TVS, Bajaj, Hero are growing in the EV market. Can Ola keep its throne?

iQube is sprinting, Chetak is galloping and Vida is revving up. The OGs of the two-wheeler industry—TVS, Bajaj and Hero—have been growing in the electric vehicle

The big boys of petrol have shocked the EV world with their electrifying performance.

The big boys of petrol have shocked the EV world with their electrifying performance.

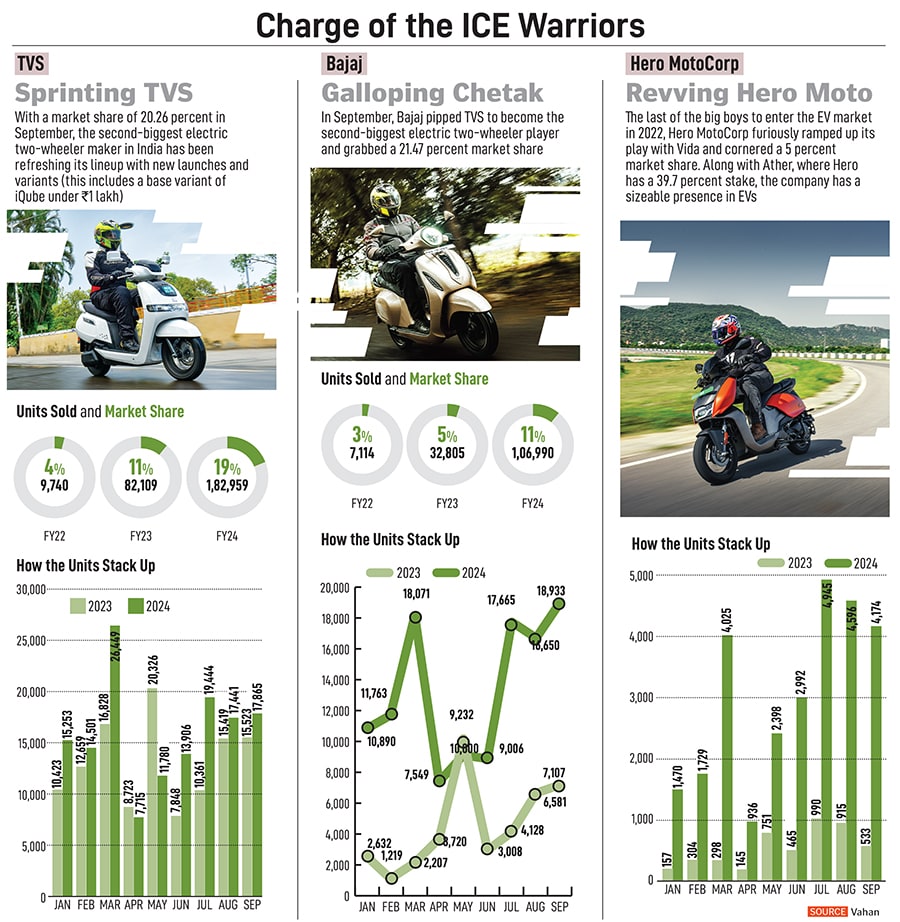

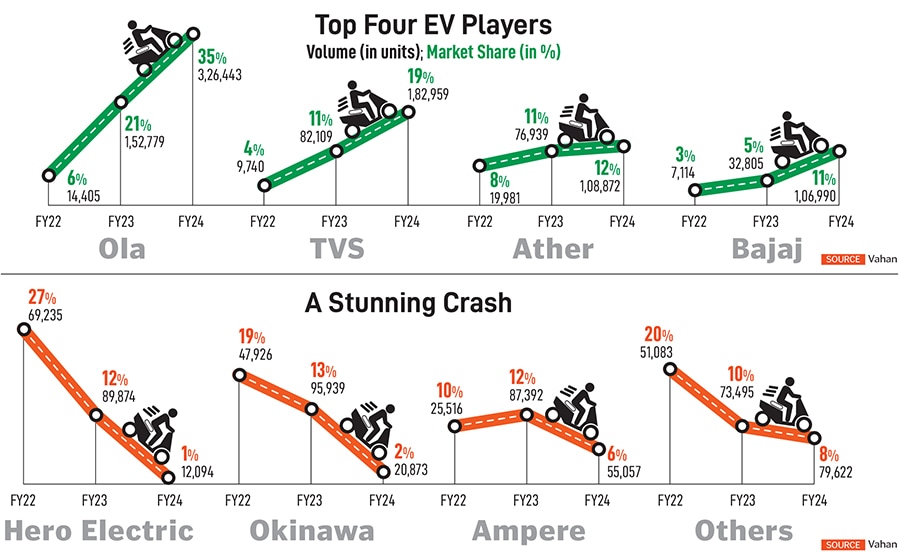

The leaders were sluggish in slipping out of the ICE (internal combustion engine) age. While Bajaj and TVS ambled into the EV (electric vehicles) party with Chetak and iQube, respectively, in January 2020, Hero—the biggest two-wheeler player in volumes—made a slow-motion entry with Vida in October 2022. EV, decried analysts and auto pundits, was not a game for heavyweights of the petrol two-wheeler industry. The incumbents—Hero Electric, Okinawa and Ampere—were well entrenched by FY21, and by FY22 they beefed up their presence by capturing close to 60 percent of market share.

The legacy players, in contrast, were stacked against formidable odds. Just two months after their rollout, Chetak and iQube reportedly clocked sales of 91 and 18 units, respectively, in March 2020. Twelve months later, the collective numbers stomped from two digits to three digits. Chetak remained stagnated at 90 and iQube inched to 355 units. In FY22, Bajaj had a 3 percent market share, TVS was a shade ahead with 4 percent, Ola Electric had cornered 6 percent, and Hero—which had been piggy-riding on Ather—was yet to launch its EV brand. In EVs, the three big boys—Hero, Bajaj and TVS—were pale shadows of their dominating might in petrol two-wheelers.

Fast forward to October 2024. The big boys of petrol have shocked the EV world with their electrifying performance. TVS has become the second-biggest EV two-wheeler player with iQube and has pocketed a 19 percent market share in FY24. In September, it increased its share to 20.26 percent. Bajaj has emerged as a No 4 brand with Chetak and has scooped 11 percent market share in FY24. In September, it pipped TVS to become the second-biggest EV maker and grabbed a 21.47 percent market share. Hero MotoCorp, which entered the EV market with Vida in late 2022, has raced to grab a 5 percent share in FY24. If one adds the market share of the third-biggest EV player, Ather, where Hero has a 39.7 percent stake, the combined clout of both players stands at 17 percent.

“They came, they saw, they kept quiet and then they captured,” reckons Amit Kaushik, managing director (India) at Urban Science International, a Detroit-based global consulting firm. The success of the legacy players, he says, can be attributed to a slew of factors. First, TVS, Bajaj and Hero have spent decades selling bikes and scooters. They understand the dynamics of the market, and decode the needs and aspirations of the buyers. “The EV upstarts and the first movers in the segment underestimated the resilience of the ICE players,” says Kaushik, adding that the legacy players were waiting for the right time to amplify their play.

The second big factor was the long-term play of the big boys. Over the last decade, the EV market has seen a significant froth in terms of a bunch of players who were importing EVs from China and selling in India. Most of them were price warriors who had turned EVs into a commodity game because of the low-entry barrier. “The casual approach led to an unprecedented casualty in terms of poor quality of the product,” says Kaushik. The absence of R&D and in-house development led to heavy dependence on imports, perpetrated a lack of differentiation with me-too offerings, and cooked a recipe for disaster.

(This story appears in the 01 November, 2024 issue of Forbes India. To visit our Archives, click here.)