to lose their premium position.

Citi’s exit has also meant that Standard Chartered Bank, which has 100 branches in 43 cities, and operating here since 1858, will need to start to dominate the consumer banking position once again. StanChart offers a mix of retail products, from personal and home loans to loans against securities and property and credit and debit card products to its Indian customers.

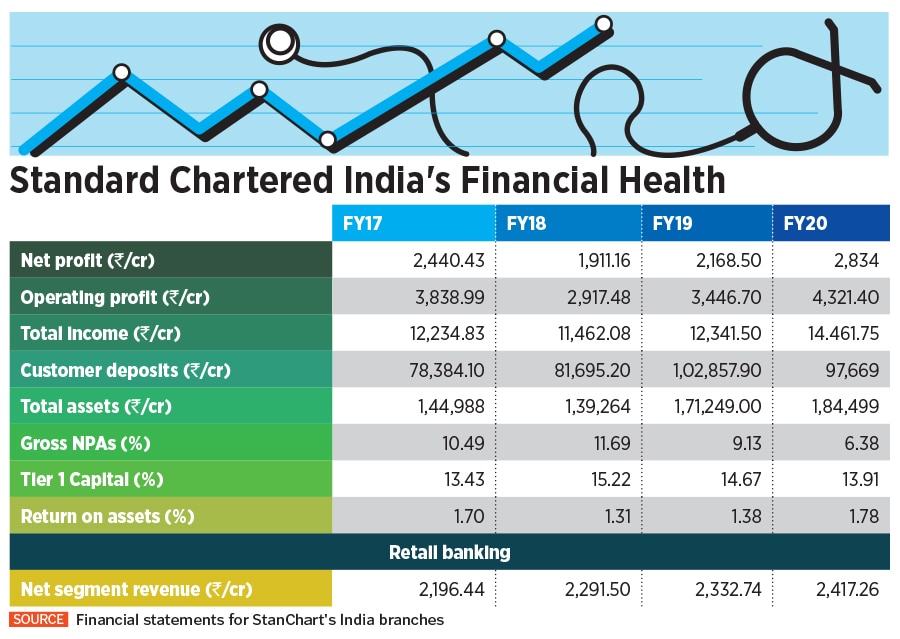

Standard Chartered Bank’s tryst with retail banking in India has been mixed in many ways. Over the past decade, its retail banking size as a percentage of the total business has ranged between 24 and 30 percent. In FY20, the Indian operation reported a net segment revenue of Rs 2,417.26 crore for retail banking and Rs 3,637.8 crore for wholesale, from the total of Rs 9,420.76 crore.

The bank’s focus on retail has always been steady and well measured, without getting too aggressive. It is something that rivals and bank insiders might want to say about the tenure of its chief executive Zarin Daruwala too.