Why insurance sector needs a course correction after Budget 2023 double whammy

With the government's move to tax high-value insurance policies, insurers will need to work on their product mix, sell more policies and sell them harder in the new fiscal year, to keep topline and margin growth unaffected

Insurance companies will need to change their product mix or simply need to sell more policies to ensure volume growth, experts say. Image: Shutterstock

Insurance companies will need to change their product mix or simply need to sell more policies to ensure volume growth, experts say. Image: Shutterstock

The insurance sector, particularly private sector companies selling life products to millions of Indians over the past over two decades, appears to be—post budget FY24—in a state of disbelief. The stocks of several listed insurance companies have, in February, been equally listless and analysts have—after policy decisions—lowered growth estimates, ratings and target prices for these companies for the next 12 months.

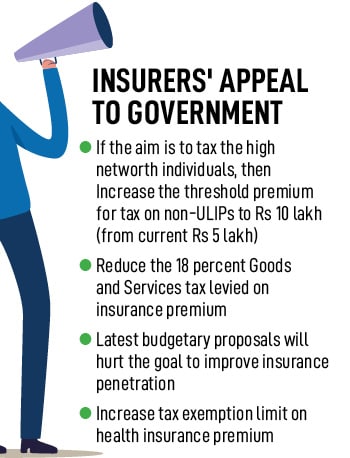

A string of pre-budget recommendations which the industry had made to the government for consideration were ignored in the FY24 budgetary announcements announced February 1. Instead of that came a ‘double whammy’ blow of sorts. The finance minister Nirmala Sitharaman announced the removal of tax exemptions on income from non-ULIP (unit linked insurance plan) policies purchased after April 1, 2023, where the aggregate annual premium is above Rs 5 lakh.

The government, also, in a move to drive people towards an exemption-less new tax regime, lowered personal taxes and made life insurance policies somewhat less attractive as pure tax saving instruments (under Section 80C).

Also watch: 5 takeaways from Budget 2023-24

Insurance companies will need to change their product mix or simply need to sell more policies to ensure volume growth, experts say. While they will continue to grow in 2023 and beyond—and there might be a flurry of business till March-end (as investors will try to take a tax benefit before this financial year ends)—they will need to put in more effort to ensure premium volumes and margins do not sag in the next fiscal.

A blended 20 percent tax rate indicates that approximately Rs 4.2 trillion of total deductions were claimed by individual taxpayers under Section 80C and around Rs 362 billion under Section 80D. With an estimated Rs 11.3 trillion (except the principal repayment on home loan, stamp duty on home purchase and tuition fee payment) eligible for deduction under Section 80C, and only Rs 4.2 trillion being claimed for deduction, it seems that private life insurers’ dependency on the Section 80C deduction is lower, Singh observes, based on this government-based data.

A blended 20 percent tax rate indicates that approximately Rs 4.2 trillion of total deductions were claimed by individual taxpayers under Section 80C and around Rs 362 billion under Section 80D. With an estimated Rs 11.3 trillion (except the principal repayment on home loan, stamp duty on home purchase and tuition fee payment) eligible for deduction under Section 80C, and only Rs 4.2 trillion being claimed for deduction, it seems that private life insurers’ dependency on the Section 80C deduction is lower, Singh observes, based on this government-based data.

The same source said the “psychological impact” of the new tax regime and the 80C exit will be seen on the entire market. “There will be a short-term impact but for most people the cap is consumed by other elements of the 80C category [such as EPF, PPF and ELSS]. So, while in the short-term a small percentage—4 to 5 percent of the tax paying universe—may not opt for a life insurance product, this behaviour of the individual is likely to change over the next three years. “One must understand that there is no instrument in the Indian market, besides life insurance, which offers you savings for a long term of over 25-30 years,” the source said.

The same source said the “psychological impact” of the new tax regime and the 80C exit will be seen on the entire market. “There will be a short-term impact but for most people the cap is consumed by other elements of the 80C category [such as EPF, PPF and ELSS]. So, while in the short-term a small percentage—4 to 5 percent of the tax paying universe—may not opt for a life insurance product, this behaviour of the individual is likely to change over the next three years. “One must understand that there is no instrument in the Indian market, besides life insurance, which offers you savings for a long term of over 25-30 years,” the source said.  Insurance firms, from both life and health segments, have through the Confederation of Indian Industry (CII) appealed to FM Sitharaman to have a re-look and revise some of the budgetary proposals (see chart), but a conclusive dialogue has yet to take place.

Insurance firms, from both life and health segments, have through the Confederation of Indian Industry (CII) appealed to FM Sitharaman to have a re-look and revise some of the budgetary proposals (see chart), but a conclusive dialogue has yet to take place.