The necessary 5G gamble for telcos

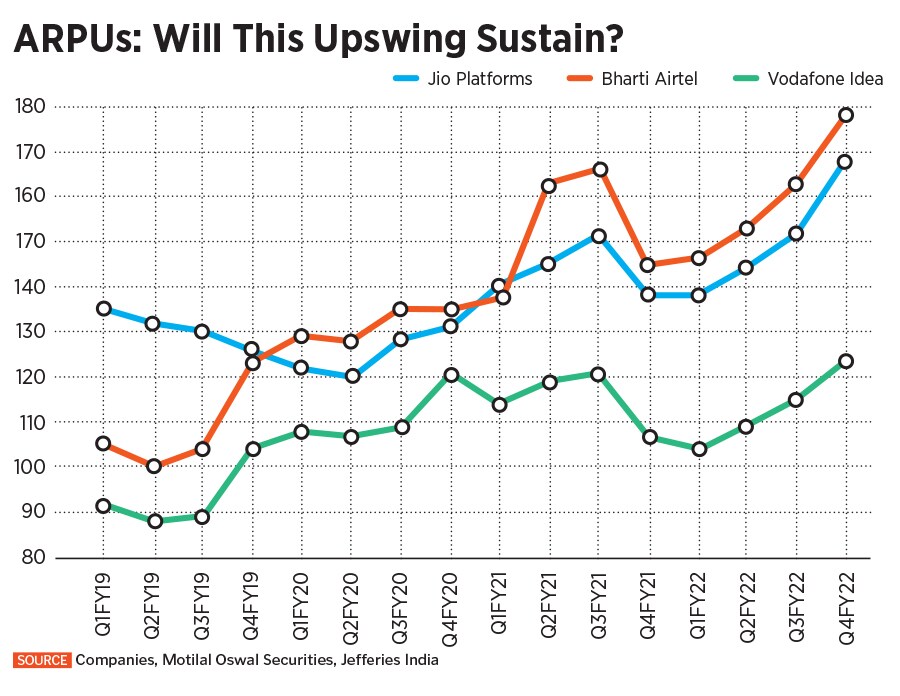

The entry of enterprises into the 5G technology ecosystem increases revenue uncertainties for telcos. The 5G rollout is imminent by 2022-end, but monetising this is going to be tough

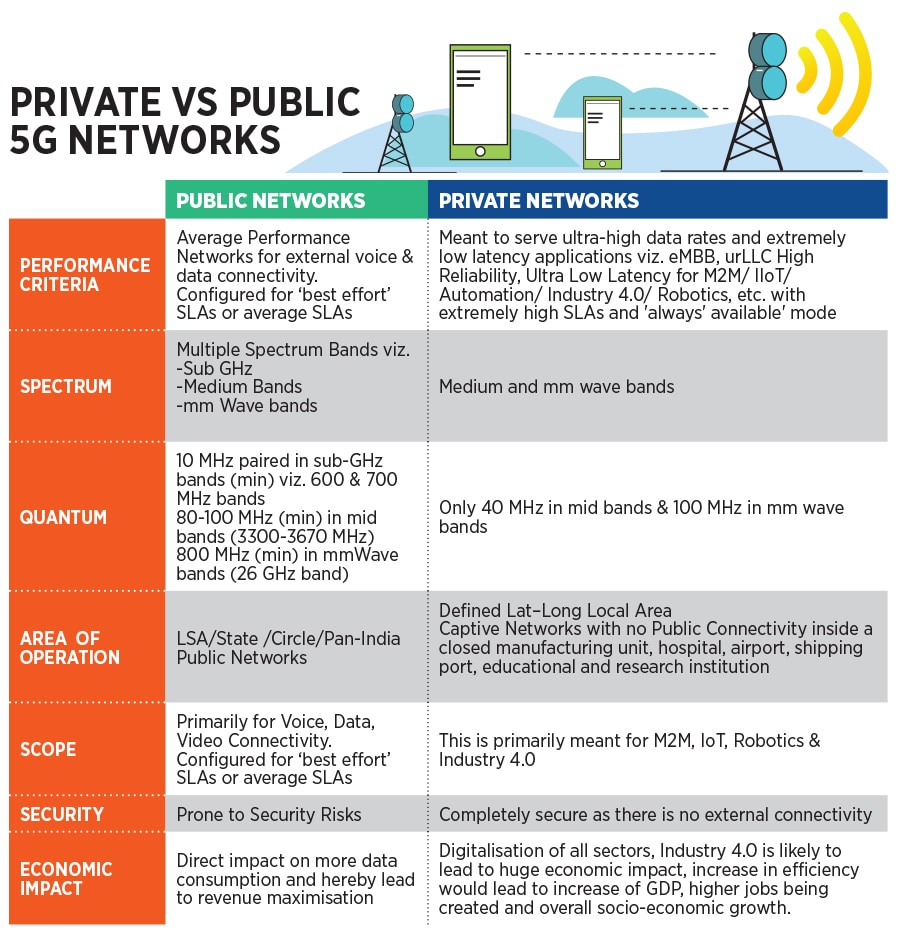

Private 5G networks are likely to be similar to the public 5G (which telecom companies will bid for), but is expected to be cheaper and connectivity will be limited to the space of the enterprise

Private 5G networks are likely to be similar to the public 5G (which telecom companies will bid for), but is expected to be cheaper and connectivity will be limited to the space of the enterprise

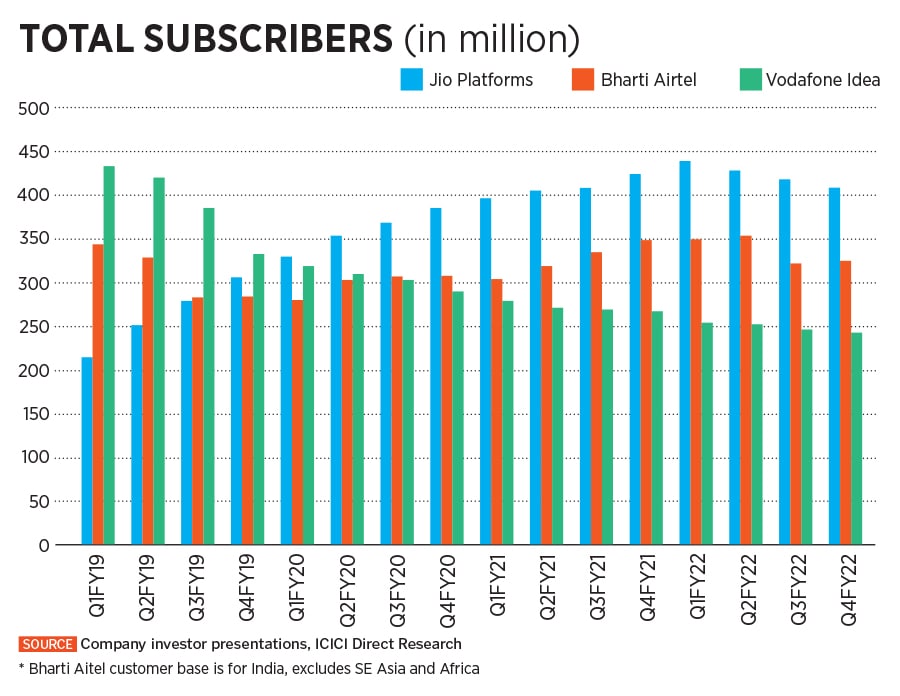

India’s telecom companies Reliance Jio, Bharti Airtel, Vodafone Idea and, to a limited extent, MTNL, had, for the past six-eight months, expressed their preparedness for the implementation of fifth generation (5G) telecom network and technology services by conducting regular trials across different parts of the country. The Department of Telecom (DoT) had allotted trial spectrum across three different bands in May last year to these companies for 5G trials in urban, semi-urban, and rural areas.

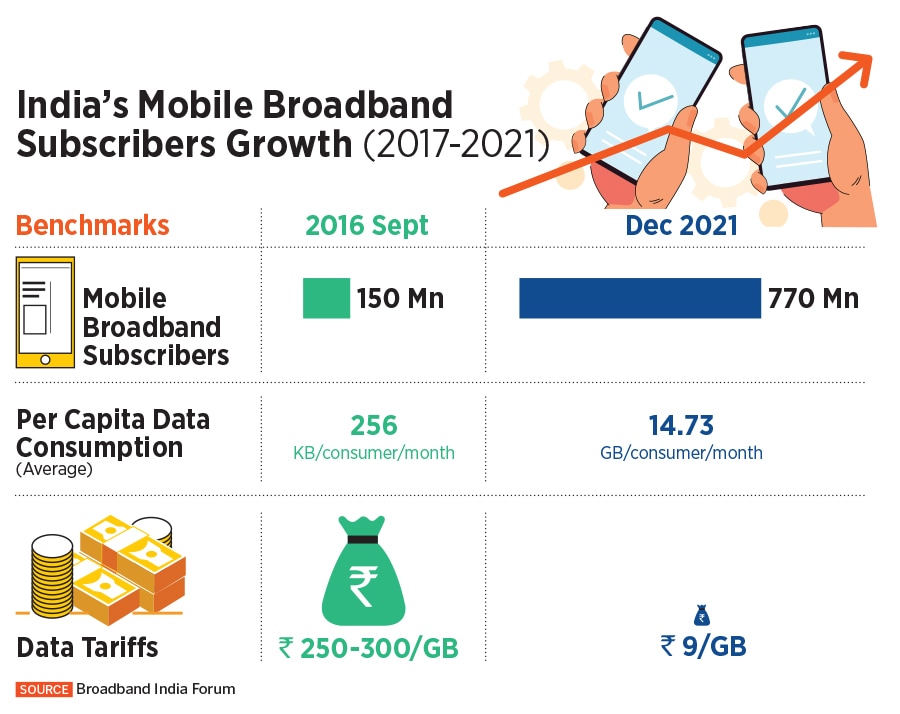

The buzz for the auctioning of spectrum by the regulator has grown louder and starting July 26, spectrum will now be offered to successful bidders. But this year will be like no other, marking a historic occasion in India’s digital transformation journey.

The radical change

For the first time ever, India will reserve part of its telecom spectrum for private 5G networks that can be run by various enterprises, including large technology giants such as Google, Tata Consultancy Services (TCS) or Infosys. Enterprises will also be allowed to lease spectrum from service providers to run a network.Private 5G networks are likely to be similar to the public 5G (which telecom companies will bid for), but is expected to be cheaper and connectivity will be limited to the space of the enterprise.

Depending on which industry you belong to, this decision has become divisive. The telecom companies are not going to be happy, and, obviously, the enterprises will be thrilled. It will be a transformation for enterprises from hospitals to ports, IT companies to engineering giants which need 5G capabilities to drive their application across factories or other service lines, as part of their digital transformation.