Where is 10-minute grocery delivery headed?

After a frenzied 2021 for quick commerce startups, it might seem as though the bubble has popped with several companies shutting shop, sacking staff or being acquired. But some are still tackling the market which they believe is only set to grow

Zepto emerged as the poster boy of quick commerce, racing to a near-unicorn $900 million valuation in less than a year of founding in May 2022.

Zepto emerged as the poster boy of quick commerce, racing to a near-unicorn $900 million valuation in less than a year of founding in May 2022.

It might seem as though the quick commerce bubble has popped. JioMart Express, Reliance Jio’s 90-minute grocery delivery service which it forayed into in March 2022, recently announced that it was ending the service. Ola Dash, Ola’s speedy delivery venture, folded in June 2022. While Dunzo, which saw Reliance acquire a 25.8 percent stake in January 2022, is said to be faltering, according to an industry insider. Tellingly, the Bengaluru-based startup has quietly been pushing for group deliveries rather than single deliveries to make the economics work.

Quick commerce startups—as they are known—offer customers about 2,000 groceries and everyday essentials that can be ordered via an app and arrive in 10 minutes. The goods are stocked in dark stores—mini warehouses strategically set up across cities—and delivered by a fleet of riders.

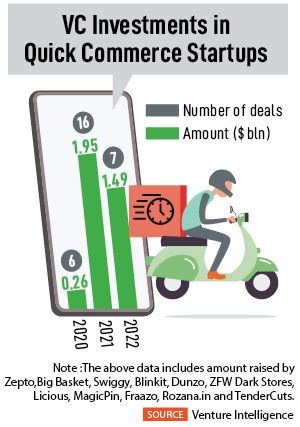

In 2021, quick commerce was one of the most-hyped sectors: It attracted $1.9 billion in funding from venture capitalists (VC), as per Venture Intelligence, a data provider. Startups hired hundreds of staff, set up scores of dark stores and pandered to customers, especially nervous ones who avoided supermarkets during the Covid-19 pandemic.

Zepto emerged as the poster boy of quick commerce, racing to a near-unicorn $900 million valuation in less than a year of founding in May 2022.

But by late-2022 the startups began faltering. Faced with huge losses, a funding drought and increased competition, they scaled back operations, fired staff and shut down dark stores.

But by late-2022 the startups began faltering. Faced with huge losses, a funding drought and increased competition, they scaled back operations, fired staff and shut down dark stores.

Within the product assortment, there are items that fetch higher margins than others. Fresh fruits and vegetables offer fatter margins of 18 to 40 percent, while standard FMCG products provide margins of 4 to 18 percent.

Within the product assortment, there are items that fetch higher margins than others. Fresh fruits and vegetables offer fatter margins of 18 to 40 percent, while standard FMCG products provide margins of 4 to 18 percent.